| |||

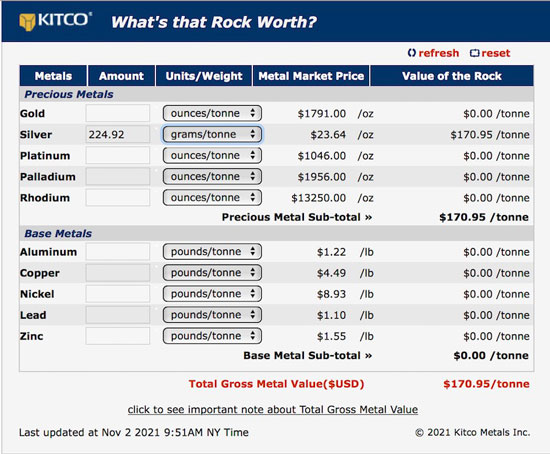

Eloro Hits BiglyBob Moriarty The last time I talked to Tom Larsen of Eloro, the company had 8,000 assays outstanding. They can look at the core and know they are in mineralization but don’t have hard numbers. Progress on the assays are being made and they are down to 3,000 assays outstanding. On November 2, 2021 Eloro put out a press release again showing outstanding numbers. They highlighted 188.5 meters of 100 g/t Ag eq/t consisting of 38.71 g/t Ag, 0.88% Zn and 0.51% Pb. That’s one of the longer holes and contains $72 rock over an incredible length. (Click on images to enlarge) Within that 188 meter hole there was a higher-grade interval of 65.8 meters of 75.51 g/t Ag with 0.16% Cu, 0.65% Pb and 0.96% Zn worth an interesting $122 USD per tonne. In another hole they showed 224.92 g/t Ag eq over 7.42 meters. In that hole they showed 0.55% Sn (tin). They are using an absurdly low price for tin. Currently, 5.5 kilos of tin is worth $212 all by itself. When the dust has settled and the assay labs get caught up and ELO has a dozen drill rigs turning on Iska Iska, they are almost certainly going to show over 2 billion tonnes of $100 rock. This is one of the best stories in the last twenty years. It is still way below the radar screen of most investors even with an absurd market cap today of about $225 million CAD. Eloro has one of the highest caliber technical teams in South America and brilliant management. The stock was $.15 in March of 2020 only twenty months ago. When the market wakes up, it is going a lot higher. Eloro is an advertiser. I have participated in several private placements in the past and bought shares in the open market. I am naturally biased so do your own due diligence. Eloro Resources Ltd ### Bob Moriarty |

Copyright ©2001-2025 321gold Ltd. All Rights Reserved