|

|||

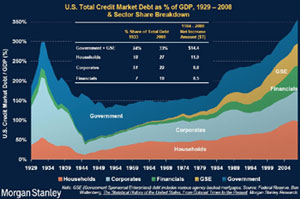

Our Last PresidentKarl Denninger So here we have it, one quarter in the books (almost.) 2009 is shaping up to be an "interesting" year, in the form of the old Chinese curse - not the sort of "interesting" you want. I am going to focus on a few things; let's start with this graph that got posted over on the forum and was apparently excerpted from a Morgan Stanley report; it depicts the debt load and breaks it out (I've run a previous copy of a similar chart, but without the breakdown - this is much prettier)  While GDP went from roughly $10 trillion to $14 trillion between 2000 and 2007 (I don't have a final 2008 number handy yet) debt grew much faster. But from this graph it is clear that the problem didn't start in 2000. In fact we came out of the historical "safe range" after the early 1980s recession, as the decision was made by government to start playing games with regulation and soundness not only for private citizens and corporate America, but for themselves as well. This sort of "fake prosperity" indeed looks real good and feels even better - for a while. I lived it, you lived it, we all lived it. I've spent a bit more than half my life living in this world, and indeed, life has been good. I have built businesses, sold one at a very nice profit, have been able to trade in the markets successfully and provide for my daughter, along with myself. But let's not kid ourselves - this "growth" was not real, and the above graph only speaks to the "on balance sheet" debt, ignoring the over $53 trillion in other liabilities that the government is carrying "off balance sheet" via Social Security and Medicare - obligations that have grown dramatically (and unsustainably) in the last 20 years. Anyone who has ever used a credit card (that would be most of us) knows how this works. If you walk into a store and buy a flatscreen TV for $1500, pulling out the plastic, you have taken an action that in fact has increased your cost of ownership of that television, not decreased it or kept it the same. Even if you pay it off at the end of the month, the store has paid a discount charge on your use of plastic (typically from 1-3%), and had you paid in cash you might have been able to negotiate for some or all of that as a lower price. Further it is inevitable that you will be eventually forced to either pay for the TV or go bankrupt. Many people played the "roll it over" game with credit cards for years, taking the balance on one card and rolling it to some new card before they had to pay it off. That game can continue for quite some time but eventually you reach the end of the rope where lenders will no longer finance this charade, and you're once again forced to cough it up or go under. Our government has become a machine to play "kick the can", but increasingly that can has been filling up with cement and it is moving a shorter and shorter distance with each kick. Eventually we will stub our toe. In 2000 had we taken our medicine the total contraction in GDP necessary to restore balance was approximately 10%, or $1 trillion dollars in net output that was being "pulled forward" via debt service, plus the embedded cost of interest. Today it has doubled as a direct consequence of our attempt to borrow and spend our way out of 2000-03 recession. While it appeared good initially, we bought only a few short years of apparent and false prosperity, instead digging an even deeper hole into which the average American has now descended. Government has learned exactly nothing from this; here are some excerpts from Tim Geithner this morning on "This Week". Note the contradiction:

The first part is right. But the second part isn't correct - it's a dodge for what was intentional misrepresentation of risk in instruments that the lenders knew were being mispriced.

Riiight. The very same Congress that passed Gramm-Leach-Bliley dismantling Depression-era regulations that would have prevented most of this silliness had they been in place? The very same Congress that has refused to rein in The Fed for effectively expropriating the power of appropriation that The Constitution gives exclusively to The House of Representatives? The very same Congress that not only allowed Henry Paulson to ramrod a bill through giving him plenary authority to spend $700 billion but when presented with hard proof that he knew full well prior to final passage that he did not intend to do with it what he had said with the first half, they let the other $350 billion out anyway?

You can't get there without reducing the debt back to sustainable levels. Levels that were sustainable and proved as such over the previous fifty years. Levels that are roughly half of where they are now. Levels that would require, with a constant GDP (ha!) the default or repayment of some twenty-five trillion dollars in debt!

That's a lie. In the 90s the so-called "strong growth" was based on a broadly-repeated lie about growth in Internet use, which led to unreasonable expectations and thus asset price appreciation. It was no more true than "houses always go up in price by 10% a year" was. And then we have this little ditty:

Cut the crap Tim. It's not credit, it's debt. See the above graph? Go back and look again. The total debt in the system must contract, not expand, before we can have a durable and sound economic recovery. Yet everything this administration is doing is going to radically expand that debt - in fact, it will expand the total outstanding Federal debt by more than 10% this year alone, and 20% if you measure only against the public float (the correct measure.) Accountability? Where?

OUR NATION pursued a policy at all levels, public and private, of pulling forward demand and when the bill came due, we pulled it forward again. This is unsustainable as eventually that debt must be paid down or defaulted. We are here because of the policy that you are espousing here and now Mr. Geithner, along with your puppeteer President Obama. You, along with those who preceded you, believed that we could pull forward demand forever and never pay the check, continually rolling debt over and accruing the interest. Anyone with more than two firing neurons and a basic understand of mathematics knows that eventually you must face the music with such a policy. We are simply arguing over when that music will be faced, not if. In order to restore economic balance without massive defaults you would have to more than double GDP while not taking on one more dollar of new debt. That is obviously not going to happen, as put forward by President Obama's budget - in order to achieve that he would have to have promulgated a budget that was balanced, yet find a way while doing so to get GDP growth back on track and forsake private credit growth. But that's not what he did or what you're promoting. You are attempting instead to kick the can down the road one more time, and it will not work.

Why shouldn't those who "took on too much risk" suffer catastrophic damage? Why shouldn't the homeowners who lied about their income go bankrupt? Why shouldn't the bank who securitized debt with bought-and-paid-for ratings using fault models go bankrupt? Why shouldn't the bank that funded too much commercial development at insane (and blatantly unsupportable) cap rates go bankrupt? Why shouldn't those who refused to listen to people just like myself and a handful of others - who were warning years ago about the dangers of this sort of economic policy, both in writing and elsewhere, go bankrupt? The fact is that they should and must go bankrupt, because it is only through bankruptcy that this sort of behavior is punished by the marketplace and people are dissuaded from doing it again!

That's a flat lie. AIG could have been told "no money unless these contracts are renegotiated with a haircut." Indeed, GM and Chrysler were told this. "Here's some money, but if you don't get those haircuts negotiated in a reasonable amount of time, we're going to claw it back and you're going down the chute." AIG could have had the same stricture imposed. It wasn't, and I believe the reason it wasn't was to allow what amounted to a $100 billion dollar heist to be perpetrated upon the American Taxpayer without the knowledge or consent of Congress.

This is simply not true. Treasury could have conditioned the receipt of money by AIG originally on the haircutting of these contracts and could have conditioned the second "slug" of it as well. It also could, right here and now, today, use its 79.9% ownership stake in AIG to fire the entirety of the board and management in AIG, nationalize the firm entirely, and refuse to put one more dollar into the company until these contracts are renegotiated, forcing immediate defaults by putting the firm into receivership if the counterparties refuse. All of this is within the government's power, but it is more important to provide a backdoor bailout to certain banks than to protect the taxpayer's interest.

Oh yes it will Mr. Secretary, and much sooner than you think. Just not in a way you'll like. President Obama hasn't got his arms around the truth yet - or is simply unwilling to speak it:

Nope. That is exactly backward; the excessive debt must be paid down or defaulted and the economy must be re-based to a sustainable level of output predicated on actual production and ability to earn - that is, to spend what is earned, not what can be borrowed from someone who is a bigger sucker than you. The Atlantic ran a powerful article by a former chief economist for the IMF; the short version is contained in this quote:

Gee, you think? Then he comes out with what I have advocated all along:

Yep. And a warning. ...

Does that make it clear where my "doom and gloom" comes from? Do we have to wait for the full-on economic collapse before our government gets it? An increasing number of people who have seen this before, from bloggers like myself to economists at the IMF to people like Paul Krugman, have been and are sounding the alarm. Many of them have come around slowly to the reality of what we face, but come around they have. The math, my friends, is simply never wrong, no matter whether you would prefer to deny it or not. Simply put, once again:

We can do this the hard way or we can do this the catastrophic way, but whether we like it or not it will happen, because the mathematics of the situation make it inevitable - whether the government and "elites" like it or not. I will repeat what I said months ago - Barack Obama is our first Black President, and if he does not get his act together and stop this stupidity he is going to be our last President. Mar 29, 2009 Karl Denninger's Market

Ticker All material herein Copyright ©2007-2011 Karl Denninger. All Rights Reserved.

No material here constitutes "investment advice" nor is it a recommendation to buy or sell any financial instrument, including but not limited to stocks, options, bonds or futures. The author may have a position in any company or security mentioned herein. Actions you undertake as a consequence of any analysis or opinion in this article are your sole responsibility. Looking for "The Best of Market Ticker"? Check out Ticker Classics. |

Disclaimer: The content of this

article is provided without any warranty, expressed or implied.

All opinions expressed in this article are those of the author

and may contain errors or omissions.

Disclaimer: The content of this

article is provided without any warranty, expressed or implied.

All opinions expressed in this article are those of the author

and may contain errors or omissions.