>

|

|||

Blame it on DemographicsJohn Mauldin

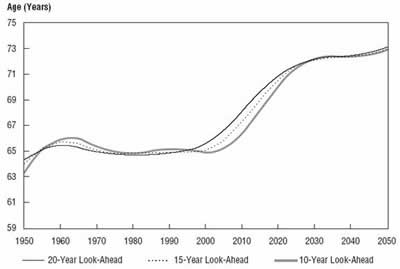

Last week we talked briefly about some of the problems surrounding Social Security, and especially the possibility that the deficit problems may be worse than we thought because of the trend towards (on average) living longer. But a large part of the current debate misses what I think should be the real point, and that point is the focus of this week's letter. Everyone assumes that if they work hard and save they will be able to retire. While a sad number of people do not plan for retirement, those who do make assumptions about what type of retirement they will be able to afford with their savings, pensions and Social Security based upon historical performance of the markets. But past performance is not indicative of future results. Today we are going to look at a study which suggests that past performance might in fact be highly misleading. That is because the conditions which created that past performance have changed dramatically, and that is going to have a great affect upon the retirement plans of the Boomer Generation. Bill Gross of PIMCO, commenting on this topic last week made these comments, which helps us put the topic in perspective: "Rob Arnott of Research Affiliates LLC, sub-advisor of PIMCO's all asset strategy and a co-collaborator with Peter Bernstein on several articles about risk and future asset returns, has advanced what I consider to be the most realistic take on Social Security and Medicare trust funds. Pre- funding these systems, he argues, 'is basically irrelevant.' And (in my own words) it matters little whether the system is pre-refunded with Treasury bonds or privately held stocks. The fact is that both of these financial assets represent a call on future production. If that production could possibly be saved, like squirrels ferreting away nuts for a long winter, then Treasury IOUs or corporate stocks might make some sense. But they can't. Future healthcare for boomer seniors can only be provided by today's teenagers, twenty-somethings, and even the yet to be born. We cannot store their energy today for some future rainy day. Nor can we save food, transportation, or entertainment for anything more than a few years forward. Each must be provided by the existing generation of workers for those who have retired and are presumably incapable of working." I wrote on the studies Gross is referring to in my book, "Bull's Eye Investing." Given the current debate over Social Security, I think it pertinent to reprint this section from chapter 10 which deals with retirement issues (with a few updates) and then offer a few comments. Quoting from the book: Retirement in an Aging World There are numerous forces that impact the economy, our investments, and our lives, but none is more fundamental than demography: the study of the characteristics of human populations, such as size, growth, density, distribution, and vital statistics. The popular concept of demographics is wrapped up in our ideas about the baby boom generation. A huge cohort of children born after World War II caused all sorts of changes, positive and negative, in our society. As this group gets older, there will be even more changes that must inevitably occur. And it is not just the United States, but nations throughout the world that have their own aging problems. As we will see, our problems are mild compared to those of Europe and Japan, a situation that has serious implications for the world economy. But there are also nations where the median population is getting younger, and this presents a different set of problems and opportunities. The aging of America and the world will affect us as almost no other issue. Most other factors have a great deal of volatile possible futures associated with them. How the nation ages is already in the cards. Demographically speaking, we know what the future holds. Now let's look at how that will affect our economy, investments, and possible retirement. Is Retirement in Your Future? First, we turn our attention to the question of retirement: Will the boomer generation be able to retire on time? Will Social Security go bankrupt? Is Harry Dent, author of The Roaring 2000s, right when he asserts that we will have a boom until approximately 2008 to 2009 because boomers are saving and spending? And then watch as things go bust (an actual depression) because boomers start selling stocks and retiring? (There are two caveats to which all must agree prior to reading this: First, you cannot shoot the messenger--meaning Robert Arnott, Anne Casscells, and especially me. Second, I am distilling a lengthy paper with a great deal of backup data into a few pages. Do not hold Arnott and Casscells, "Demographics and Capital Market Returns," Financial Analysts Journal (March/April 2003), responsible for my efforts.) We will look at the conclusions first, explain why they came to be, and then explore the implications. First, the good news: The boomer generation is going to live longer and be healthier than any previous generation. Each succeeding generation, as did our fathers, has lived longer than their parents and will continue to do so. The bad news is that boomers, on average, who are expecting to retire at 65 will not be able to do so. Your individual situation is up to you, but the average boomer will work until at least age 70, and probably 72 or 73. The good news, again, is that we are all healthier. I, for one, do not intend to retire at 70 or even 75. Again, this is an average, and with proper planning many will be able to retire earlier, should they so desire. (Richard Russell has been writing the Dow Theory Letters for 45 years, and now writes daily! He is my hero, going strong and writing more brilliantly than ever at 80. I shall not imitate him by getting up at 3 A.M., however, even in my dotage. I consider him one of the most insightful and savvy financial writers of our times. You can subscribe at www.dowtheoryletters.com.) Second, this delayed retirement is not a financial problem, but a demographic problem. Thus the solutions are not simply financial, such as save more money or raise Social Security taxes. Third, Social Security is not the primary problem. Long before we get to the predicted funding crisis of 2017 or 2029 or 2040 (depending on which politician you listen to), we have a market driven demographic crisis. Finally, I am going to suggest this is not a crisis at all, in the true sense of the word. It is merely an adjustment in expectations. It may even be a blessing. Fantasy Island Arnott and Casscells contend that the markets will force this increase in the retirement age. (See Figure 10.1 below.) This will happen whether or not politicians adjust the age for Social Security benefits. To explain what they mean by the market forcing the boomer generation to retire later, I am going to resort to a simplistic analogy. We will examine the merits and weaknesses of the analogy afterward. As you read, please know I am aware of many weaknesses in the story, but am trying to get over a major point that is critical to this argument. (The numbers I use are for illustration purpose only, to help you understand the concepts. They are not meant to be literal.)

Economists like to use an island economy to illustrate a point, and I will do so as well. Let's assume an island where 15 percent of the people are retired, 65 percent of the people are working, and 20 percent of the population are children. The elderly and the children depend on the workers to produce the goods and services they need, in addition to the goods and services the workers need. That means there is a ratio of about two workers for each dependent. The retired swap assets they have saved for the services they need. Now, let's add something to the water that makes workers want to have more children. Slowly, over time, the number of dependents per worker goes up. The population now needs even more goods and services. Each worker can be more productive, and that helps, as they create more ways to produce goods cheaper and faster. Fortunately, whatever has been added to the water also makes people stay healthy longer, so that people can work a little longer. It is not much longer, just a few years, but it makes enough of a difference to keep things progressing. The reason working a little longer makes such a difference is that the retired population consumes about three times as much in goods and services as the children do. So even though the percentage of the children in the population rises, it does not require nearly as much community effort to produce the needed goods and services for the young as it does to support the retirees. The combination of increased productivity and the older workers working a little longer makes for generally increasing prosperity. Notice that it is not the amount of money the retired population has saved. The critical factor is that someone has to do the work so that things and services can be bought. Society produces X amounts of goods and services. If there is more demand for these goods and services by retired people than actual goods and services produced, then:

If supply of overall goods and services drops, then prices will rise. Retirees require goods and services. If there are not enough goods and services to meet demand, prices will rise. This will make it difficult for people to afford to retire on their savings, and thus they continue to work. The earlier adult generation on our island has to work just a little longer to have enough assets to retire on and produce the goods that society needs. Because they work longer, they produce more goods and services, which has the effect of holding down prices and allows them to save more for retirement. Now, an interesting thing begins to happen 18 years or so after the miracle drug is added to the water. Their kids begin to enter the workforce, and the number of dependents actually falls, as more kids enter the workforce than the number of people who decide to retire. The retirement age actually rises slightly even as those retiring live longer. Thus there are more workers producing goods and services. Then another funny thing happens. Someone changes the water again, and the boomer generation stops having as many kids per family as their parents did. Because there were so many in the boomer generation, there were still lots of kids, just not as many per family. Even as more and more of their parents retire, the ratio of dependents to workers does not change. The boomer generation continues the tradition of their parents and becomes increasingly more productive. The amount of goods and services needed to maintain the population does not get out of proportion to the number of workers. Things become stable. The parents of the boomers, as they retire, exchange their savings for goods and services produced by the boomers and their children. The workers are willing to take these assets at ever-increasing prices for their products, because there is plenty to go around. This is partially because there is not a lot of demand from young dependents. Then it becomes time for the boomers to retire. Most of them have been saving for retirement. Knowing they are going to need their savings for retirement, they slowly begin to get out of riskier investments long before the time comes for them to actually retire. But they still expect to retire at the age their parents did, or around 65, even though they expect to live at least five years longer, and 15 years longer than their grandparents. But the boomers have made one big miscalculation. They forgot to have enough kids to support their retirement. So as time goes on, the working population has to produce more goods and services just to keep everybody supplied. The number of dependents per worker rises by 50 percent, until there are only 1.5 workers for every retiree/dependent. The workers see the time they have to work rise each year, just to produce everything that is needed. This gets old very quickly (pardon the pun). The remaining workers get tired of working 60-hour weeks, instead of the 40- hour weeks their parents worked, just to produce the same amount of needed goods and services. The workers go to the boomer generation and say, "We want more for our work. Either give us 50 percent more money for what we produce or we are going to give you 33 percent less goods and services for what you give us. But we will not work 60 hours a week any longer for the same amount of your assets as we once took for only 40 hours. If you don't like this, you are quite healthy and can work a little longer before you retire. Take it or leave it." The boomer generation is quite upset. This isn't the deal they thought they had. They had been promised by their leaders they could retire at 65. Now they find they do not have enough assets to pay for the goods and services they need. It does not matter how much they have saved. There are only so many goods to go around, and the workers set the price of the goods, plus they have control over the prices they are willing to pay for the assets the boomer generation has spent a lifetime saving. There is only one solution, as the boomers need the goods and services to live. They have to go back to work. Supply and Demand Is the Main Culprit Before we can examine the implications of the story and data, you must get in your mind one main point: This problem is one of supply and demand. It has nothing to do with how much a generation saves or how much a generation gets on Social Security. Crudely, if there are more rabbits than wolves, you will see an increase in wolves. If there are not enough rabbits, you will see a decrease in wolves. There is a balance in nature, and there is also a balance in economics. Arnott and Casscells show that when you look at the dependency ratio (the number of workers for each dependent) and adjust for the fact that it takes more to support a retired person than a child, there is a strong correlation and in fact a causation between the average age of retirement and the number of workers still in the workforce. As the parents of the boomer generation have retired, there have been fewer children demanding resources so that the dependency ratio of workers to children and retirees has been stable. That trend stops in a few years, and they predict the average age of retirement will begin to increase, starting in just a few years and rising to 69 by 2015 and over 70 by 2020, and, if the ratio holds, to 73 by 2050. Literally, if every one of the boomer generation retired at age 65, there would not be enough people left in the workforce to deliver the pizzas, provide health care, supply police services, and so on. Ironically, one of the bright spots of this report is that it means unemployment for the next generation will probably go down over time as more and more people retire and others must take their places. In places or countries with shortages of workers, labor costs go up. That means the labor component of goods and services goes up, which raises prices and/or lowers profits. This process will play out over the next four decades. It will be slow and inexorable. Even dramatically increased productivity, beyond even today's explosive growth, will only mitigate the force of this trend. The boomer generation will demand goods and services, and because there are not enough workers, the economy will not be able to supply enough goods and services, and workers will demand more of the saved assets of retirees for what they produce. This can come as increased prices for the production, as a drop in the value of the saved assets, or both. That means either an inflation in prices or a deflation in wealth or a combination of the two. If today one share of Cisco will buy you a meal at Denny's, will it buy you a meal in 2020? People investing in Cisco today hope that the price of those shares will rise to where it will buy several meals. They expect stocks to rise 7 percent a year. However, in 2020 when there are not enough workers to produce everything retirees want, the law of supply and demand means that it will take more Cisco shares to buy a dinner than we currently plan on. Unless, of course, we can find more workers. (end of book quote) The Necessity of Absolute Returns This underscores the importance of one of my primary investment themes: this is the era where investors should be seeking absolute returns. Let's revisit one of the last paragraphs: "The boomer generation will demand goods and services, and because there are not enough workers, the economy will not be able to supply enough goods and services, and workers will demand more of the saved assets of retirees for what they produce. This can come as increased prices for the production, as a drop in the value of the saved assets, or both. That means either an inflation in prices or a deflation in wealth or a combination of the two." You must have a strategy that will allow your portfolio to outperform inflation. But you must also be hedged against a deflationary drop in the prices of your assets. For most investors that means the stock market. That is why I am against an investment philosophy which says you should be a long term buy-and-hold investor of index funds for the rest of this secular bear market cycle. If you have 40-60 years before retirement, you will have time to recover. However, if you want to retire in the next 20 years, and are depending upon not only your principal but some hypothetical compound number to provide that retirement, I think there is substantial risk in such a relative return strategy. A properly executed absolute return strategy will allow you to both beat inflation and hedge your investment portfolio against this secular bear market cycle. I certainly expect you to be able to retire and prosper in the coming years. It is going to be an exciting time. If you would like to learn more about what I mean, and if you can deal with a little shameless plug, I suggest you read my book, Bull's Eye Investing. I lay out a clear case why we are in a secular bear market cycle like 1966- 1982. If you had an absolute return strategy as outlined in my book you would have done well. You can go to www.absolutereturns.net to read more about the book, or go straight to Amazon and buy a copy. Puerto Vallarta, Connecticut and Home As you get this I am on a well deserved break for a few days in Puerto Vallarta. I have just about recovered from that nasty cold I picked up in New York a few weeks ago. Nevertheless, I will hazard another trip to the north, going to Connecticut the week I get back to a conference geared on teaching me how to think inferentially, then to New York for a quick meeting and home. Then a funny thing happens. I am home for a whole month! I had to delay my London trip to April. That also means I will be in town for spring break. It would be nice if all seven kids could get the same spring break, rather than a few here and there, but it will be fun anyway. Did anyone notice that spring training starts in a few weeks? Last fall, my Texas Rangers had to say "wait till next year" sometime in September. Now next year is here, but we still look like we will have no pitching help. The ground crew is beginning to work on the field outside my office window at the Ballpark in Arlington. Soon they will begin the annual ritual of replacing the infield dirt. I have never understood why they seem to replace the dirt every year, but the level of attention to detail on the playing field is amazing. They bring in an army to take out the old dirt and bring in the new, carefully folding and mixing and pounding it into place. But the ball does bounce evenly. If we invested our money like they take care of the grass, we would all retire millionaires. Have a great week and take some time to plan for your own future even while you take pleasure in the present. Retirement is not the goal, it is just part of the trip. Make sure to enjoy as much as you can the first time, as we don't get to do it again. Your 'anticipating the crack of the bat' analyst,

February 11, 2005

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Thoughts from the Frontline may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273. This information

is not to be construed as an offer to sell or the solicitation

of an offer to buy any securities. |