|

|||

Pinnacle: Opportunity For Profit with Real HistoryGreg McCoach PINNACLE MINES EXPERIENCE AND FORESIGHT HELPS CAPITALIZE ON SEVERAL BIG OPPORTUNTIES

What makes up Pinnacle's Silver Coin property is really several pieces of land that were amalgamated into one through a series of mistakes and faux pas by others. While the market was down and out in the late 90's and early 2000, 2001 the various owners of this land package for one reason or another let the mining leases go, or simply let them fall through the cracks. One family had held part of the property since the 1930's. Another mining company called Uniterre Resources, by accident, simply let the grants expire. Pinnacle's partner, knowing the value of the property and its relation to the Silbak-Premier mine quickly staked the ground and dealt it to Pinnacle, who is now in a position to benefit with the higher gold price. In addition, the property has a rich history of drilling, data and small production.

So here we have a property that has the exact same geological signature of a very successful mine located just a short distance to the south along strike. The geological similarities are as follows:

Putting all the previous work and data together has yielded some excellent targets for Pinnacle to drill, AND drilling is currently underway. The potential looks very good that the Silver Coin property could host ore bodies of the size and grade comparable with the ore bodies mined at the nearby Premier Mine. The mistakes of others have given Pinnacle the roadmap to success! Company Profile: Pinnacle Mines Ltd. is a Canadian based mineral exploration and development company with assets in Canada and China. In Canada the properties are in Northwestern British Columbia, in proximity to numerous past and producing mines including Barrick Gold's famed Eskay Creek Mine. In China, Pinnacle's current focus is in Southeast Yunnan, an area being increasingly considered for its potential to host significant mineral resources including "Carlin" style gold deposits. Pinnacle is managed by a very senior and well-rounded board of directors. Three of the six board members are senior mining engineers who have all been credited with the development of numerous mines worldwide. One board member, who is also the vice-chairman of Pinnacle's Asian subsidiary, is the largest mining contractor to China's largest gold mine. In addition, all senior officers and board members have been instrumental in financing hundreds of millions of dollars for mineral exploration and subsequent mine development. In British Columbia, Pinnacle's senior management and consulting geologists have been active in mineral exploration for over 30 years and were directly responsible for building at least three successful gold mines.

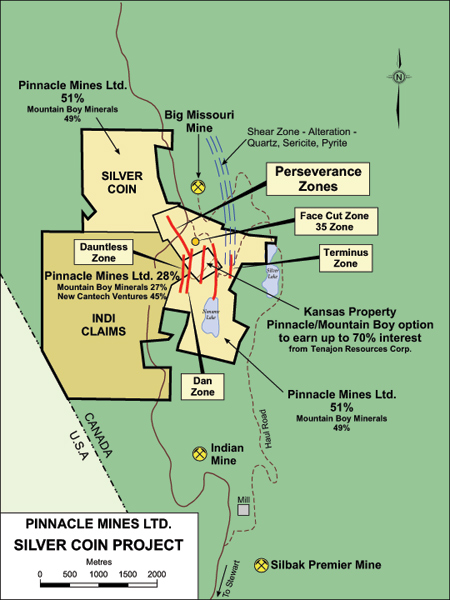

Silver Coin is a gold-silver-base metal property located about 24 kilometres north of Stewart, British Columbia in the Skeena Mining Division. The entire project consists of the Silver Coin property, the Dauntless property and the Kansas property. Through various option agreements, Pinnacle has the right to earn at least a 60 % interest in the Silver Coin property, a 33 % interest in the Dauntless property and up to a 70% interest in the Kansas property. The project covers approximately 1,500 hectares and features a zone of faulting and shearing with accompanying mineralization up to 300 metres wide that has been traced for 1.6 kilometers. Silver Coin shares many characteristics with the nearby Silbak Premier Mine, located just 5km to the south. Over its mine life the Silbak-Premier mine produced 4.7 million tons yielding approximately 1.8 million ounces gold, 41 million ounces silver, 4.2 million pounds copper, 62 million pounds lead and 20 million pounds zinc. Exploration potential on the property is excellent with numerous zones remaining to be tested. Due to the high concentration of mineralized zones, exploration is focused not only an underground mining situation but also on the possibility of mining a large open-pit. In addition, past exploration has been solely focused on the precious metals values rather than both precious and base metal values of the property. Silver Coin already has a small resource outlined from a large amount of work completed over the years. Surface and underground diamond drilling programs conducted from 1982 to 2004 have resulted in a total of 22,642.68 metres of core drilling in 168 holes from surface and 11,727.6 metres of core drilling in 214 holes from underground. Most of this work has been focused on the Kansas/West Kansas zone where the total inferred resource is 1,774,000 tonnes at 2.24 grams per tonne gold and 5.3 grams per tonne silver. Key to Pinnacle is increasing this resource by recognizing the missed opportunities of the past in view of the new information discovered in 2004. There are four main reasons why the previous property operators failed to discover more high-grade mineralization: 1. They failed to identify the main source of mineralization on the property. They mistakenly identified them as K-feldspar alteration. Dykes of K-feldspar rich rock called premier porphyry are the source of mineralization in the Premier Mine. As a result, they never applied a Premier Mine model in their exploration. 2. They failed to understand the structural setting of the property. In their exploration they closely followed three subparallel northwest striking west dipping faults, the Anomaly Creek, Gully and North Gully faults. These three faults however are secondary faults joining the main north-south oriented deformation zone with associated alteration and mineralization. 3. They never drilled below 700m elevation. Mineralization at the Premier Mine occurs at elevation ranging from 200 to 700 metres. 4. The previous operators of the property drilled very intensively on the Kansas/West Kansas, Facecut, 35, Storm and Snowball zones, neglecting large areas of silicification and quartz-carbonate veining. As a result, large areas of the property with a high potential to host precious and base metal mineralization received very little or no exploration at all. Only half of the 16 mineralized zones identified within the property to date were drilled. As is well known, the Premier mine has a relatively low-grade outskirt surrounding the rich core (which was mined out during 1919-1953) for open-pit mining during 1980s and early 90s. Thus, all the work so far done in Silver Coin property might be mostly in this outskirt and just have touched the tip of the core. The highest priority exploration target on the property is the recently discovered Perseverance zone and Kansas/West Kansas zones which is over 700 metres in strike length with a potential to double, exposed over a height of 300 metres and possibly having a true width of 50 to100 metres. The presence of roads crossing

the property, a nearby mill and the year-round seaport in Stewart

and its associated infrastructure makes the property an attractive

exploration and development project. CHINA GOLD PLAY In addition to the Silver Coin story, the company has made a bold move into China. China, which just recently opened up its highly prolific mining industry to foreign participation, has quickly become the "hottest spot" on the planet for major new gold discoveries by North American exploration companies. Pinnacle's participation in the Chinese mining picture could prove to be a huge winner all by itself, let alone in combination with what they have at Silver Coin. The Chinese Economic Miracle What is happening in China is truly amazing! With China's explosive economic growth and push towards a free market economy, an investment opportunity of a lifetime is now unfolding for those who know precisely where to look. In recent year's, the Chinese government has taken a number of critical steps to attract an ever-increasing level of foreign direct investment. The days of foreign investors facing massive red tape and exhausting bureaucratic delays have been replaced with a thriving market based system that has made China the most attractive country in the world to conduct business. As a direct result of the tens of billions of dollars now flowing into the country each year, China's economy is now the fastest growing on the planet. Pinnacle Mines is poised to take advantage of a once in a lifetime opportunity to work and profit in China, where tremendous potential for new discoveries of major gold deposits is unfolding. Many of the great areas known to host gold are now being made available to advanced western mining techniques. Chinese mining entities are finding western partners who can bring this technology to the best prospective gold properties in the country. Pinnacle is already positioned to take advantage of this opportunity with their Yang Wen Chong gold property in Yunnan Province and their critically important connections with China. I believe those connections will soon lead to a landmark deal that will greatly increase Pinnacle's importance in the gold exploration business in China and provide a major opportunity for early investors to profit. Insatiable Demand For Precious Metals Nowhere will China's growth have a greater impact than in the precious metals markets. The Chinese people have always had an insatiable demand for gold and silver. As the Chinese economy continues its incredible growth, more and more Chinese will be able to afford precious metals, which they consider to be timeless assets. Indeed, with recent passage of laws allowing individual citizens to own and trade precious metals, the Chinese government is teaching its citizens to purchase precious metals as a hedge against currency risk. Smart people!

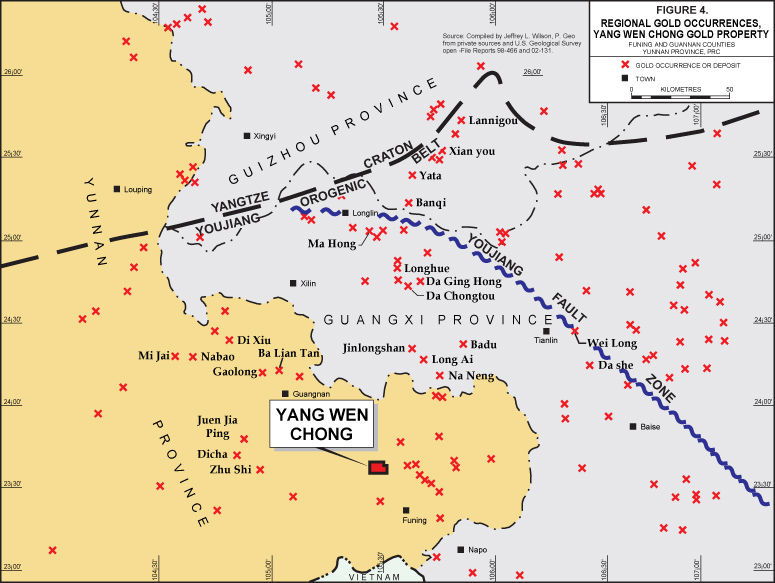

This prospective property was discovered as being a potential gold mine in 1990, while producing antimony on the property, the Chinese government discovered gold. This is very typical of other gold deposits around the world, particularly in Nevada. Where you find antimony, you will usually find gold. The YMC property is a 51.2 square kilometer mineral exploration license located in Yunnan Province, China. During the period 1996-2000, YMC was part of a joint venture between Yunnan Geology and BHP Exploration. To date 9 holes have been drilled on the property, numerous trenches, test pits and tunneling have been completed. One hole is reported by the BHP/Yunnan geological team to have a gold mineralization intersection of 1.63 grams/tonne (g/t) over 83 meters. In addition, significant mineralization has been identified over a length of 3 kilometers. Individual trench samples have widths and grades varying from 3.25 g/t over 10.63 meters t 3.15 g/t over 98.15 meters. The mineralization if open along strike and dip. Pursuant to an agreement with Yunnan Geology and Mineral Resources Co. Ltd. (YGM), Pinnacle acquired a 25% interest in the Yang Wen Chong gold property. Pinnacle and YGM are now establishing a sino-foreign joint venture company wherein Pinnacle can increase its ownership in YWC to 70% by spending 12,500,000 RMB ($1.9 million CDN) in exploration at YWC over a five-year period. Company geologists believe that the Yang Wen Chong property is geologically similar to the Jerritt Canyon gold mine in Nevada, which has produced over 5 million ounces of gold to date. In fact, southeast Yunnan has increasingly been attracting attention among the international geological community who believe that the region bears a strong resemblance to mineralization of the Carlin trend in Nevada. In 2004, Pinnacle completed and filed a technical report on the Yang Wen Chong gold project. Jeffrey L. Wilson, P. Geologist, following a property visit in early June 2004, prepared the report. He states his site visit and verification sampling corroborates significant gold mineralization and his main conclusions are:

In the mining world, it is no secret that the majority of economic mineral deposits are found by the junior mining companies. Perhaps the most important reason juniors make most discoveries is the talent, motivation and dedication of their management teams. It is often said in the mining business, that if an exploration geologist finds a mine it is likely that he will find others. This is due to the fact that far fewer than 5% of all exploration geologists will ever be credited with a discovery that leads to a mine in production. This is because those select, gifted, explorers who find numerous mines, seem to have a sixth sense that moves them to succeed. When looking for juniors to invest in, the most important factor that weighs on my mind is a team that has done it before, multiple times! The Pinnacle team surely has been here before and has earned the respect as "minebuilders". Andrew W. Bowering, President,

CEO Paul F. Saxton, Chairman,

COO and Director Steven Y. Chi, Director Gerald L. Sneddon, Director Ke Xi Ping, Director and

Vice-Chairman Pinnacle Asia Ltd. Bradford Cooke, Director The Big Picture for Gold: A new enthusiasm for gold is firmly in place. The past few years have witnessed a remarkable resurgence in the popularity of precious metals among both individuals and institutional investors. There is a growing number of market experts that are now convinced that a "Perfect Storm" is brewing that will provide more upward pressure than any natural or artificial market pressures can contain. With many analysts citing numbers above $1000 an ounce for gold, this can mean mind-boggling profits for shareholders of gold mining companies. Summary: The search is on for major gold deposits around the world. A junior mining company like Pinnacle, with such great properties and share structure, offers investors an immense opportunity to profit, with very little downside risk. The mineralization and database that is already in place on Silver Coin tells me that we have at least 500,000 - 1,000,000 ounces of gold in the ground, even though we cannot refer to that as a resource until we get more drill results. With drilling currently underway and results forthcoming very soon, those numbers look to be confirmed and hopefully grow, along with our share price! Since the Silver Coin property is located in a famous mine area, the entire infrastructure, including roads, power supply, water supply etc are all readily available. The mill that processed the ore for Silbak-Premier is also close by and could be rehabilitated which would drastically reduce capital investment and increase the rate of return if Silver Coin went into production. While Silver Coin is unfolding the company also has this very important China connection, which I feel could end up being far more important to the future of the company. Time will tell on this one, but I'm very optimistic that something will happen that could be significant for our share price. Dealing with the Chinese is all about relationships and Pinnacle certainly has that in hand. Last but not least, I see the price of gold continuing to go much higher as demand from the 1.3 billion Chinese citizens, who are prospering, becomes a dominant force in the physical gold market. This demand by itself, let alone all the other factors that are extremely bullish for gold, will insure a hot market for many years to come. I am recommending Pinnacle Mines as an immediate BUY for no more than 5% of your overall mining stock portfolio. Timing is of critical importance here as forthcoming announcements could see the share price move much higher. Since the company has so few shares outstanding, any good news could really move this stock quickly. Pinnacle Mines Ltd. July 2005 |

Often

times in the mining business it takes multiple mining entities

looking at the same promising property before the geological

key is discovered that unlocks the value of a property. That

has certainly been the case for another company we recommended

last year called Viceroy Resources that started with a resource

of 1.5 million ounces (originally discovered by Anglo gold 15

years ago) and which now has at least 3 million ounces and is

still growing. It is very rare that the first company that does

work on a property is the one that reaps the rewards. What happens

in most cases is that a company finds a promising target to explore

for gold and starts spending money on drilling. While searching

for an economic deposit, a negative business cycle (lower gold

price) can often take its toll on such a company and leave a

property sitting dormant for years before someone else gets a

chance to capitalize in the next bull market. Great opportunities

have come to the right mining executives when they can acquire

a property with a history for cents on the dollar when the market

is out of favor. All the money that was spent by others previously

provides the foundational setting for the new owner's success.

Such is the case for Pinnacle Mines on their Silver Coin property.

Often

times in the mining business it takes multiple mining entities

looking at the same promising property before the geological

key is discovered that unlocks the value of a property. That

has certainly been the case for another company we recommended

last year called Viceroy Resources that started with a resource

of 1.5 million ounces (originally discovered by Anglo gold 15

years ago) and which now has at least 3 million ounces and is

still growing. It is very rare that the first company that does

work on a property is the one that reaps the rewards. What happens

in most cases is that a company finds a promising target to explore

for gold and starts spending money on drilling. While searching

for an economic deposit, a negative business cycle (lower gold

price) can often take its toll on such a company and leave a

property sitting dormant for years before someone else gets a

chance to capitalize in the next bull market. Great opportunities

have come to the right mining executives when they can acquire

a property with a history for cents on the dollar when the market

is out of favor. All the money that was spent by others previously

provides the foundational setting for the new owner's success.

Such is the case for Pinnacle Mines on their Silver Coin property.