| |||

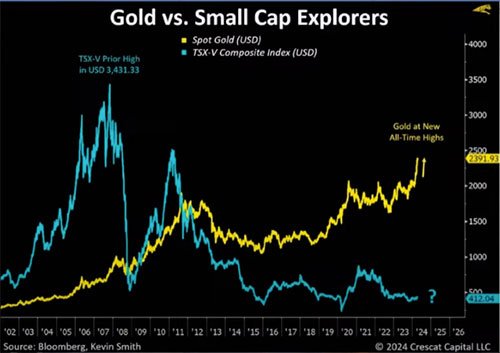

Core Assets Now Drilling CRD and High-Grade Porphyry in BCBob Moriarty I have been doing a lot of interviews over the last year and done very little writing about junior resource stocks. There is so much misinformation and disinformation about Ukraine and Gaza that I felt an obligation to stand up and speak out. I will admit the CIA has done a wonderful job of demonizing Russia and Putin. But the war in Ukraine is 100% the product of the Military Industrial Complex to generate more sales. They probably view World War III as a benefit. Wasn’t it the CIA connected Deagle that suggested that by 2025 the US population would have declined by 70%. World War III is closer than ever before and most Americans are oblivious. Perhaps it is all planned. And frankly junior resource stocks have been boring right up to the last couple of months as gold and silver began their skyrocket. Currently we are in a minor correction but China still controls the price and as of Friday last Comex valued silver at $29 and Shanghai valued silver at $36. So, I plan on doing a lot more writing about the junior lottery tickets in the future. I find that there are dozens, perhaps hundreds of underpriced resource stocks, offering a once in a life time opportunity to create generational wealth. I stole an interesting chart from one of Crescat’s presentations that shows the disconnect between the price of gold and the cost of junior resource stocks. Stocks are cheaper in relative terms than in my memory yet no one wants to invest. That’s exactly when you do want to invest. (Click on image to enlarge) One of my favorite Canadian juniors just released important news last week. The company, Core Assets (CC-C) started drilling in Northern BC last week. Two years ago, the shares were trading at $.83 apiece while ten weeks ago those same shares went for $.10 and have climbed by 50% since then. Nothing has changed for the worst except investor sentiment. The company completed two highly successful drill programs in the period from then yet the shares went down 88%. Part of the reason the shares got so cheap two months ago is due to the Northern Canada drilling curse. Because the winter stops everything, little or no news comes out once drilling is complete and assays have been announced. Naturally investors get bored and bored investors pound the sell button. That can be silly to do because the company has actually made incredible progress in the last couple of years. In 2023 Core drilled the deepest hole on the property, drill hole SLM22-006 reaching 471 meters deep. The hole demonstrated porphyry mineralization. As the depth increased, both copper and moly grades increased. At the end of hole assays reported as high as 2.5% CuEQ. For most of the last couple of years the company has been emphasizing the high-grade, near surface skarn and CRD prospects. A CRD occurs when an acidic high temperature fluid containing dissolved minerals hits limestone rock. A change in acidity in the fluids causes the more base levels of the limestone to dissolve and the minerals precipitate out into the rock. For an excellent discussion of what CRDs are and why they are so valuable, go here. Last week, Robert Sinn writing as Goldfinger on CEO.CA put out a wonderful piece on the current 5,000-meter drill program at Silver Lime for 2024. In the past Core has focused on the CRD/Skarn discoveries since they are both high-grade and near surface. But their technical people are telling management that the home run is going to be the porphyry target they have already snagged in the 2022 drill program. Similar systems would be the Cinco de Mayo property of Mag Silver with a $2 billion market cap, the Taylor Deposit in Arizona bought by South 32 for $1.8 billion and Penasquito gold/silver mine owned by Newmont. Penasquito is the fifth largest silver project in the world with over a billion ounces of silver and almost eighteen million ounces of gold. There are no issues at Core. The management has a handle on the technical issues. The company is fully funded for the 5,000-meter program for 2024 while from a technical point of view they seem to have tapped into a major copper, silver, lead and zinc deposit in Northern BC. With a $19 million market cap in CAD, I think the company is very cheap. Core is an advertiser on 321Gold. I have participated in several private placements and bought shares in the open market. Naturally that makes me biased so do your own due diligence. Company president Nick Rodway did an excellent presentation on YouTube taking the voodoo out of the technical side. Core Assets Corp ### Bob Moriarty |

Copyright ©2001-2025 321gold Ltd. All Rights Reserved