Casey Files: Casey Files:

What's Going On With Gold?

David Galland

Managing Editor BIG

GOLD

from CaseyResearch

Oct 18, 2007

In the beginning, which, for

the purpose of this analysis, we would point to as mid-July,

when the credit crisis began laying waste to markets around the

world, gold closely tracked equities.

As the Dow was plummeting from

14,000 to less than 12,500 (nearly an 11% haircut), gold was

also dropping, though not so steeply. The metal fell from a high

of $683.50/oz on July 20 to an intraday low of $640 on August

16, a decline of 6.4%.

For a while, the correlation

remained tight as investors rode alternating waves of optimism

and pessimism about stocks and gold. Equities up, gold up. Equities

down, gold down. Set your watch.

This correlation was due to

a number of factors.

For example, the need for hedge

funds and other institutions to sell anything with a bid - for

instance, gold - in the scramble to build liquidity in suddenly

(and surprisingly so) illiquid bonds and commercial paper.

Pressure on both equities and

gold at the time can also be attributed to the dawning realization

that (a) the credit crisis was real and, (b) it probably wouldn't

be terribly helpful to the global economy. Of course, when one

worries about recessions and such, one thinks less of holding

either stocks or gold. The former for the obvious reason that

bad economic conditions make for bad business; the latter because

anything that is supposed to be an inflation hedge can't also

be a deflation hedge, can it?

Though admittedly impatient

to see the gold show get on the road, we were largely unconcerned

by gold's behavior. That's because our eyes remained firmly fixed

on the perfect trap set over the years for Bernanke's Fed.

Like hunters of antiquity watching

large prey grazing toward a large covered pit, the bottom of

which is decorated with sharpened sticks, we watched the handsomely

attired and well-groomed Bernanke and friends shuffle ever closer

to the edge, their attention no doubt occupied by pondering the

flavor of champagne to be served with the evening's second course.

One minute pondering bubbly,

the very next standing, wide-eyed and hyperventilating, on thin

cover with decades of fiscal abuse cracking precariously under

their collective Italian leather loafers. We can't entirely blame

Bernanke for the dilemma he now finds himself in; it was more

about showing up to work at the wrong place at the wrong time.

Regardless, all of a sudden

the Fed and many of the world's central bankers found themselves

faced with the rock-and-a-hard-place scenario we've been warning

readers of for some months now.

Namely, raise rates - or even

just do nothing - and the whole shaky structure of debt comes

crashing down, pulling the global economy with it. Swing in the

opposite direction by cranking up the printing presses to full

speed and risk alienating foreign holders of an unprecedented

six trillion in U.S. dollars, triggering a monetary crisis, also

with global implications.

When Push Comes to Shove

Watching the closely correlated

moves between gold and the broader stock market in the early

days of the crisis, however, had us wondering just when it would

be that other purportedly intelligent market observers would

figure out the nature of the Fed's dilemma, and the inevitable

implications of same. To wit, that when push came to shove, the

Fed would almost certainly sacrifice the dollar.

The reasons for that conclusion

are, at least in our thinking, obvious.

While the Fed and the world's

central banks could, after the initial round of rate cuts and

cash infusions, switch course again and decide to simply sit

tight, allowing a deep recession - or perhaps even a depression

of 1930s depth - to clear out the monumental excesses now in

the financial system, we don't think they'll find that option

attractive, especially in the midst of a presidential election

cycle. Instead, the law of relative unpleasantness strongly

skews the odds in favor of the printing press option.

Specifically, they are now

well aware of what sort of unpleasantness will almost certainly

occur if they fail to feed the beast with greenbacks by the helicopter

load. Collapsing real estate prices, closing factories, soaring

unemployment and, given the size of the problems, a clear possibility

of things spinning seriously out of control from there. Returning

to my earlier metaphor, we're talking a sure trip onto the sharpened

sticks below.

Against that probability,

they have the possibility that, by setting the printing

presses on high speed, the Fed might alienate foreign dollar

holders who, theory has it, have as much to lose from a falling

dollar as anyone. So, maybe, just maybe, the foreign holders

will hold tight, preferring to see their many trillions depreciate

by, say, 10%, rather than taking a deeper loss by heading for

the exits en masse.

And that provides the Fed just

the intellectual cover needed to do what is, after all, its default

mode - depreciate the currency. For the truth of that observation,

look no further than the fact that the U.S. dollar has lost over

96% of its purchasing power since the creation of the Fed in

1913.

But there are additional reasons

for the Fed to opt for a loose money policy. To name one, the

U.S. is in the aforementioned presidential election cycle. Foreign

dollar holders don't vote, but heavily indebted Americans do.

For another, a weak dollar will help make U.S. manufacturers

stay more competitive (hey, it worked for the Chinese!). Finally,

a weaker dollar benefits the government by allowing it to pay

down its many debts in depreciated dollars.

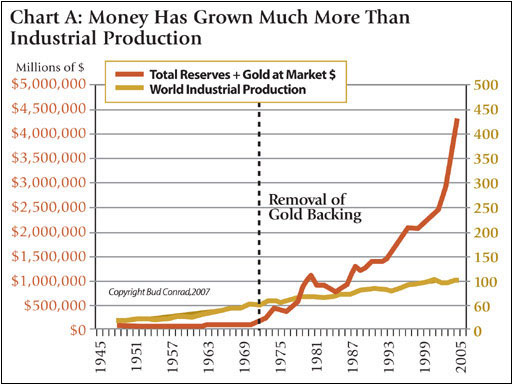

Most people don't fully appreciate

how poorly the Fed has managed the currency since cancelling

the dollar's convertibility into gold in 1971. That brazen act

cut the ties between the dollar and any fundamental value, leaving

only political restraint to underpin the dollar.

The chart below paints a clear

picture of the result.

In time, and maybe in our time,

the piper has to be paid. And make no mistake, the price of too

many dollars chasing too many goods is inflation. And record

money creation leads to record inflation.

Of course, there are many potential

negatives associated with a collapsing dollar, including the

higher interest rates the Fed is trying to avoid in the first

place, but those negatives are more hypothetical at this point

than the clear and present danger of simply letting the global

economy take it hard on the chin by staying out of the mess.

Given the choice between the

possibility that foreign dollar holders will dump their greenbacks

and disadvantage themselves in the process, versus the certainty

of deep financial pain should the Fed do nothing at this juncture,

we think the Fed will continue to take the path it believes is

relatively less unpleasant and keep the spigots open wide on

money creation.

Awakening Day

The market finally seemed to

see the light on Thursday, September 6, when a major divergence

in the paths of gold and the broader stock markets occurred.

On that day, the Dow dropped over 125 points while gold shot

up more than $13 an ounce. And it continued up on Friday, Monday

and Tuesday, with gold breaking through the $700 mark even as

equities did little or nothing. That was the first time the two

marched to different drummers since the crisis hit.

Since then, gold has gained

a new appreciation in the investment milieu. When the stock market

soared after the Fed lowered interest rates, so did gold. And

when the market retraced, gold pushed higher still.

Even more cheering for readers

of our monthly editions of BIG GOLD is that the market

didn't just come to its senses about the role that gold had to

play in the unfolding crisis, it also remembered that gold stocks

were, in fact, related to gold.

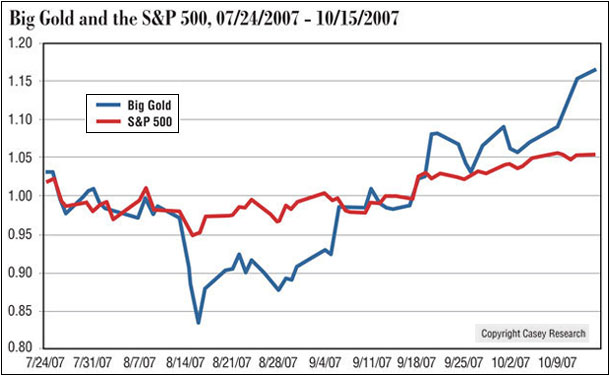

The chart below shows the action

in the BIG GOLD portfolio of recommended securities from

the period of August 15 - October 15, 2007. As you can see, until

the first week of September, the Big Gold portfolio had been

tracking, or even underperforming, the broader market as represented

by the S&P 500.

While still baby steps in terms

of what we expect, this is exactly the sort of price action we've

been expecting... an early indication that institutional investors

are starting to move into large-cap gold stocks, the investment

class that pops first to mind when the Wall Street crowd decides

that gold belongs in the portfolio.

No matter which way things

go, gold - as it has been for thousands of years - is the ultimate

hedge in times of crisis. And the recent shift into the metal,

and now to gold stocks as well, is a sign that increasing numbers

of investors are learning to see it as such.

David Galland is the managing editor of the BIG

GOLD advisory from Casey Research, one of the nation's oldest

and most respected organizations providing unbiased research

on natural resource investments.

BIG GOLD is designed for conservative investors

looking for an easy and lower-risk way to participate in gold

markets through producing and near-production precious metals

companies, ETFs and mutual funds you can buy and sell through

your favorite discount broker.

Consider: Since its low in 1999, the price of

gold bullion is up about 200%. By comparison, the American

Stock Exchange index of gold stocks is up 556% in the same bull

market phase! That's profit-boosting leverage of better than

2-to-1... financial rocket fuel.

To learn how you can play the

gold bull market without taking excessive risk, learn

more about BIG GOLD and its unhesitant 3-month 100% money-back

guarantee by clicking

here now.

###

Doug Casey

Casey Archives

321gold Ltd

|