Gold and Silver "To buy

or not to buy?"

-that is the question

Peter Degraaf

Posted Apr 3, 2009

Historically, and based on

35 years of data, gold usually puts in a bottom in March and

a top in April. We've had the bottom in March (on March 18th),

and we await a top in April.

This top in April usually lasts

for several months, resulting in sideways action with a downward

bias and another buying opportunity in June or July.

The next question is: Can we

count on gold rising to a top in April, or is this a year where

we cannot count on historical data?

(In the case of silver we most

often see a top in May followed by seasonal weakness).

For the answers to our questions

we turn to the charts.

Charts courtesy www.stockcharts.com

and Federal Reserve Bank of St. Louis.

Featured is the weekly gold

chart. The blue arrows point to the bottoming of the 7-8 week

gold cycle. The last bottom came in week #9 and we are currently

operating in week #2. Price on Thursday morning is testing the

multi-month support line. It is at this juncture that people

either step in and buy, or panic and sell out. As long as the

fundamentals are bullish for gold (and they are), then it makes

more sense to buy gold here than to sell gold. The expectation

is that since we are in week #3 of the 7-8 week cycle, gold is

more likely to rise from here than to fall below the support

line.

My Gold Direction Indicator

is registering +72% which is a buy signal. The supporting indicators

(RSI and MACD) are positive.

***

Featured is the index that

compares the gold and silver stocks of the HUI index to the price

of gold. On Wednesday April 1st this index flashed a buy signal,

as price established itself above the 200DMA. A rising trend

in this index is bullish for both gold and gold and silver stocks.

The supporting indicators are positive.

***

Featured is the SLV silver

ETF. The last three times price came near the rising support

line, (including so far on April 2nd), buyers forced the price

back up again (blue arrow). Volume has been declining during

the pull-back which is bullish (green arrow). The RSI is at multi-month

support (horizontal green line), and the 50DMA has just moved

into positive alignment with the 200DMA, which is another bullish

signal.

***

Featured is the chart that

reflects the total bank credit at the US commercial banks. It

reflects the loose policies of the Fed, as the trend is in the

process of going exponential. The aim of the FED is obviously

to push the trend higher. Notice at the top of the chart, some

reluctance on the part of bank credit to keep rising. This reflects

a slowdown in the increase in bank credit despite the Fed's efforts

to force banks to have and make credit available to the market

place. This in turn will cause the FED to pump money into the

system even faster, as they do not want this trend to turn down.

This chart then presents a picture that is bullish for gold and

silver, as it makes a strong case for further accommodation on

the part of the Fed.

***

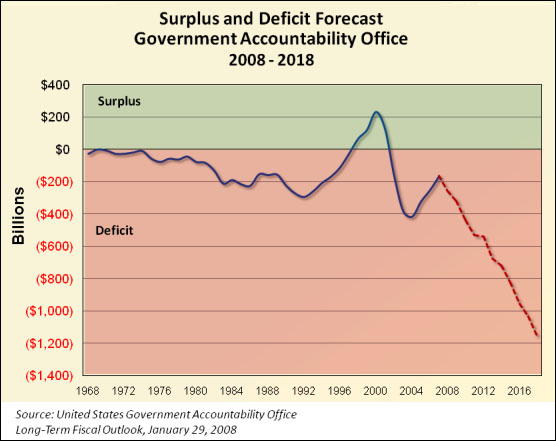

Featured is the chart that

shows the current and projected US government deficits as charted

by the US G.A.O.

Federal deficits always lead

to monetary inflation which leads to price inflation which leads

to commodity inflation (including and especially gold and silver).

***

Featured is the CEF, Central

Fund of Canada. The uptrend is well defined. The supporting indicators

are positive. Volume has been declining during the recent pull-back

which is bullish. Earlier today (April 2nd) I added to my holdings

in CEF by buying at the 50DMA (blue arrow), and I then sent out

an alert to my many subscribers, so they could do the same if

they so desired.

***

Summary:

As long as the fundamentals

for gold and silver are bullish (and they are - current Washington

policies guarantee it), every price dip presents an opportunity

to buy.

During a bull market, every

time price moves near the 50DMA it is an opportunity to buy.

-Peter Degraaf

Peter Degraaf

is an online stock trader with over 50 years of investing experience.

He issues a Weekend Report for his many subscribers. For a sample

copy, or a 60 day free trial, send him an E-mail itiswell@cogeco.net or visit his website

www.pdegraaf.com.

DISCLAIMER: Please do your own

due diligence. I am NOT responsible for your trading decisions.

321gold Ltd

|