Casey Files:

The Bursting Commodities

Bubble

David Galland

Managing Director

Casey Research

BIG

GOLD

Jun 19, 2008

A steadily growing drumbeat

is sounding throughout financial mediadom; a major commodities

blowout is in the cards. The most widely quoted reason is a U.S.

recession that will sympathetically pop the commodity bubble.

It seems to me that these views

are intertwined with a changed perception of how the economy

works. A new paradigm if you will.

People used to pay homage to

the notion of a business cycle, a somewhat predictable and even

stately progression of economic growth leading to excess, followed

by a corrective recession. After which the cycle would begin

anew.

In today's bold new world,

however, most investment observers overlay onto the business

cycle a shifting series of rapidly rising - and falling - sector-focused

bubbles.

Because of their noticeable

size and influence, it seems to me that the bubbles can mask

the underlying business cycle to some extent. Case in point,

we all easily recall the dot.com bubble but have a harder time

recalling what the prevailing economic times were in the late

1990s. What came after the dot.com bust? Why, the housing bubble,

of course.

Of course, bubbles have always

occurred. But they appeared only periodically, every generation

or so. Prior to the dot.com bubble that heralded in this new

era, economic activity was more broadly distributed. When times

were good, the sectors that normally benefited, all benefited

in something of a range.

Today, however, while most

remain somewhat range bound, a single sector appears, Godzilla-like,

to cast a shadow over the broader financial landscape. It is

that sector that then receives the lion's share of the focus

and the investment flows, quickly becoming a self-fulfilling

prophecy.

Of late it has been the turn

of the commodities to stalk the land. And, if you believe the

pundits, it is time for the monster to be brought low. If not

by Mr. Market alone, then with the help of the regulators with

all their many WMDs (Weapons of Market Disruption).

Before commenting on whether

or not I believe they may succeed, a brief observation on the

origin of this new bubble era.

In my view, it is largely due

to the massive amount of money in various forms sloshing around

the globe, most of which emanates from the Quicky Print Fiat

Money Machines which have been reliably chugging away at

central banks around the globe for decades now.

One of the primary outcomes

of this odd chapter in monetary history is that the notion of

the value of money has been pretty much thrown out of the window...

though not one person in a thousand understands that the game

has changed.

For example, the Chinese are

correct in thinking their reserves include 1.4 trillion foreign

currency units, but that fact is increasingly disconnected from

any reliable measure of future value.

Underscoring the point, 1 trillion

U.S. dollar units set aside 5 years ago are today, adjusted for

inflation, worth just $620 billion. But who can say what those

1 trillion units will be worth five years hence?

While it would require far

more electro-ink than time allows for today, it is my contention

that the utility of the fiat monetary system is beginning to

fade. After all, at its core, the acceptance of unbacked money

is an act of faith.

And people are losing faith

in the fiat currency units they are being asked to accept in

exchange for their many labors, or in return for their tangible

assets -- and what is more tangible than commodities?

Back to the Bubble

So, are commodities merely

the latest bubble, a bubble now resting up against a pin? Or

is something else going on?

In my view, the explanation

hinges on the difference between, say, a dot.com fantasy company

run by a couple of twenty-somethings and, say, oil... the stuff

you use to get to work in the morning... or to assure the icicles

stay on the outside of your windows.

As much as you might enjoy

the software offered by your favorite dot.com, when push comes

to shove, you could probably manage without. Oil? Food? Good

luck.

To a lesser or greater degree,

the same acid test can be applied to the value-add of Bear Stearns

and the other financial stocks versus, say, the iron that supports

your local highway bridges. Or the copper that is so important

to all manner of electronics.

Or even houses and condos bought

on speculation by people who couldn't afford them versus the

nickel needed to create the stainless steel that is everywhere.

It is my simple contention

that while selected commodities can and will get ahead of themselves

(and probably already have)... the underpinning reality for their

higher prices has far more to do with the value of the currency

units they are priced in than with some broader investment fad.

To this date, I can count on one hand the number of friends of

mine outside of the business circles I run with who have made

any investments in commodities.

Add into the equation the clear

supply and demand challenges for many of the core commodities

and the bubble doesn't seem quite so bubbly.

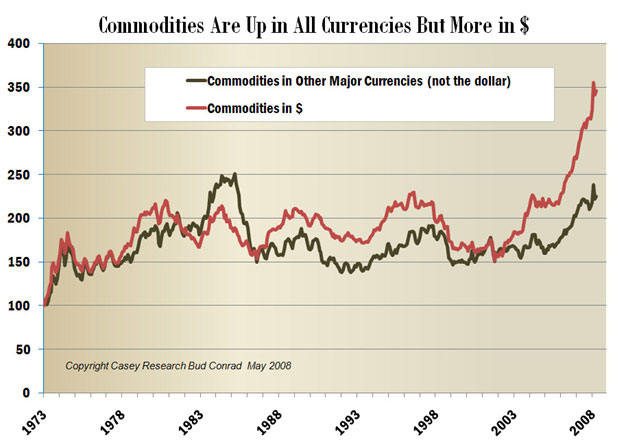

Here's a picture of commodities

against both the U.S. dollar and the major currencies (ex-dollar).

And gold?

Well, while useful in certain

industrial applications, gold as a commodity has a unique utility

- it is considered as tangible money the world over. It is portable,

easily divisible, durable and unquestionably accepted around

the world. In an environment of a global crisis in confidence

in fiat money, gold will provide a critical function that will

only grow in importance in the months and years just ahead. [Editor's note:

Cast your weary eyes on this fine "H&S formation"

spectacle - '"Bearish"

on Gold

...LOL -Barb]

In short, the occasional corrections

aside, this show is far from over. In short, the occasional corrections

aside, this show is far from over.

How do you protect your assets

in times of economic decline? Which investments provide safety

when blue-chip stocks, government bonds and mutual funds do not?

You'll find specific answers

and actionable advice in our new FREE special report The

Recession Tool Kit - 9 Winning Strategies to Profit from Crisis.

Including: a nest egg for rainy days and how to buy it... lucrative,

low-risk investments that every prudent investor should have...

how to make money instead of losing it... and much, much more.

You don't want to miss this

special report. To get your Recession Tool Kit FREE

today, click

here.

###

Casey Archives

321gold Ltd

|