|

Kimber Resources Inc.by Jay Taylor Kimber Resources Inc.

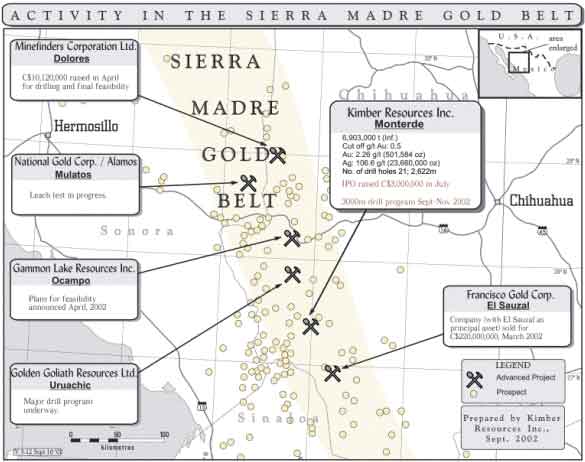

In the very early stages of development Kimber Resources has outlined a 500,000 oz. gold and 23.5 million ounce silver resource at its Monterde property in the Chihuahua State in Mexico, on which it holds an option to acquire a 100% interest, free of royalties. On the basis of the company's very early gold and silver resource and its multi-million ounce exploration potential, we think the upside potential for investors who buy this company's shares at is current price is very considerable for the following reasons:

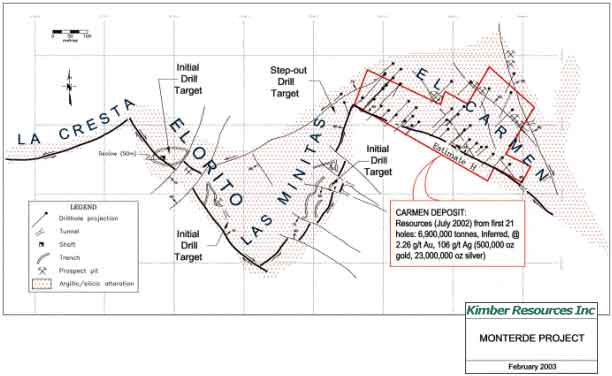

A sense of exploration potential can be gleaned from glancing at the illustration below. While the company's focus to date has been mostly on the Carmen zone, evidence exists that the gold/silver mineralization extends westward along a 2.5 kilometer structure. For one hole (MTR22) drilled during the 2002 exploration program, it was demonstrated that gold and silver grades, over a significant width continue into the neighboring structure identified on the map below as the Las Minitas area to the southwest of the Carmen. MTR22 captured a 28-meter intersection that graded 0.43 grams gold and 134 grams silver/ton. In addition, assay from a trench on the Las Minitas assayed 4.86 grams gold and 65.4 grams silver over a 5-meter intersection. On the (southern end of the) El Orito area located 750 meters west of the Carmen deposit, rock chip samples graded up to 1.05 grams gold/tonne were revealed. The ability to uncover the mysteries at the Las Minitas and El Orito from trenching is hampered by a significant overburden. However, there seems to be enough "smoke" from these two areas to warrant future drilling. In fact, not shown on the map below are two more zones included in the company's land package that are also considered prospective, totaling a strike length of 2.5 kilometers. Trenching that was carried out last year recorded significant gold values in well-altered rock in two locations. One was approximately 250 meters to the southwest of the Carmen and the other was 750 meters to the west of the Carmen.

Company President Robert Longe has noted that the market pays approximately $25 per ounce gold when it is in the "measured and indicated" category. It pays a lot less when a resource is categorized simply as "inferred." For example the market is currently paying less than $5 per ounce for Kimber's inferred resource. Looking down the road still further, we might contemplate even higher multiples as the company develops its project still further, to turn "measured and indicated" resources into "proven and probable" reserves. It is not unusual for the market to pay $50 to $100 for reserve ounces as opposed to resource ounces. To upgrade a resource from the current "inferred" to "indicated and measured" categories requires infill drilling, which President Longe correctly observes is lower risk drilling than "wildcat" or step-out holes put down to expand the dimensions of mineralization. So to prudently employ scarce capital, management's strategy is to spend approximately 80% of its exploration dollars on upgrading the Carmen deposit and 20% to expanding the known dimensions of mineralization both at the Carmen as well as the other numerous zones pictured above.

Robert Longe, P. Eng. President and Director. Mr. Longe, who has a 35-year career in the mineral exploration and development business, has worked with multinational companies, including Consolidated African Selection Trust and Rio Algom. Since 1980 he has provided consulting and contracting services to the mineral industry in North and South America, and in Africa and has served as an Officer and Director of junior public companies. Michael E. Hoole, B.Comm., LL.B. Vice President, CFO, Corporate Secretary and Director. Mr. Hoole is a lawyer who has been employed in resource industries for more than 25 years, primarily as a senior officer and General Counsel of multinational, public corporations, including B.C. Forest Products and Gibraltar Mines. Most recently Mr. Hoole was Vice President, Secretary and Counsel with Westmin Resources (now Boliden), where he was involved in the initial development of the Lomas Bayas open- pit copper mine in northern Chile. Alan D. Hitchborn, B.Sc., Geol. Vice President, Development and Director General - Minera Monterde. Mr Hitchborn, a geologist with 22 years experience, recognized the potential of the Monterde property in 1998. His experience includes nine years at Placer Dome's Bald Mountain Mine in Nevada, where he was successful in adding 2,000,000 ounces of gold to the mining reserve at a cash cost of less than US$5.00 per ounce. Mr Hitchborn also worked as a senior geologist in Placer's Resource Estimation Group, where his responsibilities included reserve and resource estimation. J. Byron Richards, P.Eng. Vice President, Engineering. Mr. Richards is a geological engineer with 34 years experience in the mineral exploration and development business. He is the owner of JB Engineering Ltd., a private consulting company providing services to the mining industry, resource estimation and sampling in particular. Among other duties for Kimber Mr. Richards is responsible for sampling protocol and quality control. Arthur Fisher, P. Eng. Director Mr. Fisher, President of Olympus Pacific Minerals Inc. and Lysander Minerals Corporation, has been active in the gold mining industry for over thirty years. He has served on the boards of several companies, including Emperor Mines from 1990 to 1995, a period during which the Emperor mine in Fiji was successfully expanded. J. John Kalmet, P. Eng., Director. Mr. Kalmet has a 35 year career in the mining industry. Until recently he was President and Chief Operating Officer of Wheaton River Mineral Ltd. During this time the Golden Bear mine was brought successfully to production. His previous positions have included Vice President, Operations for Canamax Resources Inc. and General Manager, Western Canada, for Noranda Minerals Inc. Luard Manning, P. Eng Director. Mr. Manning has over 45 years mining experience, the last 30 of which have been as a mining consultant practicing out of Vancouver, British Columbia. He has extensive expertise in operating underground mines, and has also operated small open-pit mines. Mr. Manning is currently a Director, Secretary and CFO of L.E.H. Ventures Ltd. and a director of several other junior mining companies.

This micro-cap junior mining company has a market capitalization of a mere $3.6 million. Judging by the way the market is pricing somewhat more advanced peers of Kimber, it is not unreasonable to expect that figure to rise by a factor of five fold as its current 501,000 ounce resource is upgraded. Moreover, if as anticipated, the Carmen zone alone contains twice this resource, this stock currently selling at $0.27 could become a "ten bagger" as the Carmen zone is developed and upgraded into the measured and indicated category. Should the company further upgrade resource ounces into reserves by way of feasibility work, we would expect the market to pay a still higher multiple. Also, if you agree that we are still in the early stages of a bull market in gold, multiples ultimately paid for all resource and reserve categories are likely to rise further as the price of gold rises. The obvious merits of the Monterde property combined with a highly experienced, conservative and competent management team, are reasons why at its current price level, Kimber is one of the better exploration stocks we are aware of. Subscribers who might like to learn more about the company should call the management in Vancouver at (604) 669-2251 and/or visit the company's web site at www.kimberresources.com. Investors outside of the United States are invited to contact Ian Gordon, of Canaccord Capital and author of The Long Wave Analyst. Ian knows this company's story very well and has assisted it in raising equity in the past. Ian can be reached at (604) 643-0280. Americans are encouraged to call Rick Langer, who works side by side with Ian and who also knows this company well. Rick, who is licensed to sell securities to Americans, can be reached at: 1-800-667-5771.

###

For more

information about Jay Taylor and his newsletter please visit

www.miningstocks.com. Jay Taylor

is featured on the Korelin/Hartfield Radio show every other week.

Al Korelin interviews Jay Taylor and other Gold newsletter writers

and gold companies. If you would like to listen to a recent Jay

Taylor interview, click here: http://www.kuik.com/KH/KH.html. |

Jay Taylor

Jay Taylor