Field Evaluation Report: Copper

Canyon Resources (CPY.V)

Copper Canyon Project, Galore Creek

district, British Columbia

Michael Fulp

Posted Nov 23, 2007

Written Oct 16, 2007

Introduction

On September 15, 2007,

I conducted a field evaluation of Copper Canyon Resources' Copper

Canyon project in the Galore Creek district, northwestern British

Columbia. I was accompanied by Tim Termuende, President and CEO,

and Chuck Downie, Vice-President Exploration of CPY, and Andy

Schwab, investor relations consultant. Danette Schwab, geologist

for Nova Gold (NG), guided the examination. Nova Gold is presently

earning a 60% joint venture interest in the Copper Canyon project

from CPY.

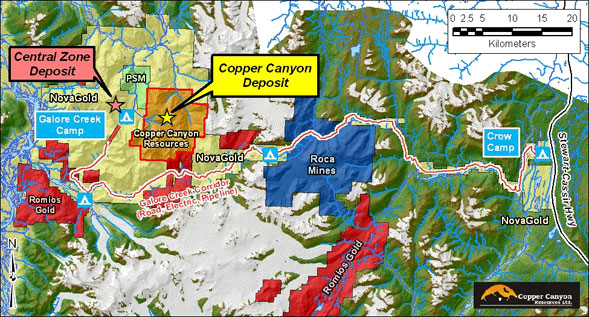

Access to the property from

Vancouver was via regular commercial air service to Smithers,

followed by a four hour drive north on highway 37 to Bob Quinn

and on to the Crow Camp staging area, thence a 30 minute helicopter

ride southwest to Nova Gold's Galore camp. The mine site is located

70 kilometers west of highway 37 and 150 kilometers northeast

of Stewart, British Columbia, a year-round concentrate shipping

port. The terrain is extremely rugged and consists of steep ridges

and glaciated peaks with hanging valleys, and braided glacial

streams and rivers in broad, U-shaped, outwash valleys.

The field examination was brief

and included a fly-over of numerous development and construction

activities, including road and bridge building, tunneling, camps,

staging areas, and drilling. This was followed by examination

of core from three recent Nova Gold drill holes at Copper Canyon,

a walking tour of the Galore camp, and an overlook of NG's Central

Zone discovery gossan. The tour ended with a fly-over and field

examination of the Copper Canyon discovery outcrop and flight

back to the staging area.

Satellite image of Galore

Creek district showing access, land positions, camps, and deposits

referred to in text.

At the time of my visit, 667

people were working from six camps and 15 helicopters were in

service. Galore Creek is the largest airlift and private mine

development project in Canadian history with a capital expenditure

budget of $2.0 billion, more than twice the entire 2010 Vancouver

Olympics.

Crow Camp helicopter

and equipment staging area

Crow Camp helicopter

and equipment staging area

Nova Gold's Galore Creek feasibility

study in October 2006 included a proven and probable reserve

of 540 million tonnes grading 0.56% Cu, 0.30 g/t Au, and 5.3

g/t Ag. The total global resource is over one billion tonnes

with 7.8 billion lbs Cu, 7.8 million oz Au, and 172 million oz

Ag, more than $30 billion in contained metal. One of their primary

exploration goals in summer 2007 was drilling CPY's Copper Canyon

deposit to complete their 60% earn-in and expand and upgrade

the resource. Twelve holes totaling 4940 m were drilled. With

this program, NovaGold has completed its work commitment to earn

60% in the joint venture. It may acquire an additional 20% interest

by paying Copper Canyon C$1 million and completing a feasibility

study by October 2011.

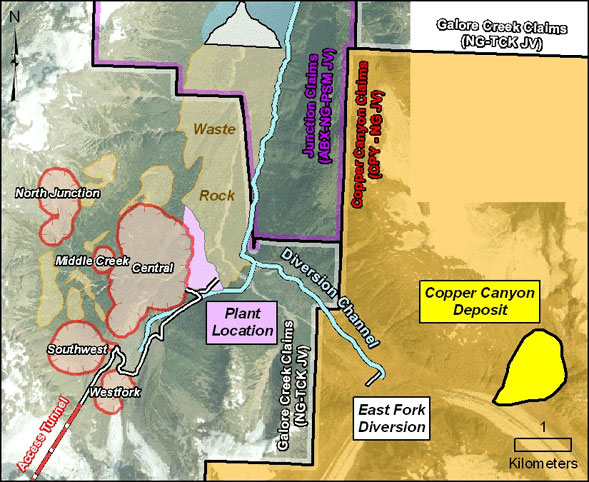

Galore Creek district

showing claim positions and joint ventures, porphyry copper-gold-silver

deposits, and infrastructure including diversion dam and channel

on ground covered by mineral claims of Copper Canyon Resources.

Exploration History

Copper Canyon was discovered

in 1956 by geologists of American Metals Company in a helicopter

reconnaissance program. They staked 71 claims on copper oxide-bearing

gossans.

Copper Canyon discovery

outcrop looking northwest to ridge above tail section of helicopter;

green, blue, and black copper-oxides underlying rusty-brown iron

oxide gossan.

Seven core holes totaling 1000

m with poor recovery were drilled in 1957. Two geophysical programs

were conducted in the early 1960's. In 1988, Canamax Resources,

the corporate successor, examined the deposit for its gold potential.

In 1990, a junior exploration company, Consolidated Rhodes Resources,

optioned the property, twinned three of the early holes, and

drilled another 12 widely-spaced holes over three known mineralized

zones. They dropped their option in 1992. Canamax merged to become

Canada Tungsten in 1993 and the property lay dormant. In 2001,

the claims lapsed and were immediately staked by prospector Bernie

Kreft. Eagle Plains Resources acquired a 100% interest in the

claims and in 2003 joint-ventured the property to Nova Gold.

Since that time, 22 additional holes have been drilled by Nova

Gold, including 12 in the summer 2007. In 2006, Eagle Plains

spun the Copper Canyon property into a separate company, Copper

Canyon Resources (CPY).

Copper Canyon Geology, Alteration,

and Mineralization

The Copper Canyon deposit is

an alkalic copper-gold-silver porphyry located in the Stikine

Terrane of northwestern British Columbia. It lies six km east

of Nova Gold's Galore Creek Central Zone deposit. Mineralization

is hosted by Jurassic-Triassic alkaline volcanic and volcaniclastic

rocks and intruded by multiple phases of syenite as dikes and

a stock and magmatic-hydrothermal breccias. The K-Mg dominated

alteration assemblage consists of potash feldspar, biotite, garnet,

carbonate, sericite, anhydrite, and albite. Ore mineralization

is chalcopyrite, lesser pyrite, minor sphalerite, and gold.

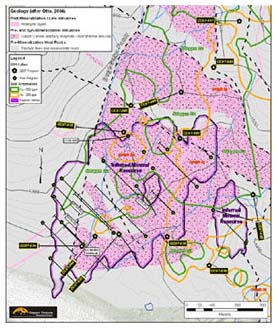

Drilling prior to 2005 defined

a broad area of mineralization at least 700 meters by 400 meters

that is open in all directions. The mineralization begins at

surface to at least 300 m deep and occurs as a roughly 100+ meter

thick zone of disseminated chalcopyrite and lesser pyrite. Recent

drilling in 2007 (12 holes, 4940 m) by Nova Gold was designed

to expand the known resource both laterally and to depth and

also explore some of the numerous soil geochemical and geophysical

anomalies that exist within the largely untested alteration halo.

(Click on image to

enlarge)

Copper Canyon geology,

drill holes, inferred mineral resource, and Cu-Au soil anomalies

Discussion and Recommendation

Reference should be made to

my previous evaluation report on Copper Canyon Resources (published

by Jay Taylor's Gold & Technology Stocks on April 5, 2007

and posted on CPY's website) for share structure, management,

other properties, and company positives and negatives. Major

project development at Galore Creek has occurred since the report

was written with entry of Teck-Cominco as 50% partner with Nova

Gold and their commitment to fund the first $500 million of capital

costs. All permits are now in place and the project is slated

for production in 2012.

Porphyry copper-gold deposits

are commonly valued at 3-4 cents/lb copper equivalent in-the-ground.

Copper Canyon Resources has a 43-101 inferred resource of 165

million tonnes at 0.74% Cu-eq equaling 2.68 billion pounds of

copper at 0.35% cut-off. Given NG's 60% interest in the Copper

Canyon project, CPY's 40% net is 1.07 billion pounds copper.

This methodology predicts a strict, peer-based valuation market

capitalization of $32-43 million. CPY has a current market cap

of $45 million and it is fully valued based on this approach.

However, a strong case must

be made that Copper Canyon should be valued much higher than

most deposits of this type for the following reasons:

1). The Nova Gold-Teck Cominco

JV will fund all capital costs for development of the Galore

Creek deposit including access, power, slurry pipeline, water

diversion, tailings dam, mine and processing equipment and infrastructure.

Under the joint venture agreement, Copper Canyon Resources is

carried to feasibility if NG-TCK elects to acquire 80% of the

project. After that, CPY will be required to contribute 20% of

the capital costs to develop the Copper Canyon deposit. They

will not be required to contribute capital to other infrastructure

costs such as access and power.

2). Recent drilling by Nova Gold has been successful in expanding

the copper mineralization significantly, in particularly to depth

250 m below the discovery hole first drilled in 1957 and twinned

in 1990 (CC-90-02 with 271 m of 2.41% Cu-eq). This hole (CC-07-33)

is mentioned on NG's website and strong chalcopyrite mineralization

is verified by my recent core examination. Assay results of all

holes are expected within two months. In addition, numerous soil

geochemical and geophysical anomalies remain untested in the

alteration halo surrounding the presently defined resource.

3). The 43-101 resource estimate

was completed in February 2005 using the following metals prices:

$0.90/lb Cu, $375/oz Au, and $5.50/oz Ag. Given the secular bull

market for commodities, these are very low base values for long-term

metals prices. An updated 43-101 resource is expected in early

2008 and, because of recent drill success and major increases

in two-year trailing average metals prices, CPY's net copper-equivalent

resource is expected to increase significantly.

4). Copper Canyon has the highest

gold grade of the seven porphyry deposits known in the district.

Potential also exists for high grade gold veins along faults

(e.g., 2005 drill hole with 2.5 m grading 50.6 g/t Au and 71.6

g/t Ag).

5). Nova Gold's mine plan anticipates

a need for higher grade mill feed after year five of production

at the Central Zone deposit. The Copper Canyon deposit has higher

grade at 0.74% Cu-eq than other satellite deposits on NG's ground

and logically would be mined next.

6). NG-TCK's Galore Creek feasibility

study plans construction of a 1500 m-long water diversion channel

and 18 m-high diversion dam structure in Copper Creek commencing

in the second quarter 2008 with completion by year's end. These

structures will divert surface runoff waters from the planned

tailings area located directly downstream and must be completed

before start of construction on the main tailings coffer dam

in January 2009. These developments are on surface lands overlying

the Copper Canyon mineral claims.

With the upcoming infrastructure

development in Copper Creek and the prospects for a substantial,

qualified resource increase in the near future, a probable scenario

for Copper Canyon Resources is take-over by the Nova Gold-Teck

Cominco joint venture in 2008.

In my opinion, Copper Canyon

Resources is undervalued at its present market capitalization.

I recommend Copper Canyon Resources as a moderate risk, mid-tier,

junior stock at the current price of 90c. Target price is $2.00/share

within the next 12 months.

Michael S. Fulp, M.S., CPG

Consulting Geologist

email: msfulp@attglobal.net

Disclaimer: I am a shareholder

of Copper Canyon Resources and a paid consultant to the company.

321gold Ltd

|