| |||

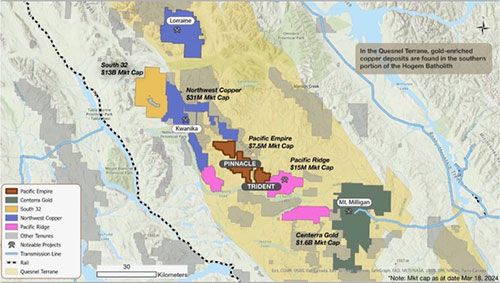

Pacific Empire Targets Copper Porphyry After Geophysics TrialBob Moriarty Gold and silver stocks remain subdued with little interest from potential investors even though the latest correction has been relatively mild. I highly suggest investors watch Stockhouse or Stockwatch or CEO.CA closely. The trading volume on resource stocks is almost non-existent. That’s what you get when the market is about to go much higher. CEO.CA has an additional advantage in that it shows just how many people are viewing a stock at the same time. I watch it and it is the lowest I have ever seen. An old adage of Wall Street is to “Never short a boring market.” I wrote about Pacific Empire Minerals only ten weeks ago. Gold was under $2300 and silver about $26. Gold is now above $2300 and silver above $29 and PEMC is 25% lower in spite of excellent news just released. As I said in my April piece about Pacific Empire, the company focus and main projects are right in the heart of the Quesnel Terrane home to half a dozen copper/gold porphyries. It is truly elephant country. Their nearest neighbor is Mt Milligan producing seventy-four million pounds of copper a year (in 22) along with one hundred and eighty-nine thousand ounces of gold. Other copper giants in the area include Teck Resources, South32 and Northwest Copper. (Click on image to enlarge) After their technical team looked over their past results including many high-grade copper assays from drilling conducted by several previous operators, they determined that the company should conduct an Airborne Mobile Magnetotelluric (MT) survey. Pacific Empire did conduct a test over the Trident property in the heart of the Quesnel Terrane. On the 13th of June Pacific Empire released the results. Much to their pleasure the MT survey revealed a new highly potential copper/gold porphyry target with a resistivity anomaly similar to that of Mt Milligan. The anomaly not only comes to surface, it extends to depth and is as much as 1.5km in width similar to Mt Milligan’s resistivity signature. Previous drilling by other companies in the past has shown copper grades as high as 0.84% Cu. In comparison, Mt Milligan shows copper reserves of 0.17% Cu. The Trident property consists of 6,618 Ha and has a number of logging roads providing full access to the project. Pacific Empire owns 100% of Trident subject to a 2% royalty. Of course, the proof is in the pudding. Pacific Empire must engage the truth detector machine and drill into the new target shown by the MT survey. The company plans a drill program in the August/September time frame. Almost certainly the company will need to conduct a private placement to raise the money for exploration. At today’s price for the shares, Pacific Empire has a market cap of just over $6 million. Even taking into account the dilution required to raise money for exploration, a series of successful holes could drive the share price far higher. Pacific Empire is an advertiser. I have participated in two private placements so naturally I am biased. Do your own due diligence. Pacific Empire Minerals Corp ### Bob Moriarty |

Copyright ©2001-2025 321gold Ltd. All Rights Reserved