| |||

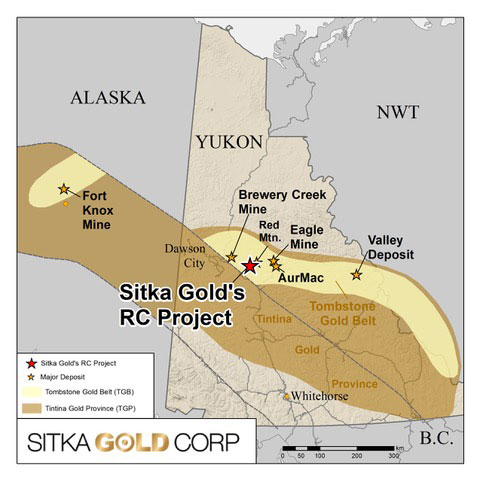

A Tale of Two Gold Mines; Snowline and SitkaBob Moriarty "It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair.” Those words first published by Charles Dickens in 1859 seem perfect for today. We have a new record high price for gold and silver went up by $1.55 just yesterday. Resource investors should be popping champagne corks. There is the other side of the coin with the most powerful country in world history attempting to sail without a rudder or captain. We have genocide taking place on three fronts in the territory of Israel with barely a peep from those with a conscience. I call it a territory because countries have borders and obey international law. The Zionist monsters don’t. It's one of those good news, bad news stories. We have the highest price for gold in history yet we are on the verge of World War III in either Ukraine, Israel, Yemen, or China. What could possibly go wrong considering the quality of leadership we have today in the world? (Click on image to enlarge) As the chart shows, gold shares compared to the price of gold topped in 1968 and have been in a steady decline since. However, the majors and some mid-tier miners are catching a bid and perhaps one day the junior lottery tickets will spring to life. One that won’t is Victoria Gold. The company shit in their own lunch bucket back in late June when they had a leach pad failure at their 166,000 ounce per year gold producer at the Eagle Mine in the Yukon. I really like the management of the company at the time but when you spend hundreds of millions of dollars designing and building a mid-tier gold mine you aren’t supposed to have leach pad failures. Someone screwed up big time. It could have been one of their engineering firms or just bad management but events like that literally poison the industry. This isn’t 1890 where you could get away with that.

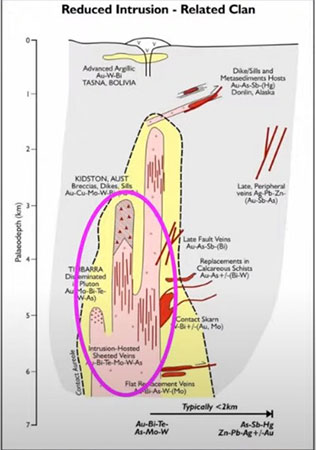

Two nearby companies in the Yukon were affected by the failure at Victoria Gold. Snowline (SGD-V) that has been a giant success story for the past three years going from about $.30 to a high of $6.40 after multiple great gold intercepts in their Yukon project before tumbling from $5.40 to a low of $3.90 in early August before recovering. During the same time period Sitka Gold (SIG-V) actually went up from $.125 to $.215. Both companies have similar deposits called a Reduced Intrusion related Gold-System. RIRGS for short. Snowline is far more advanced than Sitka. Snowline has a pit constrained resource of 7.31 million ounces. The company has 158 million shares outstanding with a market cap of $903 million and $63 million cash in the till. (Click on image to enlarge) Sitka has a resource of only 1.34 million ounces with 315 million shares outstanding and about $6 million in cash with a market cap of $105 million. While Snowline has about 5.45 times as much gold, they have a well-deserved market cap 8.6 times higher than Sitka. Snowline lacks many of the infrastructure advantages that Sitka has. Without a doubt, Snowline is a candidate for a buyout at far higher prices. The company still suffers from the stigma that came about when Victoria Gold went teats up. Ignoring the $63 million in the till, they are only getting about $123 an ounce in the ground. They will add ounces and a major will eventually take them out with a bid more like $400 an ounce. While Sitka does have the advantage of better access and more infrastructure, they are only getting about $78 per ounce of gold in the ground. But Sitka has a giant advantage that Quinton Hennigh has been pounding the table on for months. He did a brief on YT a month ago that every investor should watch. I’m not sure Quinton was planning on showing a porn shot in his presentation on Sitka but that’s sure what it looked like. At least to me. (Click on image to enlarge) The project of Snowline has been glaciated and much of the top of the deposit has been sheared off and dragged further south into BC. That has not been true of the Sitka deposit. Therefore at least in theory the Sitka property should be larger in gold ounces. Only time will tell but the company needs to be drilling deep with 150–200-meter step outs. On the 11th of September Sitka announce the deepest hole on the project and mineralization from surface to 680 meters with over 40 instances of visible gold. I see results coming out in the next week or so that will be as good as anything Snowline has drilled. That looks to be a home run hole. Once the market understands that Sitka is a lookalike to Snowline I see much higher prices. Sitka is an advertiser. I have participated in a private placement in the past and bought a lot of shares in the open market. I am biased so do your own due diligence. Their presentation is here. Sitka Gold Corp ### Bob Moriarty |

Copyright ©2001-2025 321gold Ltd. All Rights Reserved