Graceland Updates 4am-7am Graceland Updates 4am-7am

Gold at 925, What's The

Gold Plan, Stan?

Stewart Thomson

email: s2p3t4@sympatico.ca

written May 7, 2009

posted May 8, 2009

1. I have some bad news. I

woke up a little earlier than usual this morning. I made my way

to my office, and realized the thunder was coming out of my own

office! It was the deafening thunder of a multitude of Kachingo's

ringing from my cash registers of booked profits on oil, gold,

Dow, general commodities!

2. Time erases painful memories.

Last week's plunge to gold 880, with mass bailing in the gold

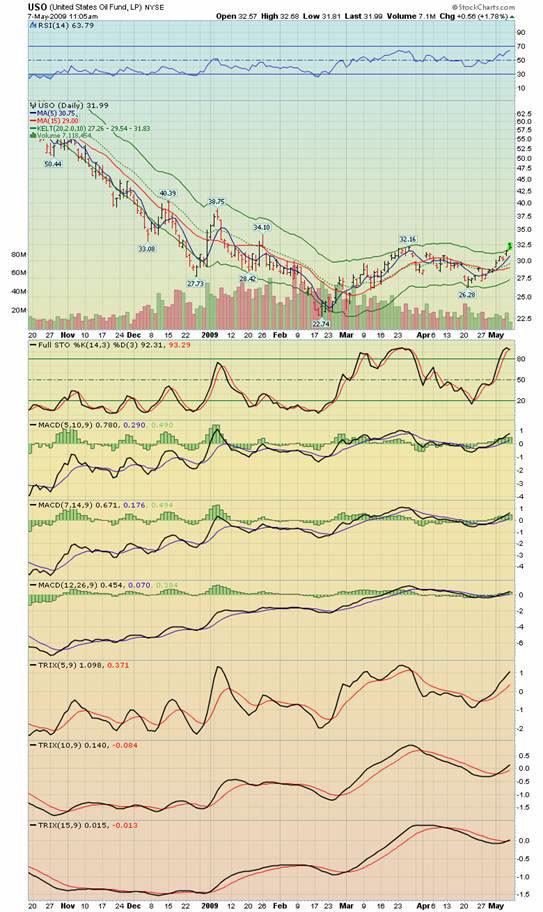

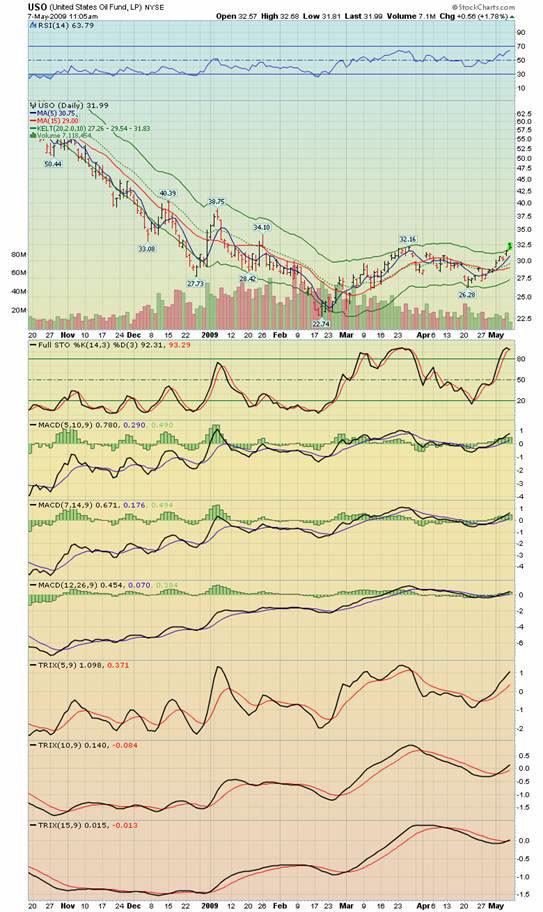

community, has been quickly forgotten. The hopes and dreams that

"this is the big breakout!" are alive again. I try

to balance the carrot with the stick. Try. Nobody is 100% successful.

If you fail to buy into the lows of any price reaction in gold,

the simple fact is you make less money, or actually lose money,

when you finally do buy.

3. Professional investors sell

into strength. Amateur investors sell into tops. You decide which

you want to be.

4. Making the transformation

to a professional takes time. If I beat on readers when price

is down, "what's the matter, are you a wimp, get in there

and buy!", well, there's a fine line between a coach and

a power-tripping bully. Nobody needs a bully. Beating on an incapacitated

fighter is the act of a bully. The transformation must take place

in small stages, suited to the investor's personality.

5. Looking back over the

article I posted a week ago, thinking about your mental state

at gold 880, I hope you can see why I said some of the things

I did. I attempt to draw out the ability to buy a bit of gold

on weakness. For many, the first step in the transformation involves

simply bailing "less" on weakness. And buying "less"

in the price chasing frenzies. One of those frenzies may be near

at hand, or we may even be in it now.

6. Sadly, when most chart signals

are giving buys, the bankers are offloading what they bought

earlier. Bought when the charts were giving sell signals. One

of the many professional hats the banker wears is:

7. Chart Painter.

8. Gold is the world's smallest

major market. As such, the gold charts are the most easily "painted".

The COMEX is not about to blow up because JP Morgan has a hundred

thousand gold shorts going. In their world, that's like you blowing

up because you have 10 shares short on Barrick gold stock. The

bankers, with the world's largest physical position in gold,

are not about to lose all their trillions on an upwards move

in gold. Especially since the taxpayers just handed them 10 trillion

dollars. That's a fantasy of failed gold speculators.

9. Each dollar higher in the

price of gold makes the bankers richer. Not poorer.

10. The good news for you,

is the bankers want gold higher in price. Vastly higher. If you

had to rely on the overleveraged hedge funds to take it higher,

well, let's just review what kind of job the funds did for you.

In May 2006, they bought gold for you. What happened? It melted.

In the spring of 2008, they bought gold for you. What happened?

It melted.

11. What else happened when

it melted? The bankers bought it.

12. So, who is supporting gold

and who is not? I'm saying the same things now I did at 880.

The message is appealing now. Simply because price is rising.

Talking about buying weakness is one thing. Executing such action

is another. There are a lot of emotions at play, an avalanche

of negative news at play, when the price of gold is falling.

You need specialized tactics to take the same actions in the

market that the bankers take. Or you will get a heart attack

and liquidate in terror.

13. If you didn't buy gold

at 880, but are buying now at 920, that's fine. Just know you

are buying from myself, my subscribers, and most importantly,

from the bank families. Before pushing the buy button today,

ask yourself one question: "WHERE is the gold coming from

that I'm buying?" Answer: It's coming from the bankers selling

into strength. Booking profits.

14. I use charts all the time.

Every day. Charts are quasi-maps. They aren't like a road map,

where you know that road A takes you to road B. They indicate

possibilities and show past action.

15. Like the strength in gold,

oil is also showing strength. I have a TRUCKLOAD of subscribers

booking profits by the HOUR in oil right now. Sadly, most oil

chartists have not participated in the oil rally. They tried

to buy, but were stopped out repeatedly. Here's the oil chart

for USO, the main oil ETF. While the short term indicator Stochastics

is very overbought, MACD is barely at the zero line on the bulwark

12,26,9 series. Price has broken above the upper keltner supply

line. I see oil in a basing formation, but it could turn into

a consolidation followed by new lows. Regardless, oil has risen

25% and I am selling into the strength daily, and have for about

a week.

16. Many years of experience

tells me the answer as to why that happened. I'll put it bluntly:

Champagne taste with a beer bottle pocketbook. If you trade too

big, you have to keep ultra tight stoplosses. The bankers see

all the speculators' positions. It's very easy for them to move

the price around enough so you are "eliminated" from

the game via your stoplosses.

17. The Dow is perhaps the

most interesting game right now. After the chartists watched

the Dow fall to 6500, they went short. One retired bank trader

friend of mine told me all the hedge fund managers he knows were

short the Dow at the time. All of them. He is pretty well connected

in the hedge fund community.

18. Now, things are going the

other way. The bankers and near-record levels of insider selling

are occurring. What the chartists looking at the Dow don't understand

is the basics of risk and reward. A number of Dow stocks have

rallied 100% in just 2 months.

19. That is ten years of gains

for most fund managers. Citigroup leaped 400%. Does anybody know

how much money the bankers and insiders just made?

20. For Citigroup to quintuple

again, from $5, it has to go to $25. That is a vastly harder

job than the $1 to $5 astroblast that just occurred.

21. I'm in touch with a number

of top producing brokers on a regular basis. One of them told

me that clients at his company were calling HIM yesterday to

buy the stock market. Masses of them.

22. These "investors"

think everything is fixed. And are now rushing forward in a price

chasing frenzy. The banker's motto: "Sell in May and go

away" has been translated by the public to:

23. "Price Chase in May

and Stay!"

24. I would suggest the public

call a repairman to take a look at their translation machine.

Not tomorrow. Today.

25. This brings us back to

the law of the markets: Sell into strength.

26. Where will the Dow top

out? I have no idea. All I know is that every day I am booking

50% to 100% gains on Dow positions I bought at a huge multitude

of price points, all on weakness into Dow 6500.

27. How do you make a profit?

Answer: You book it.

28. Nobody ever lost money

booking a profit. Think about it.

29. I know the monthly chart

shows the Dow drastically oversold. TRIX, MACD, Stochastics are

all giving "mega" buy signals. Keep this in mind: Markets

can CRASH when in that condition. The bottom line is the Dow

has rallied a mind boggling two thousand points, and now the

public shows up to buy?

30. Not one of the price chasers

has stopped to ask themselves, "Hey, who is selling all

this stock that I'm buying"?

31. Maybe it's the Tooth Fairy.

Bringing free money to all price chasers around the world. If

you want to feel good, join them. If you want to make money,

don't. In the past the drug LSD caused people to leap off buildings,

believing they could fly. In all seriousness, what has caused

more suicides, LSD, or Price Chasing?

32. Here's the Dow daily chart.

Notice how the RSI and Stochastics are overbougtht and the huge

volume on what may turn out to be a sort of key reversal day.

33. Trader Dan Norcini,

who I consider one of the world's top chartists, notes that if

gold breaks above 925, it could set off a "bonanza of buy

stops". If that occurs, the price could blast up like

a rocket. If so, my subscribers will be booking profits machine

gun style. So should you. There is only one way to take part

in such profit booking party. You have to buy into weakness that

goes against your own intuition of where the market might go.

WILL gold break over 925 on the current run? I have no idea.

I know that IF it does, I'll get a stormsurge of letters reporting

that you are booking a shockwave of profit. Again, gold could

go either way here. Let's not do any price chasing into strength

to 925 because we "know" 925 will be taken out. We

know what we will DO if it is, and that is all we want to know.

What happens if 925 IS taken out upside and YOU haven't bought?

34. "You only have five

thousand more chances" -Jim Sinclair, world's largest gold

trader.

35. "But I have to buy

now, right now!" -Joe Blow. World's smallest gold trader.

36. Here's the gold chart.

See the price breakout out of the down wedge? Price has closed

above the red supply line. Chartists see this as a "buy".

I see it as an indication that price is going higher, perhaps

much higher, with 968 for starters. Am I buying now on that indication?

No. I'm selling. And I'll sell all the way to 968. Not because

I think gold is going down. It takes a certain mindset to sell

strength, yet believe gold is going higher. A mindset that you

want to make money.

37. There will be a zillion

more situations like you see gold here at 925. Patience, not

impatience, is the road to Victory.

38. I have sent out the Pyramid

Generator (Pgen) screenshots that I promised many of you last

week for the gold stock of your choice, and continue to send

more out daily. If you haven't got yours yet, it's coming. This

is about a 2 week process to get everyone's request completed.

39. Check the "Free Reports"

section on my website for the latest gold stock charts from Golden

Surveyor (GS). Today. He has made money, consistently, for 14

years in a row without a losing year, doing thousands of trades

for his own account. Position trades. Not day flips. His charts

give you a crisp picture of where certain gold investments might

be going. My Pgen provides the professional tactics to take action

on them.

40. Letters are POURING in

from subscribers this week as hundreds of former lifetime market

losers, are transforming into "mini bankers". Systematically

buying into weakness and selling strength! Here's one from this

morning. Let's call him Stan. And have a look at Stan's gold

plan at 925 this morning:

41. "Hi Stewart. You may

as well add me to the parade. 2 Yamana trades in 2 days. One

for 12.7% and the one this morning BOOKED at 18%. Followed by

2 SLW trades. One for 14.7% the other at 16.4%. Oh and a AXU

trade for 31.7% thrown in for good measure! Again, you're one

of the highlights of my day. THANK YOU!!"

###

May 7, 2009

Stewart Thomson

Graceland Updates

website: www.gracelandupdates.com

email for questions: stewart@gracelandupdates.com

email to request the free reports: freereports@galacticupdates.com

Tuesday 1st Apr 2025

Special Offer for 321gold readers: Send an email to freereports@galacticupdates.com and I'll send you my free “CDNX: New Highs & Blue Skies!” report. I highlight the hottest junior miners making new highs… highs that look like they are here to stay! Key investor tactics are included in this report.

|

Graceland

Updates Subscription Service: Note we are privacy oriented. We accept cheques.

And credit cards thru PayPal only on our website. For your protection

we don't see your credit card information. Only PayPal

does.

| Subscribe via major credit cards

at Graceland

Updates

- or make checks payable to: "Stewart Thomson" Mail

to: Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario

L6H 2M8 / Canada |

Stewart

Thomson

is a retired Merrill Lynch broker. Stewart writes the Graceland

Updates daily between 4am-7am. They are sent out around 8am. The

newsletter is attractively priced and the format is a unique numbered

point form; giving clarity to each point and saving valuable

reading time.

Risks, Disclaimers,

Legal

Stewart

Thomson is no longer an investment advisor. The information provided

by Stewart and Graceland Updates is for general information purposes

only. Before taking any action on any investment, it is imperative

that you consult with multiple properly licensed, experienced

and qualifed investment advisors and get numerous opinions before

taking any action. Your minimum risk on any investment in the

world is 100% loss of all your money. You may be taking

or preparing to take leveraged positions in investments and not

know it, exposing yourself to unlimited risks. This is highly

concerning if you are an investor in any derivatives products.

There is an approx $700 trillion OTC Derivatives Iceberg with

a tiny portion written off officially. The bottom line:

Are

You Prepared?

321gold Ltd

|