| |||

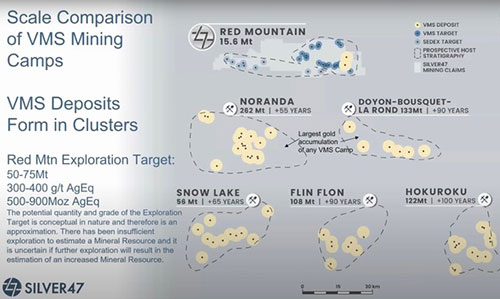

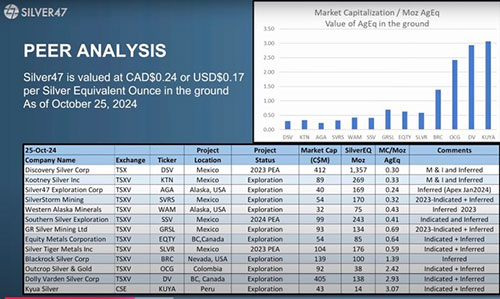

Silver47 Rises from the Ashes After Abject Stupidity from Prior Australian Management On the Same ProjectsBob Moriarty For some bizarre reason I have lost the most money on what seemed at the time to be the best projects. I had a lot of shares in two different companies that were such easy calls that someone would have to work 24/7 to fuck them up. Since the value was so plain to see the future, I gave shares to everyone in my immediate family. One promptly went bankrupt. The other plunged by 94%. One was Irving Resources in Japan. I took samples from the ground in Hokkaido in Northern Japan that assayed at over $25,000 a tonne. The samples were just above a mine that was taken out of production during WW II. Irving spent about $38 million poking holes all over Hokkaido at prior mining sites led by Quinton Hennigh and the top geologists in Japan and supported by Newmont’s best technical teams. Irving may as well have piled up pallet loads of $100 bills, poured diesel over them and burned them for all the success they found. My shares were down a magnificent 94% from the high. That wasn’t as bad as White Rock Minerals. White Rock had two company making projects in Alaska and a backup joint venture on the Mt Carrington gold property in Australia. The plandemic known as Covid 19 hit in early 2020. The Australians went Auto-Stupid. Government essentially shut down the borders of Australia. Matt Gill, the MD of White Rock, farted around arranging a drill crew for the Red Mountain $5 billion dollar project in Alaska, and missed an entire season of drilling on a project that had already showed it was an easy call to go into production. Then in 2023 the brilliant planning from the Mining Department of NSW increased the reclamation bond for their JV gold project known as Mt Carrington from $968,000 to $6,881,466. The ink wasn’t dry on the paper before their JV partner ran out the door. Since Matt Gill had the checkbook for White Rock, he dumped the remaining money from the treasury into the Woods Point gold project in Victoria. Not to be outdone by the Mines Department of NSW, the Earth Resource Regulator of Victoria eased the rehabilitation bond on Woods Point from a pesky $153,000 to a minor $16,346,000. When White Rock blew up, the explosion could be heard on Mars. I had been in close contact with Matt Gill on a regular basis since I held a large position in the company. I begged him to spin out the two major assets in Alaska to get some value out of them since the market was pricing them as worthless. He ignored me because he realized he was so much smarter than a minor mining site operator. After White Rock disappeared and he lost his absurdly high weekly pay check, he took on employment as a cooking assistant at his local McDonalds where he is still learning the ropes. But all was not lost. The $5 billion Red Mountain VMS project was still in the wind. Someone came to me back in 2022 pitching me on a private company wanting to advance a new silver project in north central Yukon. They named the company Silver47. While I am not a giant fan of private companies, they are lost money until they go public, I invested in the story at $.50. Silver47 started with the Michelle Project in the Yukon. Michelle consists of a giant 158 square km land package that was 100% owned. Silver47 began drilling in 2022 with success. The company put about $5 million into the ground. Michelle is a silver rich Mississippi Valley SEDEX style deposit. Normally these deposits are primarily lead and zinc but Michelle included high silver grades. The best hole from 2022 was 15 meters of 907 g/t Ag with 45% lead and 4% zinc followed up by 18.29 meters of 310 g/t Ag with almost 17% zinc and over 8% lead. Progress came to a grinding halt in late 2022 thanks to the bureaucrats in what is termed the Environmental and Socio-Economic Assessment Board refused to grant the company a permit for an additional 60,000 meters of drilling. A few months later the Yukon Government stepped in and filed a request to initiate a judicial review of the YESAB’s decision. The Yukon government is asking for the review on the basis the YESAB Board “failed to observe a principle of natural justice and procedural fairness.” A hearing on the petition will be heard on November 24th, 2024 however given the glacial speed of any judicial process no decision is expected for months. In the worst case Silver47 could be granted reimbursement for the $5 million they already put into the ground or alternatively if they were shown to be damaged by loss of a highly prospective project they could be awarded damages up to $50 million. Meanwhile back at the ranch. . . Silver47 was dead in the water without a serious project. I actually stepped in and suggested to everyone that I knew that the Red Mountain project across the border into Alaska already had some world class resource numbers and outstanding potential and thanks to the stupidity of the management and government in AussieLand, the project could be picked up cheap. Silver47 stepped up to the plate and purchased Red Mountain for about $6 million USD in cash and shares. Red Mountain contains a 620 square km property located about 100 km south of Fairbanks in the Tintina Gold Province. A haul road to a major coal mine exists about 30 km to the west giving reasonable access to the project. Naturally bring in power and building suitable roads would cost many millions but there are far worse places to build a mine in the world. The property is on state managed land free of Federal jurisdiction and indigenous claims. (Click on images to enlarge) Twenty-five million in drilling and a major exploration program under White Rock Minerals proved up a 43-101 resource of 15.6 million tonnes at a grade of 335.7 g/t AgEq for a total of 168.6 million ounces of silver equivalent. The original resource was done under the JORC looser rules and showed an even higher resource. Silver47 is targeting a 50-75 million tonne resource at 300-400 g/t AgEq for a total potential of 500-900 million ounces of silver Eq. Based on already completed exploration, drilling and surface samples the property compares favorably to many other VMS mines, some of which have been in production for as long as one hundred years. Anytime you look at a project, do some comparibles to see what other companies are getting for similar assets. When you compare what Silver47 gets in the market at an $.80 price you will realize it is not only in an excellent jurisdiction, it is cheap. I’ve been in the stock for a couple of years now. I’m glad they are going public. I believe the market is looking for a good silver story. Through Silver47 you can buy silver for ten percent of what investors are paying for other companies with a lot less silver. Silver47 is an advertiser. I have bought shares in previous private placements so naturally I am biased. Management is young and aggressive. The company is cashed up. Their presentation is excellent and should be reviewed by all potential investors. Silver47 Exploration Corp ### Bob Moriarty |

Copyright ©2001-2024 321gold Ltd. All Rights Reserved