Casey Files: Casey Files:

Lessons from History:

The Simple Path to Resource Riches

David Galland

Managing Editor, Doug Casey's International

Speculator

Aug 17, 2007

At the risk of sounding like

I'm on happy pills, I'm going to use four charts to demonstrate

a simple path you can use to make a lot of money with

only modest effort and capital.

How much money?

Would it seem out of the question

that, with only four trades, one about every ten years, you could

turn $35 into $100,000? Well, you could have...

Step #1: Be sure the trend is your

friend

Global investment markets are

extremely complex. However, if you take a hard, invariably contrarian,

look at the bigger picture, there are times when you can spot

larger trends in motion that are likely to stay in motion.

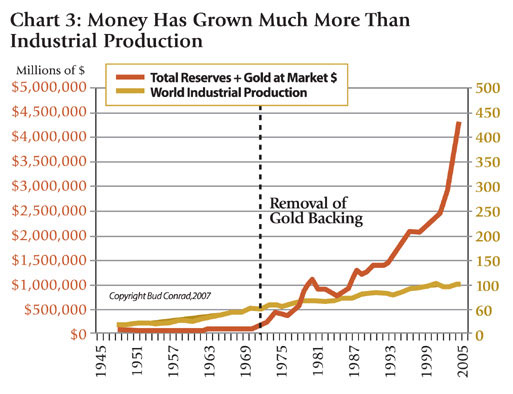

Casey Research Chief Economist

Bud Conrad compiled the chart below that shows being directionally

correct on a mega-trend is exceptionally profitable. String together

a few of these mega-trends and there is a private plane and mansion

in your future.

Of course, the odds are microscopic

- but not impossible - that anyone made those exact trades at

exactly the right time, but the lesson holds water nonetheless:

catching big trends early can pay off in a very big way.

Step #2: Be sure you are right, then

go ahead

Davy Crockett, in the War of

1812, was heard to say "Be sure you are right, then go ahead."

Important words indeed, with special relevance for investors

looking to make extraordinary returns. After all, once you have

settled on the trend to play, it will do you no good if you don't

take action.

But what is the current

trend?

In today's economic environment,

the big money is being made in the natural resource sector with

a focus on the junior gold stocks.

But isn't the bull trend in

gold a bit long in the tooth?

Certainly, the easy

money was made by those who invested in the gold stocks before

2000. It was during this time that my partner Doug Casey, in

the pages of the International

Speculator, was a lonesome voice urging his readers to

back up the truck on the quality gold plays. The following is

from the November 30, 1999 edition of that letter (the lead article

of which was devoted to urging readers to dump their over-appreciated

dot.com stocks):

"The price of gold has

drifted down somewhat, resting at $292 at the moment - about

halfway between its low of $252 and high of $325. Was the move

a flash in the pan or the start of something big? I remain a

steadfast bull. Nobody knows what gold is going to do tomorrow;

but I'm betting that in this cycle it's not just going through

the roof, but to the moon."

Since 2000, of course, gold

has better than doubled, but the quality gold stocks have gone

up much more... 400%, 1,000% or more (we just closed out one

position, recommended in August, 2001 with a 4,329% gain). So,

that was the easy money.

But we remain convinced that

the big money in the gold bull trend is still ahead. Take

a look, for instance, at the chart just below. As you'll see,

over the last 137 years the shortest gold bull market

has lasted 10 years. By that measure we are only about halfway

there.

And, for reasons I'll touch

on now, we don't think this bull trend will be among the shortest...

but very well could be among the longest... and strongest.

Why the Gold Trend Is Well Intact

There are many compelling reasons

for this gold trend to surprise everyone with its persistent

strength. But, in the interest of space and time, let's cut to

the chase.

The only real reason for gold

to go higher is if investors feel that it will hold its value

better than other forms of money. For instance, if you lived

in Zimbabwe today and were offered an ounce of gold or a brown

paper bag of rapidly depreciating Zimbabwean dollars, what would

you take? (Hint: take the gold; inflation in Zimbabwe is so bad

that a roll of toilet paper now costs over $200,000.)

But the world doesn't trade

off the back of the Zimbabwean currency unit. That honor belongs

to the U.S. dollar which, as you are no doubt aware, has evolved

into the de facto reserve asset of virtually every central

bank in the world today.

That the unbacked currency

of one country is now the core holding of all the countries in

the world is unprecedented in the history of the world.

Books have been written about

how it happened. The short version of this fascinating story

is that it came about as a direct result of the U.S. being the

"last man standing" after World War II. In 1944, as

the war wound down, delegates from 44 war-battered countries

gathered at Bretton Woods, New Hampshire, and after some arm

twisting, [Ed. note: unsure of editing; should read "war-battered"]

agreed to accept the role of the U.S. dollar as the currency

of global commerce. The decision to make the greenback the supreme

currency was made easier because, as a component of the agreement,

the U.S. agreed to make it always redeemable for gold.

Unfortunately, when dealing

with politicians, "always" has a different meaning

than to regular folks; in 1971, when faced with a run out of

dollars, Richard Nixon unilaterally canceled the dollar's gold

convertibility. From that moment on, the U.S. dollar became an

abstraction, backed by nothing at all... and unrestrained by

anything other than political whim.

As you can see from Chart

Three below, the creation of dollars since Nixon ended convertibility

has been stunning.

There are many implications

attached to this global flood of unbacked money. But the primary

thing to ponder while looking at the chart is the definition

of inflation. It is not the increase in the price of consumer

goods, but rather an increase in the number of currency units.

Of course, in time, consumer prices rise as a consequence of

too many dollars chasing too few "things."

And don't forget that we have

already seen some of the impact of all these dollars... in the

dot.com bubble, in real estate, in oil and other commodity prices.

Soon, once the Chinese and other emerging market companies stop

selling the U.S. cheap goods - as the Japanese had done before

them - we'll see consumer prices rising too.

There is, in the chart above,

an extremely important nuance, one that you can ignore to your

peril, or understand to the core of your DNA and profit from

the gold trend. Namely, the underlying reason for all that growth

in money. Simply put, it is due to the nature of democratic politics.

Expressed as a motto, it would be "He who promises the most

money, gets the most votes."

Since the end of gold convertibility,

there have been no limits on what the politicians can promise

or what they can spend. A fresh example is provided by the sub-prime

credit crisis, in response to which the government has gone on

record stating they would provide "unlimited" credit

to banks.

Monster chickens, the product

of decades of proliferate spending, will eventually come home

to roost on a shaky house of cards. The monetary crisis that

will follow will eliminate the U.S. dollar as a serious competitor

to gold... the only asset that has withstood the test of time

as money. And we are not talking decades, but millennia.

Step #3: Be timid when others are

bold... bold when others are timid

Any number of the investors

who entered the gold trend early look at the price action of

the yellow metal over the last year - which has been flat to

slightly down - and worry that this is a sign that this gold

bull market is over and are stepping aside from the gold shares.

What they are doing is letting

their emotions run their investment portfolio, a classic reaction

during the "Wall of Worry" stage of any bull trend.

They have made big money in gold shares, they understand the

fundamental arguments, yet declining prices or volatility in

the shares (which is especially prevalent in the summer months)

gets them to thinking, then worrying, then selling.

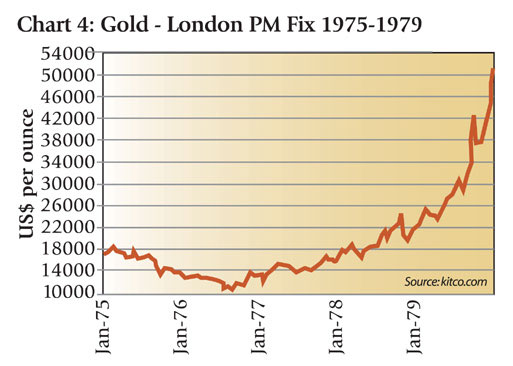

Big mistake. Look at the chart

below. It is the price of gold during the height of the last

major gold bull market. Notice the long, almost two year, decline

right in the heart of the trend.

That is what we are looking

at now... a very normal, to-be-expected consolidation phase -

understanding that fact opens the door to big profits. Right

now you have the unique opportunity to buy the very best junior

gold companies at a Wall of Worry discount, in essence taking

an extraordinarily profitable, time machine trip back to an earlier

point in this long trend.

Step #4: Buy right, sit tight

Most importantly a decision

point arrives concerning what stocks to buy in order to make

the most of this trend. And here we have two paths from which

to choose.

The first, more conservative

path, is to choose from among the big gold stocks - the larger

producers that will find favor with the big money institutional

players and hedge funds. These giant mining concerns will, when

things get rolling, offer you solid double- and even triple-digit

returns. In the last resource share bull market, triggered by

a series of major discoveries in the mid-90s, for instance, Kinross

went up 197% over a two year period; Barrick went up 57%; and

Newmont 74%.Nothing to sneeze at when compared to "traditional"

investment sectors.

The second, and most exciting

path, however, is the one referenced earlier - the better quality

junior exploration stocks. These are the junior Canadian stocks

overseen by seasoned exploration geologists - many of whom used

to work for a major - who use their knowledge and investor capital

to find prospective new geology. When they find something, they

typically joint venture it to a major company who spends the

high-risk money on follow up drill programs. Or, they will sell

their projects, or even companies, lock and stock for a barrel

of money from the majors.

Returning again to the mid-90s

resource stock bull market provides a measure of the potential

of the junior exploration companies: Cartaway, up 26,040%; Arequipa

Resources, up 5,692%; Francisco Gold, up 3,350%.

Over the last few years, a

record amount of money has gone into exploration programs around

the globe, money which will start coming back in the form of

major discoveries in the next year or two. Pick up your shares

now, then plan on holding them as this gold bull trend regains

momentum. In other words, buy right, sit tight... and you'll

come out a whole lot better than just alright.

Conclusion

So, there you have it; an easy

four-step way to turn a little money into a lot, with

relatively little work.

In fact, if you agree with

me on the trend and how to best profit from it, then all that's

required is for you to take the time to learn more about the

junior gold exploration companies. Although it will take some

dedicated time before work in the morning, or after you get home

in the evening... the pay-off can be breathtaking.

Furthermore, given the financial

turmoil gripping the world just now, gold related investments

provide extremely important diversification of risk. In times

of crisis, gold shines particularly bright.

But don't put off getting on

board this trend; the slow summer months, with Wall of Worry

concerns helping to push great companies down, make this the

right time to build a portfolio that makes the most out of this

trend... a trend we expect to remain in motion for at least 5

more years, and maybe longer.

That spells opportunity of

a very rare sort. Don't miss it.

Aug 16, 2007

David Galland

David Galland

is the Managing Editor of Doug Casey's International

Speculator,

now in its 27th year of helping investors earn spectacular returns

through carefully researched and thoroughly unbiased recommendations

on investments with the very real potential to provide a 100%

or better return over a 12 month horizon.

Today, it is

following over 30 high quality resource stocks on behalf of subscribers,

with new buy and sell recommendations monthly. To learn more

about a no-risk, no obligation three month trial, click

here now.

Casey Archives

321gold Ltd

|