Casey Files: Casey Files:

The Real Cost of the 2008

Recession

Olivier Garret

CEO, Casey Research

The

Casey Report

Dec 10, 2008

It took the statisticians of

the National Bureau of Economic Research almost a year to confirm

what the rest of us already knew, that the US registered a significant

decline in economic activity, thus officially entering a period

of recession. While I am pleased that the members of NBER take

their duties seriously, thereby ensuring that they don't leap

to any hasty conclusions, I only wish that similar moderation

could be displayed by their colleagues at the Fed and the Treasury.

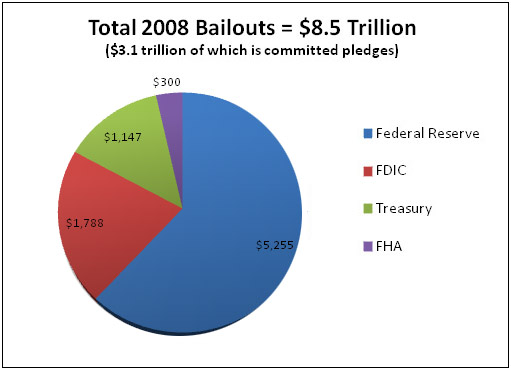

Unfortunately, the facts prove

otherwise. Three months before the recession was officially declared,

Paulson and Bernanke have embarked on the largest bailout program

ever conceived with the blessing of a lame-duck president and

a complicit Congress - a program which so far will cost taxpayers

$8.5 trillion. This staggering sum encompasses: loans backed

by worthless assets ($2.3T), equity investments in bankrupt companies

with negative net worth ($3.0T), and guarantees on crumbling

derivatives and other hollow collateral ($3.2T).

Back in September I was stunned

that Paulson was able to make his case and win the support of

Congress for a $700 billion bailout package (more than the total

war spending in Iraq to date).

How could Americans (or more

accurately, their representatives) agree to give such a broad

mandate with so few checks and balances? Have we become completely

numb?

While I realize that many of

our compatriots have been running large credit card balances

and interest-only mortgages with little thought as to how they

would repay their debt, one would expect a little more restraint

when dealing with the financial future of the largest economy

in the world.

Operating under the assumption

that our largest financial institutions are "too big to

fail", in the span of a few weeks we went from pledging

to spend $1 trillion to $3 trillion - a commitment which then

grew to $5 trillion before ballooning to a staggering $8.5 trillion.

At the rate we are going, we

will be dealing with double digits - in trillions- before the

end of the year.

And while all off that money

is not yet spent, make no mistake - these are real commitments

with serious liabilities attached to them.

I have heard the argument that

an equity infusion is not the same as spending money. While I

would agree that in an arms-length transaction this might actually

be the case, our government is definitely paying a large premium.

What is the real value of Citicorp or AIG? Since they are quasi-bankrupt

(and would be totally bankrupt without massive injections from

the Fed), a reasonable businessperson might pay a token price

for their equity and the assumption of their enormous liabilities.

Before doing so however, a buyer would have to see some significant

value in buying these entities as a continuing business. In most

cases, a buyer would not want to assume the company's liabilities

but would prefer to buy selective unencumbered assets in a bankruptcy

proceeding. Any money our government pays above what a reasonable

person would pay in an arms-length transaction is real spending

and should more accurately be called a grant.

While defenders of the too-big-to-fail

policies argue that providing guarantees is not the same as granting

money, the reality is that these guarantees are necessary to

prevent the collapse of financial institutions currently lacking

the necessary collateral to meet their loan covenants. Should

their loans be called, we could actually find out the real value

of their assets. The fact is that in-spite of Paulson's and Bernanke's

efforts, deleveraging is already happening. Although at a slower

pace, one asset class after another is being adjusted down towards

its intrinsic value, which is usually not much. Make no mistake;

many of these guarantees will eventually be called in by lenders.

In due time, unless our government is able to inflates its way

out of this bottomless pit, it will have to honor most of these

guarantees.

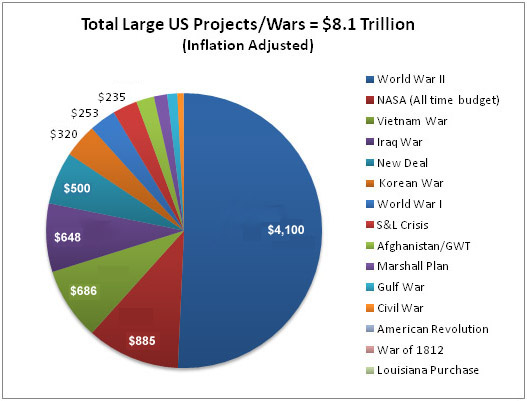

So how does $8.5 trillion dollars

compare with the cost of some of the major conflicts and programs

initiated by the US government since its inception? To try and

grasp the enormity of this figure, let's look at some other financial

commitments undertaken by our government in the past:

As illustrated above, one can

see that in today's dollar, we have already committed to spending

levels that surpass the cumulative cost of all

of the major wars and government initiatives since the American

Revolution.

Recently, the Congressional

Research Service estimated the cost of all of the major wars

our country has fought in 2008 dollars. The chart above shows

that the entire cost of WWII over four to five years was less

than half the current pledges made by Paulson and Bernanke in

the last three months!

In spite of years of conflict,

the Vietnam and the Iraq wars have each cost less than the bailout

package that was approved by Congress in two weeks. The Civil

War that devastated our country had a total price tag (for both

the Union and Confederacy) of $60.4 billion, while the Revolutionary

War was fought for a mere $1.8 billion.

In its fifty or so years of

existence, NASA has only managed to spend $885 billion - a figure

which got us to the moon and beyond.

The New Deal had a price tag

of only $500 billion. The Marshall Plan that enabled the reconstruction

of Europe following WWII for $13 billion, comes out to approximately

$125 billion in 2008 dollars. The cost of fixing the S&L

crisis was $235 billion.

The best deal ever for a government

program was the Louisiana Purchase, a deal with the French that

gave us 23% of the surface of today's US for only $15 million

($284 million in today's dollars). Why couldn't Paulson and Bernanke

display the financial acumen of a Thomas Jefferson?

How will our country repay

its debts? The current bailout represents 62% of our GDP. Our

current deficit of almost $11 trillion may exceed our GDP next

year.

Recently the Treasury has been

able to place new debt; investors have liquidated equities and

bonds and sought refuge in the relative safety of the dollar

and government bonds.

As we move forward however,

our government will need to attract trillions of dollars annually

to fund its programs and commitments. The foreigners who have

financed our irresponsible spending for many years will no longer

be able to afford it, let alone finance more of our reckless

behavior.

As a matter of fact, several

countries have already announced their own bailout packages to

prop up their domestic economy. And, unlike during WWII, when

Americans invested their savings to support the war effort and

fund our government's deficit, our citizens are in debt themselves

with no savings left to invest.

In the near future, the Fed

will have no choice but to turn on the printing presses and start

operating them around the clock to create the money that can't

be raised in the capital market.

These actions will lead to

a significant debasement of the dollar and a major appreciation

of gold and all commodities (real assets).

Once this inflationary cycle

starts, foreigners will realize that their investments in T-bills

are depreciating rapidly. There will be a massive exodus that

will put more pressure on the dollar and on interest rates. Our

weakened US economy will be faced with the rising cost of capital

and a painful period of stagflation. Trillions of dollars will

have been wasted. Our government will have mortgaged America

and the ensuing debt will have to be paid by future generations.

Not a very bright picture,

to be sure, but the Casey Research team strongly believes that

there are opportunities in every crisis. Preserving your assets

and even profiting in times of crisis by making the trend your

friend is the focus of Casey's flagship publication, The

Casey Report. We have helped subscribers get positioned in

commodities in the late '90s, buy grains in 2006, and short financial

stocks 18 months ago resulting in double- and often triple-digit

returns.

To learn more about the trends

we predicted and, more importantly, the emerging trends we now

foresee, click

here now.

Dec 10, 2008

Casey Archives

321gold Ltd

|