Wealth You Can Wear Wealth You Can Wear

Jeff Clark

Senior Editor, Casey's BIG GOLD

Dec 3, 2010

In 1975, as Saigon was falling, South Vietnamese refugees were

air-evacuated into Guam and the U.S. The company Deak-Perera

was hired by the State Department to serve as the official "money

changer" for the refugee camps, and it quickly became apparent

to the employees that even the most prominent of Vietnamese citizens

arrived with nothing but the clothes on their backs and whatever

belongings they could carry. It was a somber scene.

The problem facing the refugees was that the banks in their home

country had been nationalized (along with most everything else

in the economy), meaning they couldn't write a check that was

cashable. This presented obvious financial roadblocks for many

of them, who were already dejected about their circumstances

and insecure about the future.

Perhaps the most dramatic example was a successful Vietnamese

businessman and his family who had been uprooted by the war.

Though his suit was haggard, it was readily apparent the man

had been wealthy back in his home country. He approached the

exchange desk with two large suitcases full of piasters, the

paper money issued by the Republic of Vietnam. The Deak-Perera

worker, Michael Checkan, gulped and, with as much empathy as

he could muster, explained to the refugee that piasters no longer

existed. They were worthless, and the employee could not give

him any money.

The reality of the situation visibly struck the man, and his

face suddenly looked like he'd been told he had 30 days to live.

He protested, but there was nothing the company or Michael could

do. The currency simply wasn't worth anything. The man was broke,

in spite of suitcases full of his country's money. As he trembled,

his wife began crying and the children became frightened. They

shuffled away, hopeless.

Later that day, Michael had another well-dressed refugee approach

the exchange table with his family. He carried a ragged satchel,

and explained that he had been a banker in Vietnam. As the man

began pouring the contents of the bag onto the table, Michael

braced himself, knowing he would have to explain that piasters

could not be exchanged for anything of value.

His mouth dropped open, however, when he looked down and saw,

gleaming in the sunlight, stacks of 24-karat gold TAELs, a form

of gold bullion indigenous to South East Asia. They looked like

wafers, thin sheets of gold delicately wrapped in paper. Each

TAEL was .9999 pure gold and weighed 1.2 ounces. The man had

dozens and dozens of them.

Michael peered back up at the man; he was brimming with hope.

The employee calculated the bullion's value and moments later

bought the gold TAELs, issuing the refugee a traveler's check

for a large amount. The family hugged as they walked away.

As an American, you may not have to flee your country due to

a military conflict. But there is something far more likely;

you may have to flee your currency. There are many threats to

your hard-earned wealth, and the most insidious is a weakening

of the U.S. dollar.

For the United States, the invoices are piling up. Out-of-control

government spending, rising healthcare costs, increasing entitlement

programs, burgeoning military expenditures, etc., all add up

to a number well in excess of revenue. The only politically acceptable

solution is to print more money and devalue the dollar. The money

you use for everyday life will buy less and less over this decade.

Remember, as gold rises, it essentially means the dollar is losing

value, eroding the purchasing power of every greenback in your

wallet.

If you own any form of gold, you are already well aware of those

facts. But have you considered the implications of traveling

with that gold? Sure, coming from Vietnam in 1975, you

probably got barely a sideways glance for carrying gold TAELs,

or even a suitcase full of cash. But today, in the age of TSA

"love tap" pat-downs and full-body x-ray scanners,

and when you must declare any amount of cash over $10,000 on

your way in or out of America, leaving the country with a stack

of gold bullion is probably going to raise a few eyebrows - if

not land you in a TSA backroom somewhere.

That's why it is important not just to own gold, but to consider

owning it in various forms that give you both discretion and

portability. There is no substitute for gold bullion, but there

are far more portable alternatives, and which are far less likely

to raise eyebrows (sure, numismatics are collectibles, but good

luck explaining to customs the difference between a Gold Eagle

and a Saint Gaudens).

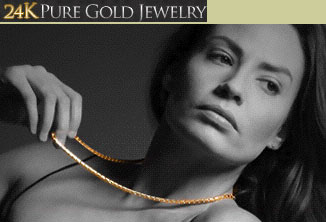

Take 24-karat gold jewelry, for instance. To the casual observer,

or the TSA agent, it's not unlike any other necklace or bracelet.

To you, it is a portable store of wealth. A "money belt"

customs will ignore. And a great insurance policy should you

find yourself in need of money on the road.

Not only does 24K gold jewelry make moving with your money simpler,

it also makes giving wealth to heirs or as a gift simpler. In

fact, there are a number of advantages that are frequently overlooked:

it's significantly cheaper than most numismatics and carries

far lower premiums than traditional gold jewelry; it's subject

to less of the complexities of taxes; it's more accessible than

gold stored in a vault or certificates that take time to redeem;

and as jewelry, it would avoid confiscation if that ever came

to pass again.

Unfortunately, you are not likely to find real 24K gold jewelry

of any significance in your local mall's jewelry store. Instead,

they are probably selling 14K gold, and at premiums of 100% or

more to the value of the precious metal. It's simply not practical

to use designer jewelry as a store of wealth - you won't find

a numismatic-like resale market for that Tiffany necklace.

Instead, you need to find a dealer that can provide you with

pure, certified 24K gold jewelry that was designed specifically

for use in passing down or traveling with your wealth, and at

a reasonable markup. It helps if the jewelry uses a common unit

of measure as well - each piece being an ounce or in some way

easily divisible. That way you can quickly account for how much

you have, and if the time ever came where you needed to sell

it for emergency cash like our Vietnamese friend above, you could

easily do so.

At Casey Research, we've found just such a partner with First

Collector's Guild, which specializes in 24K gold jewelry.

If you own bullion or any other form of gold, consider how portable

it really is. A little forethought and you may just realize it's

not all available the moment you need it. If that's the case,

a little bit of portable wealth protection might be in order.

24K jewelry is not an investment, but in the right circumstances

it can be a great form of insurance.

But don't mistake it for just bullion; this is beautiful jewelry:

These pieces are very elegant and sophisticated. It's something

you can enjoy for many years and generations to come. And they're

perfect for gifts.

If you want attractive, wearable bullion that allows you to store

value safely, then 24K jewelry is it. And it might be just the

right way to sneak some gold into a loved one's stocking this

year.

[Since every one of the beautiful necklaces and bracelets

is custom-made, you have to order by December 10 for delivery

by December 25. To see all the different choices you have and

learn more about Heirloom jewelry, click

here.]

###

Dec 2, 2010

Casey Archives

321gold Ltd

|