| |||

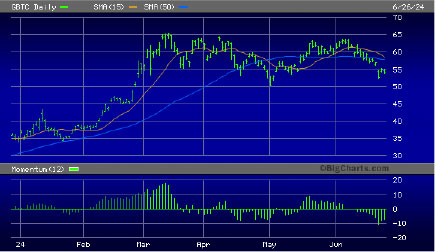

The True Purpose of BitcoinClif Droke Have you ever wondered why bitcoin was created? More importantly, are you aware of bitcoin’s true function in today’s financial market? Here I’ll provide a brief explanation of what bitcoin’s true purpose is and why, despite its speculative utility, it will never replace gold as either a safe-haven vehicle or a reliable medium of exchange. We’re all familiar with the official story of the crypto’s inception, how it was allegedly the result of that invisible mastermind, the pseudonymous Satoshi Nakamoto. We’re also told the rationale behind bitcoin was to create a non-trackable, untaxable digital currency outside the reach of central banks and federal regulators. As it turned out, of course, none of these lofty goals were ever realized. Bitcoin is trackable since all Bitcoin transactions are public, traceable, permanently stored in the Bitcoin network and recorded on the public ledger known as the blockchain. Bitcoin is also taxable since the IRS treats cryptocurrencies as property for tax purposes, which means bitcoin owners must be taxed if they sell or use it in a transaction, and it’s worth more than it was when they purchased it. And while the Securities and Exchange Commission (SEC) doesn’t yet formally regulate bitcoin, it currently regulates investments or derivatives related to the crypt asset. Thus, all three of bitcoin’s original raisons d’etre have long since ceased to be rationales for owning it. That’s not to say there are no legitimate reasons for owning bitcoin as a temporary speculative medium. While it has no inherent value, it currently carries a hefty value assigned to it by its exponents in the crypto marketplace. However, before considering bitcoin as an investment, it’s imperative to give close scrutiny to what it actually represents. Here are some of those factors: 1. Bitcoin is not a currency. It was brought into existence primarily as a speculative medium for Millennials, who for years remained skeptical of equities in the wake of the 2008 credit crash. This was the same generation who launched Occupy Wall Street, a generation that distrusted bankers and financial market promoters. They saw the devastation the stock market crash wrought on the life savings of millions and swore to avoid at all costs the equity market that ensnared their parents. But the allure of speculation beats strong in the American breast, and the younger generation could not sit idly by while the financial market recovery of 2009-2019 roared ahead without them. Instead of stocks, they turned their attention to another speculative asset, namely cryptocurrencies, which they proudly embraced as the great invention of their own generation. Ultimately, however, the allure of equities proved irresistible, and by 2018—with the advent of zero-commission online brokers like Robinhood—the Millennials were dabbling in stock trading. By 2020, the embracement of the stock market was complete for this generation. Which brings us to our second point, namely: 2. Bitcoin isn’t a legitimate competitor, or alternative, to gold. Early on in its development, a concerted attempted was made to place bitcoin and other cryptos on the same level as gold as a protective asset during periods of economic turmoil. Aside from its obvious speculative appeal, its proponents claimed for years that bitcoin would someday supplant the yellow metal as the safe haven du jour for investors looking to preserve money when financial markets go awry. However, what kept bitcoin from ever replacing gold as a safe haven was the affinity that professional speculators have always had for buying bitcoin whenever they feel like embracing risk. For this reason, bitcoin has always served as more of a leading indicator for the stock market than for gold. Physical, storable gold, meanwhile, to this day retains its safe-haven leadership over invisible crypto “coins,” and for good reason: bitcoin has no inherent value, is far more subject to confiscation by “authorities” than physical gold and is entirely too volatile to ever serve as a reliable long-term store of value. A final point can be made, which is: 3. Bitcoin is a way station on the road to the full-scale introduction of a central bank digital currency (CBDC). To further consolidate their control over the remnants of the middle-class economy, policymakers have made clear their intent to eliminate cash transactions and replace it with easily trackable CBDCs—which have the added benefit (from the government’s perspective) of allowing all transactions to be taxed without having to rely on self-reporting. And as the younger generations become accustomed to the idea of a digital “currency” via bitcoin and other cryptos, the transition to CBDCs will be made all the easier. For now, bitcoin serves the useful function for gold investors as a weather vane for the equity market, while also letting us know if risk aversion is on the rise. To that end, the recent action in my preferred bitcoin tracker, the Grayscale Bitcoin Trust (GBTC), has been less-than-ideal for stock market bulls. GBTC fell under the 15-day moving average earlier this month in confirmation of an immediate-term (1-to-4-week) trend reversal. Shortly afterward, a break under the widely-watched 50-day MA followed.

Normally, such relative weakness in the bitcoin ETF would suggest a loss of confidence among speculators and hedge fund managers, in turn putting equities at risk. But with the U.S. presidential election beckoning, Wall Street is pulling out all the stops to polish the proverbial brass and make things look good for the incumbent administration. This likely explains why for week after week we’ve seen enormous erosion in NYSE breadth via the big increase in stocks making new 52-week lows versus the shrinking number of new highs. And yet, the leading tech stocks have been able to keep the major averages trending higher. Abundant liquidity is another reason for the broad market’s buoyancy, as reflected in the still-strong NYSE advance-decline (A-D) line. As long as this important indicator is trending higher, the leading mega-cap stocks will likely continue to save the day for the benchmark S&P 500 Index.

That said, the Value Line Geometric Index (VALUG) doesn’t lie and can’t be manipulated as easily as the SPX can. Here you can see the clear tendency for VALUG to respond to the increasing risk aversion reflected in the bitcoin ETF shown above. Finally, on the precious metals front, a recent missive from the respected market technician Tom McClellan noted that small speculators in silver are heavily bullish on the white metal despite the recent price pullback in silver. That’s not a good sign from a contrarian’s perspective, and silver is starting to show signs of short-term weakness. As is often the case, a listless gold market tends to follow silver's lead, so if the silver super-bulls are wrong (as they normally are), we can expect to see some near-term weakness in gold (which I’d view as a buying opportunity from a longer-term perspective). ### Clif Droke About the author: Clif Droke is a veteran gold market analyst and published author. He can be contacted at clifdroke@protonmail.com |