Ron Rosen Precious Metals

Timing Letter

We are in pretty good shape

Ron Rosen

Nov 17, 2006

The HUI, gold, and silver will

experience one more decline lasting approximately 3 to 6 weeks

before the correction that started in May 2006 will be over.

The types of corrections that are taking place do not require

new lows in order to be complete. We are fast approaching the

start of the most dynamic part of this precious metals bull market

since it started 6 years ago. When this decline appears to be

ending I will be issuing a buy signal for the balance of funds

in the trading account. The investment account is 100% committed

and the trading account is 50% committed. Approximately 6 months

have elapsed since we last saw new highs in the precious metals

complex. The previous rise in the HUI went from 165 to 401. That

was a 243% rise in approximately 12 months. The HUI will be starting

a third of a third wave and it should be substantially greater

than the previous rise.

The trading account has appreciated

by 51% in the past eleven months. The combined investment and

trading accounts have grown by 38% during the past 11 months.

Since the gain for many multibillion dollar hedge funds is averaging

a bit over 4% for this year, I would say we are in pretty good

shape. I can't imagine paying an advisory fee, 20 % of the profits,

and making only 4% a year. We can do better with a CD at a local

bank.

The charts posted today show

the approximate amount of time left before the corrective process

is over.

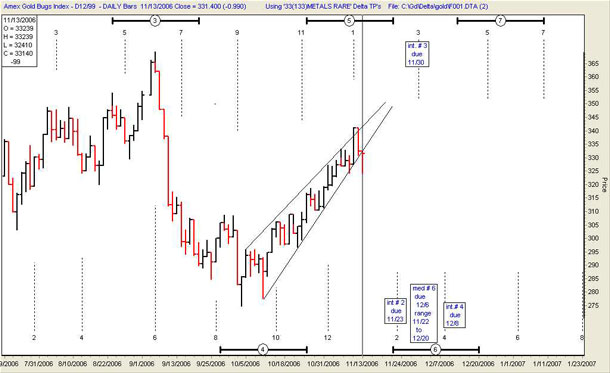

Delta medium #6 low is due

December 6 and it has a range for arrival between November 22

and December 20.

HUI DAILY

Stochastics are in overbought

territory and are about to turn down. The [e] leg should bottom

substantially higher than the low of wave [c]. I believe that

Delta long term #1 low is in and the HUI is headed for Delta

long term #2 high due in March 2007. The long term pressure is

on the upside and should mitigate the extent of any decline in

this final leg down.

HUI WEEKLY

Gold will be correcting with

the HUI and may bottom around the same time.

GOLD DAILY

Gold will be making a bottom

at Delta medium term #7 low, due December 6.

GOLD WEEKLY

The timing for a bottom in

silver may vary slightly from gold. There is a long term Delta

#5 low due on January 17. However, it has a 100% range for arrival

between November 15 and March 21, 2007. In a very strong bull

market the lows tend to arrive early. Silver appears to be in

a very strong bull market; therefore we should expect Delta long

term #5 low to arrive early.

SILVER DAILY

The next Delta long term high

for silver is #1, due June 20, 2007. The biggest moves tend to

occur on either side of #1.

SILVER WEEKLY

"When a stock [or commodity]

advances into new territory or to prices which it has not reached

for months or years, it shows that the force or driving power

is working in that direction. It is the same principle as any

other force which has been restrained and breaks out. Water may

be held back by a dam, but if it breaks through the dam, you

would know that it would continue downward until it reached another

dam, or some obstruction or resistance which would stop it. Therefore,

it is very important to watch old levels of stocks. The longer

the time that elapses between the breaking into new territory,

the greater the move you can expect, because the accumulative

energy over a long period naturally will produce a larger movement

than if it only accumulated a short period of time." -W.D.Gann

Silver exceeded the resistance

at $14.93 when it reached the high of $15.20 earlier this year.

The next level of strong resistance will be $24.18, a high which

occurred in September of 1980.

SILVER QUARTERLY

The dollar will be moving up

to Delta long term #1 high due between November 29 and January

2007 while the precious metals complex is finishing its correction.

The stochastics are about to turn up.

DOLLAR INDEX

SUMMARY

"Showtime" will begin

before this year is over. It promises to be a show to remember.

LET THE SHOW BEGIN.

Nov 13, 2006

Ron Rosen

email: rrosen5@tampabay.rr.com

Subscriptions

are available at:

www.wilder-concepts.com/rosenletter.aspx

Disclaimer: The contents of this

letter represent the opinions of Ronald L. Rosen and Alistair

Gilbert. Nothing contained herein is intended as investment

advice or recommendations for specific investment decisions, and

you should not rely on it as such. Ronald L. Rosen and Alistair

Gilbert are not registered investment advisors. Information and

analysis above are derived from sources and using methods believed

to be reliable, but Ronald L. Rosen and Alistair Gilbert cannot

accept responsibility for any trading losses you may incur as

a result of your reliance on this analysis and will not be held

liable for the consequence of reliance upon any opinion or statement

contained herein or any omission. Individuals should consult with

their broker and personal financial advisors before engaging in

any trading activities. Do your own due diligence regarding personal

investment decisions. Disclaimer: The contents of this

letter represent the opinions of Ronald L. Rosen and Alistair

Gilbert. Nothing contained herein is intended as investment

advice or recommendations for specific investment decisions, and

you should not rely on it as such. Ronald L. Rosen and Alistair

Gilbert are not registered investment advisors. Information and

analysis above are derived from sources and using methods believed

to be reliable, but Ronald L. Rosen and Alistair Gilbert cannot

accept responsibility for any trading losses you may incur as

a result of your reliance on this analysis and will not be held

liable for the consequence of reliance upon any opinion or statement

contained herein or any omission. Individuals should consult with

their broker and personal financial advisors before engaging in

any trading activities. Do your own due diligence regarding personal

investment decisions.

The Delta Story

Tee charts reproduced

courtesy of The Delta Society International.

321gold

|