| |||

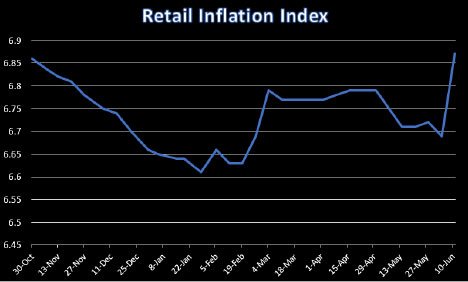

Bird flu response is now an inflation (and gold price) driverClif Droke Who would have ever thought the spread of an avian disease would serve as a legitimate catalyst for higher consumer prices and gold prices? Welcome to the year 2024, where the seemingly impossible has become a daily reality. While the major U.S. news media outlets are busy touting a supposed “easing” of inflation pressures, consumers continue to empty their wallets as retail prices remain high and, in some categories, are increasing. Here’s what CNN.com had to say on that topic: “Americans and the Federal Reserve have another positive development to celebrate: More evidence that price pressures are fading. Wholesale inflation cooled significantly in May, with prices down 0.2% from April’s 0.5% increase, according to data the Bureau of Labor Statistics released Thursday.” The Producer Price Index (PPI), which measures price changes that manufacturers pay to suppliers, rose 2.2% year-on-year in May, which was unchanged from April, but below the 2.5% price increase analysts had predicted. But as the latest retail price data reveals, diminishing wholesale inflation isn’t exactly a cause for celebration among shoppers—particularly when producers aren’t passing along the cost savings. While the news media tout the 7% drop in retail gasoline prices since April, a whopping 75% jump in egg prices for consumers—in just the last two weeks—is barely mentioned. Nor is a recent 10% increase in bagged coffee prices given much discussion. In order to provide a real-time picture of what shoppers are paying at America’s most shopped store, Walmart, I created an inflation index of sorts last year. It’s a weekly average of 15 of the most commonly purchases consumer staples using the Walmart.com shopping website as the basis for the prices. Items include things like milk, eggs, coffee, underwear, paper towels, cereal and even gasoline prices (the index’s only non-Walmart component). Here’s what the inflation index looks like as of this week:

As you can see, retail price inflation as measured by the index spiked to a new multi-month high this week—mainly on the big jump in coffee, egg and milk prices. The latter two categories are important to mention in view of the increasing attention being given to the so-called “bird flu epidemic.” Per the Guardian newspaper, “While bird flu has been around for decades, the current outbreak of the virus that began in early 2022 has prompted officials to slaughter nearly 82 million birds, mostly egg-laying chickens, in 47 US states, according to the US Department of Agriculture.” That policy response to what has so far been a non-event is starting to trigger price inflation on the retail level. Clearly, government officials didn’t learn any lessons from their overreaction to the health scare of 2020, when the long-established principle of “extraordinary claims demand extraordinary evidence” was ignored at the nation’s peril. What’s more, even milk prices are now starting to increase, which is of further significance to the developing bird flu narrative. As USA Today reported this week, “Cattle on more than 90 farms in 12 states have been infected since late last year, as well as three people who caught the disease from cattle,” in what is being styled a “highly pathogenic avian influenza.” Whether or not bird flu eventually morphs into the next “global pandemic” is still conjectural at this time. But there’s little doubt that what little we’ve already seen of this episode is beginning to push retail food prices higher. And if the episode turns into a legitimate public health scare, the government response to it will no doubt lead to even greater inflationary pressures (à la 2020). However, the “golden lining” to this cloud for investors is that the yellow metal should benefit from the increasing inflation pressures the bird flu response is creating. In the early stages of the 2020 Covid episode, gold prices exploded 40% higher in just over a four-month period as the prospect of runaway inflation first came into sharp focus. Moreover, while gold has lately been treading water just under its all-time high, it’s up 15% year to date—partly on central bank buying, but also on the increasing likelihood that consumer purchasing power continues to shrink going forward. And that loss of purchasing power—and corresponding increase in gold price strength—will almost certainly be influenced by the official response to the latest public health scare. ### Clif Droke About the author: Clif Droke is a veteran gold market analyst and published author. He can be contacted at clifdroke@protonmail.com |