| |||

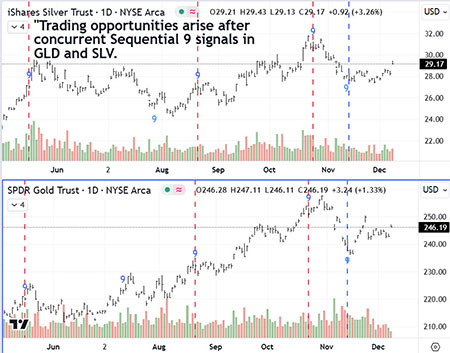

Bullion and Silver MinersRoss Clark Gold and silver bounced following the concurrent Sequential 9 Buy Setups of November 12th. Those lows have held, and prices are now making a second move to the upside as they enter the period of seasonal strength. Traders should view the lows of the last two weeks as appropriate stops. (Click on images to enlarge) Logarithmic scale charts have proven to provide more reliable resistance lines than arithmetic scaling after prolonged market declines. In the past three months, the silver miners ETF (SIL) has approached a well-established resistance line around $40. A close above this level would be seen as a potential catalyst for upward movement. ### Ross Clark

|