Chart In Focus

Gold’s Short-Term Price Oscillator

McClellan Financial Publications, Inc

Posted Dec 16, 2024

Dec 12, 2024

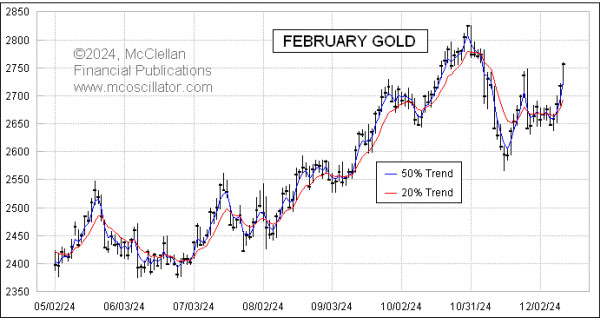

The recent 4-day up move in gold futures prices has produced an interesting overbought condition that is worth talking about. This week's chart is one I featured recently in my Daily Edition, talking about how when gold gets to a short-term overbought condition like this it is a pretty good marker of a short-term top. Gold has since started dropping out of that overbought condition.

Our Short-Term Price Oscillator (STPO) is a variation on the regular McClellan Price Oscillator, which is the difference between the 10% Trend and 5% Trend of closing prices. Some analysts may prefer to call those a 19-day and 39-day exponential moving average (EMA), but we prefer the originalist terminology employed by the late P.N. Haurlan, who was the analyst who first introduced the use of EMAs for tracking prices back in the 1960s. Haurlan was an actual rocket scientist who worked for JPL and who employed EMAs in the analog circuits they used then for adjusting how quickly rockets were steered to alter their course to track onto the intended target. He figured it would be good math to use for tracking stock prices on a computer, since he had access to one at JPL.

Haurlan referred to the different EMAs he used by their smoothing constants, e.g. 5%, 10%, etc. That refers to how fast the EMA adjusts to catch up to where the data have gone. The higher the smoothing constant, the faster the EMA. Haurlan initially employed EMAs on their own. In 1969, my parents Sherman and Marian McClellan introduced a key insight which was to look at the difference between EMAs. The McClellan A-D Oscillator does this with EMAs for the daily difference between Advances and Declines. The McClellan Price Oscillator does this with closing prices.

In the 1980s, another analyst named Gerald Appel picked up on this principle of looking at the difference between two moving averages. He introduced what he called MACD, or Moving Average Convergence and Divergence. Appel preferred different speed EMAs, equating to 12 and 26 trading days.

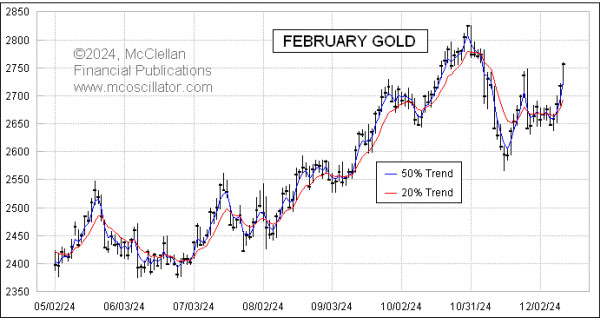

The STPO differs from our regular McClellan Price Oscillator in that it measures the difference between two much faster EMAs, the 50% Trend and 20% Trend. These would equate to a 3-day and a 9-day EMA, according to the analysts who think in those terms. Here is what those EMAs look like on a chart:

Because these are very fast EMAs, they hug the closing price data very closely. In fact it is often hard to see much difference between the two EMAs in a chart like this. That is why separating that difference out into its own indicator makes it possible to see better what is happening.

Up through Dec. 11, gold's STPO is showing a nice overbought condition. Such a condition is not a "signal", and an overbought or oversold condition can sometimes persist for longer than one might wish. It is part of the personality of gold prices that they tend to make blowoff tops and rounded bottoms, which is the opposite of the stock market. So an overbought condition like this in gold's STPO is usually a pretty good marker of at least a short-term top.

As I am posting this article on Dec. 12, gold prices are having a big downward response to this overbought condition. It does not always have to happen that way, but it does go that way often enough to make watching the STPO an important tool for a chartist's toolbox.

***

Related Charts

###

Tom McClellan

Editor,

The

McClellan Market Report

email:

tom@mcoscillator.com

website:

www.mcoscillator.com

(253) 581-4889

Subscribe

to Tom McClellan's free weekly Chart In Focus email.

Copyright ©1996-2024, McClellan Financial Publications. All Rights Reserved.

321gold

Ltd

|