| |||

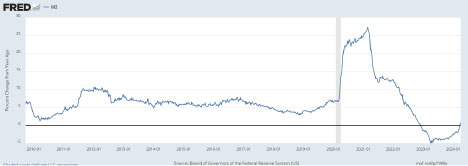

Why Inflation is Going NowhereClif Droke The predicted demise of inflation has been this year’s biggest “swing-and-miss” for Wall Street analysts and economists alike. As far back as a year ago, untold numbers of them boldly proclaimed the U.S. inflation rate would almost certainly diminish heading into 2024, an outcome that has thus far proved elusive. But certitude doesn’t always translate into reality where the political economy is concerned. Indeed, those widespread expectations for lower inflation were based largely on the collapse in the year-over-year change in money supply. The post-Covid era crash in M2 money velocity (see chart below) was put forth as the main reason why retail prices would “inevitably” decline this year.

Further integral to those failed forecasts was a misunderstanding over what exactly constitutes inflation. One well-known economic blogger recently had this to say about it: “Inflation is not caused by rising prices. It’s caused by an imbalance between the supply and demand for money. If money supply and demand are in balance, the overall price level will not rise, but that doesn’t mean that some or even many prices can’t continue to rise in various sectors of the economy.” While it’s true enough that rising prices don’t “cause” inflation, rising prices are the invariable result of inflation—in much the same way a high temperature is the tell-tale symptom of a fever. On that score, the classic symptoms of inflation are: 1.) rising prices, 2.) rising wages and 3.) rising interest rates. All three of these symptoms are currently in evidence. But let’s examine the economist’s second statement mentioned above, viz. that inflation is caused by an imbalance in the supply and demand for money. In what is perhaps the most widely quoted of all bromides concerning the phenomenon, Milton Friedman echoed this sentiment when he said: “Inflation is always and everywhere a monetary phenomenon.” Yet this basic observation fails to take into account the other side of the inflation ledger, namely the production and transportation of consumer goods in the economy. The classic definition is that inflation occurs when “too much money is chasing too few goods.” As simplistic as it may sound, experience teaches it’s the most accurate explanation for rising prices. That is, a paucity in the production (or distribution) of goods will invariably contribute to higher consumer prices when monetary liquidity is overly abundant. Indeed, at certain times, the under-production of consumer goods is the primary cause of inflation. (It can be argued that such has been the case since 2020.) And it’s for this reason that Friedman’s definition might be better expressed as follows: Inflation is always and everywhere a political phenomenon. For the better part of the last century, inflation of the runaway variety has been a rarity in America—thanks largely to the nation’s astonishing productivity and relentless technological innovation. Virtually no amount of newly minted money could keep pace with the incessant supply of new products flooding the U.S. market. The boundless supply of new goods, coupled with unbridled consumer demand, acted as a sponge to absorb excess money. But all of that changed with the nation’s—and indeed the world’s—heavy-handed political response to Covid in 2020: the shutdown of countless businesses, coupled with subsequent supply-chain disruptions, did more to engender inflation than any amount of increase to the nation’s money and credit supply could have accomplished. And even now the global supply chain hasn’t fully returned to a pre-Covid state of normalcy. Hence, the persistence of high retail prices across the economic spectrum. Moreover, persistent inflation is often the result of an over-active government which seeks to usurp the function of the free market’s “invisible hand” in setting prices. At the risk of stating the obvious, federal fiat rule has been in increasing evidence since 2020, with both state and federal governments making a growing number of economic mandates, decrees and dictates—many of them in direct conflict with clearly stated consumer demand. (The push to replace ubiquitous gas-powered cars with widely unloved electric vehicles by 2032 is a case in point.) As for the contention that the inflation rate is in abeyance by virtue of the strengthening U.S. dollar index (symbol DXY, see chart below), it should be noted that the trade-weighted dollar isn’t the true measure of the currency’s value in the everyday economy. Put another way, the “common man’s dollar” isn’t properly reflected by the DXY.

To get a truer sense of the “street” dollar, take a look at the chart for the national retail gasoline price average. As fuel prices ultimately determine the cost of a wide variety of consumer goods, the gasoline price serves as an excellent proxy for inflation trends. The chart below (courtesy of the GasBuddy website) shows current nationwide price-per-gallon for gasoline, which is well above the 10-year average. If you mentally invert the gasoline price trend, you’ll have a good idea of how much the domestic dollar is really worth.

The above chart also suggests the new long-term price floor for U.S. gasoline prices in the aggregate is $3.00 a gallon—a floor that hasn’t been broken since the White House declared in 2021 a series of executive decisions which undermined domestic petroleum exploration and development. Suffice it to say, the $3/gallon level, or anything above it, isn’t conducive for inflation to diminish anytime soon. This naturally begs the question of how to hedge or protect against a further erosion in personal purchasing power. In times when the inflation rate remains both high and stubbornly persistent, gold has been the historically most reliable anchor for protecting against a weakening currency. And with all signs pointing to inflation going nowhere, holding a percentage of one’s assets in gold will almost certainly prove to be a smart bet going forward. ### Clif Droke About the author: Clif Droke is a veteran gold market analyst and published author. He can be contacted at clifdroke@protonmail.com |