Precious Metals Market Timing Precious Metals Market Timing

The HUI and Gold Bullion

Ron Rosen

Jun 1, 2005

"Time is more important

than price; when time is up price will reverse" -W.D.

Gann

In the HUI charts above you

can see that wave B topped approximately 15 points below the

high of the complete bull move. This presents us with the probability

that Wave C will bottom approximately 15 points below Wave A.

If so that would make the bottom around 150 which would touch

the very long term uptrend line. However a breaking of the long

term trend line would likely flush out any remaining doubters

and is a good probability. You can see the long term trend line

on the monthly chart.

Once again "Patience"

is required to allow this correction to fully express itself.

There will be a bottom to this correction and we will have a

pretty good idea when it arrives. It will still have to be proven

that this coming bottom is the bottom we have been waiting for.

Bottom picking has not been a profitable activity, so we wait

and watch and don't guess that a bottom is here. The over enthusiastic

gold bugs can mislead folks all the way to the bottom. There

are ways to determine to a very high probability that the true

bottom has arrived. I have said this before, "The bottom

is proven to have been obvious on the way UP not on the way down."

"It is probably fairly

obvious that corrective waves can be extremely confusing and

can confound even the most experienced analyst. As a result,

the analyst is advised not to use Elliott in isolation."

We do not use Elliott waves

in isolation. We use them in conjunction with Gann cyclic studies

and Delta turning points. Together they are three of the most

powerful technical market tools available.

GOLD WEEKLY

JAN 1975 HIGH TO AUG 1976 bottom

**see notes below

GOLD WEEKLY

DEC 2004 HIGH TO LOW IN (SEE RANGE BOTTOM OF CHART)

GOLD MONTHLY

1980

**Gold topped in Jan 1975and

a serious correction followed. 30 years later, within day's,

gold topped in 2004 and we have been experiencing a correction

ever since. We don't know how serious this correction will be

but according to long term Delta turning points it will take

many months and possibly not bottom until summer of 2006. So

far this is a Gann cyclic study worth the time spent studying.

I have said this before also, "Believing it works is the

hard part."

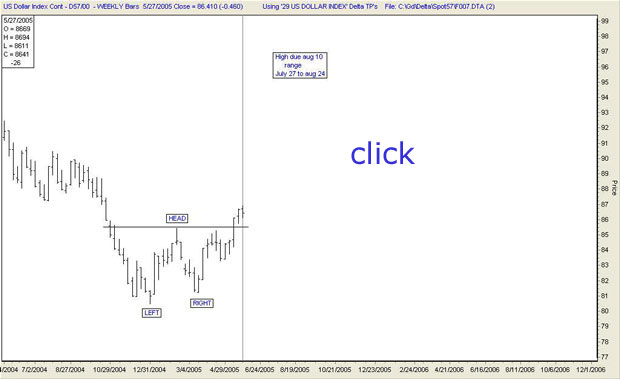

*The U.S.Dollar has shown us

the direction it was going to take over seven months ago. It

has formed and completed a perfect reverse head and shoulders

pattern. You can see this on the weekly chart.

(*)The monthly chart shows

us a bear market that has completed a 5 wave move. This is a

near perfect 5 wave Elliott pattern.

U.S.DOLLAR

WEEKLY *

U.S.DOLLAR

MONTHLY (*)

The Euro, the Dollars counterpart,

completes the picture. The Euro also completed a near perfect

Elliott Wave bull move. You can see the five wave pattern clearly

on the monthly chart below.

EURO MONTHLY

To summarize, using Delta turning

points, Gann cyclic studies and Elliott monthly wave counts we

have kept ourselves on the correct side of the Precious metals

complex, so far.

I will be doing my best to

announce "ALL ABOARD" when the time seems appropriate

according to these three tools and the 50 years of observations

I have spent time gathering. I might add a good portion of those

50 years were spent learning from mistakes. I suspect there are

more mistakes lurking out there and because of this I keep looking

over my shoulder. Hopefully this approach will keep us all out

of financial "harms way!"

Stay Well,

A subscription to Precious

Metals Market Timing may be obtained at www.trade-delta.com

or contact rrosen5@tampabay.rr.com

Jun 1, 2005

Ron Rosen

email: rrosen5@tampabay.rr.com

Subscriptions

are available at:

www.wilder-concepts.com/rosenletter.aspx

Disclaimer: The contents of this

letter represent the opinions of Ronald L. Rosen and Alistair

Gilbert. Nothing contained herein is intended as investment

advice or recommendations for specific investment decisions, and

you should not rely on it as such. Ronald L. Rosen and Alistair

Gilbert are not registered investment advisors. Information and

analysis above are derived from sources and using methods believed

to be reliable, but Ronald L. Rosen and Alistair Gilbert cannot

accept responsibility for any trading losses you may incur as

a result of your reliance on this analysis and will not be held

liable for the consequence of reliance upon any opinion or statement

contained herein or any omission. Individuals should consult with

their broker and personal financial advisors before engaging in

any trading activities. Do your own due diligence regarding personal

investment decisions. Disclaimer: The contents of this

letter represent the opinions of Ronald L. Rosen and Alistair

Gilbert. Nothing contained herein is intended as investment

advice or recommendations for specific investment decisions, and

you should not rely on it as such. Ronald L. Rosen and Alistair

Gilbert are not registered investment advisors. Information and

analysis above are derived from sources and using methods believed

to be reliable, but Ronald L. Rosen and Alistair Gilbert cannot

accept responsibility for any trading losses you may incur as

a result of your reliance on this analysis and will not be held

liable for the consequence of reliance upon any opinion or statement

contained herein or any omission. Individuals should consult with

their broker and personal financial advisors before engaging in

any trading activities. Do your own due diligence regarding personal

investment decisions.

The Delta Story

Tee charts reproduced

courtesy of The Delta Society International.

321gold Inc

|