Casey Files: Casey Files:

This week in 'The Room'

Doug Casey

International

Speculator

written Mar 21, 2008

posted Mar 24, 2008

Welcome to "The Room"

The subscribers-only home page of Casey

Research.

Dear Reader,

It used to be of no little

pride in the small New England town where Casey Research is headquartered

that school went forward, no matter the weather. Hail, 8-foot-high

snow drifts, ice rain and, should they have occurred hereabouts

(which they didn't), I am fairly sure that even hurricanes

and tornadoes would not have kept the school administration from

its daily labors in the brainwashing of innocent youth.

That all changed when, earlier

this winter, a school bus missed the turn on a gently sloping

hill and rolled onto its side, fortunately causing no serious

injuries (for some reason, which continues to baffle me, the

police will stop and ticket you for driving without a seat belt,

yet school buses are systematically unequipped with same).

The accident, no doubt, made

the school officialdom aware of some previously unexamined legal

consequence because the school now delays the morning opening

or closes down tight on what appears to me to be so much as a

semi-reliable report that a single threatening snowflake has

been observed in the general vicinity.

And so it is that, with a modest

snowfall in process, the kids are home again today, lounging

about and, because it is Friday when I write from home, crowding

me out of my office (which counter-intuitively also serves as

their toy room). Which leaves me to write to you from a couch

upstairs, with stern instructions to the kids that while I may

appear to be in residence, they should assume I am a figment

of their youthful imaginations until I have finished writing

this weekly epistle.

While it is typically with

a good deal of pleasure that I sit down to reminisce about the

action of the week just ending, this week again, the volume of

news coupled with the magnitude of that news makes the task daunting.

But no amount of dithering will make the task go away, so here

we go...

"Commodities Drop, Rally in Dollar,

Stocks Vindicate Bernanke"

That headline is not mine,

it is from Bloomberg this morning. Bloomberg's

enthusiasm is based, as hard as I find it to believe, on little

more than that the Fed cut the rate it charges banks to borrow

by "just"

75 basis points this week, and that the stock market rallied,

then fell, then rallied again in response.

The herd was, apparently, expecting

1%. Further, not only were they expecting this, they were mentally

prepared to accept a 1% cut as a sign that the economy remained

in dire straits and that, as a result, the Fed would have to

continue its loose money policy. According to the punditry, a

75 bps cut indicates that Bernanke and Co. have drawn a line

in the sand, signaling they were going to be restrained in their

approach to the crisis now stalking the land. Further, this show

of confidence portends that the worst of the crisis is nearly

behind us.

Ready to push the trigger to

buy more commodities on a 1% rate cut, the market instead rushed

into buy stocks and sell commodities...

then changed its mind and sold stocks and commodities... then bought stocks again, but still sold commodities.

Gold, silver, oil, grain... you name it, if it shows up under the heading

Commodities in the back of your favorite paper, then it got hit.

But of course, there was a

whole lot more going on this week. We'll

come back to the commodities momentarily. First, however, we

need to walk up a few floors to get a better view of the bigger

picture.

Problem Solved?

Now, you will excuse me if

I seem a touch skeptical, but I can't

help but notice that short of climbing aboard helicopters rigged

to carry pallets of dollars, the Fed is now doing exactly what

we have been expecting it to: provide all the liquidity it can

muster using its near mystical powers of money creation.

In addition to yet another

deep cut in the Fed Funds rate, they are now making the almost

unprecedented move (at least since the Great Depression) of lending

money to non-commercial banks, in the process effectively putting

taxpayers on the hook for $30 billion in suspect collateral from

Bear Stearns.

And that's

just one of many moves of late, including cutting discount rates

by a total of 1%, to 2.5% over the past week alone, and opening

up new lending facilities that allow the investment banks to

borrow directly from the Fed using as collateral the same sort

of suspect paper that brought down Bear.

Playing their part, three of

the biggest investment banks, Goldman, Morgan Stanley and, importantly,

Lehman, announced that they were going to access this new lending

facility, whether they need to or not, in order to remove the

"stigma"

(their term) of stepping up to the window, so to speak.

Give that some thought for

a second. What they were saying for all the world to hear was

that they were going to engage in what is effectively an institutional

shell game... a deliberate attempt to obfuscate

which of the banks are actually in trouble. As a shareholder

in one of these companies, you won't

have any idea whether your bank is accessing this emergency facility

because it is, in fact, in trouble.

Given the estimates that the

assets being carried as capital on the books of Bear Stearns

were worth only 10% of what was being posted, and the herd-like

business practices of the big investment houses, the odds are

fairly high that Bear Stearns is not the only institution teetering

on the brink.

Yet this week investors seemed

to actually buy the idea that the worst is now over, and that

the all-clear signal will soon be sounded.

What to believe? Whom to believe?

Could the Fed have finally figured out the right combination

to re-open the safe of prosperity? And what of the commodities,

especially gold?

This week I have received a

larger than usual amount of incoming emails presenting all sorts

of theories. Some have it that JPMorgan, the world's largest bullion bank, was in real trouble with

shorts on gold and had been buying the metal back, helping to

fuel its meteoric rise of late, but that the liquidity provided

by the Fed has now taken the pressure off and allowed them to

stop or slow their buying (our own Bud Conrad has been looking

into this notion, but so far has uncovered no solid proof).

As for the financial sector

and, by extension the rest of the market, we can't know for sure what's

going on behind the scenes, because the government and the big

banks are playing it very close to the vest. But we can, from

our higher perch, try to sort the unknown from the known, and

start with the latter.

- This week we had a major bank

failure (as predicted many months ago by Bud). Despite Jim Cramer's firm belief in the firm, Bear Stearns, the

fifth largest U.S. investment bank and a firm tightly connected

as a counter party to hundreds of billions in derivative agreements,

suffered a good old-fashioned meltdown.

x

- We know that the share price

of Bear Stearns has fallen from over $150 last year to as low

as $2.00, and what is left of the firm is now being sucked into

JPMorgan, but only because the Fed has agreed to stand behind

the deal to the tune of $30 billion, an intervention the likes

of which was last witnessed in the Great Depression.

x

- We also know that the vultures

were starting to circle Lehman, another member of the big five

U.S. investment banks. Absent the Fed's

aggressive intervention, the odds were fairly high they would

have been next to get hit with the equivalent of a run. This

is why the Treasury and the Fed worked so hard to get the Bear

Stearns deal cobbled together over a single weekend, before the

markets reopened and Mr. Market could recommence beserking. From

where I sit, it appears that we came within hours of seeing another

of the nation's largest financial institutions crash,

potentially taking down the whole house of cards.

x

- And we know the Fed dropped

the Fed Funds rate by 0.75, only the second time in the last

decade that it has cut rates by an amount that large.

We know some other things as

well. For instance, that commodities have been on the equivalent

of a one-way-up escalator in recent months. And we know that

no market goes in only one direction for any sustained period

of time, and so a correction was inevitable. Gold, oil, the grains... they all had to take a breather. And so they

have.

But Let's Try to Keep This All in Perspective...

What has actually occurred

over the last month, between February 21 and March 20?

Okay, so gold and silver are

off a little, copper a bit more, oil is still up, Bear Stearns

is a smoking hole in the ground, JPMorgan is up a bit, and Lehman

is down 10%. Other than Bear Stearns and, to a lesser degree,

Lehman, I'm not seeing anything so earth shattering.

(Sure, gold recently took a high dive off the $1,000 per ounce

mark... but it is still over $900, a level

that not one in ten thousand investors, if asked a year ago,

would have expected it to trade at. And oil over $100? Forget

about it.)

There are a few more things

we know. For instance, that consumers are debt strapped and the

housing bubble has burst and is deflating rapidly. And that falling

home prices are wiping out the net worth, discretionary spending

power and positive sentiment of the U.S. consumer who has, heretofore,

shown a seemingly unlimited willingness to go into debt up to

their eyeballs to keep the world economy afloat. That is now

changing.

We also have proof, if proof

was needed, that the government will do whatever it takes to

avoid a meltdown. While they are shoving the walnut shells around

so fast that it's hard to figure out where the pea

is these days, what is increasingly clear is that there is only

one real plan at this point: to apply as many billions of dollars

as they feel is necessary to keep the ship of state afloat.

And while some might like to

think that the country is not in a recession, at this point I

am going to put it down as fact that a recession is now underway

and that we need to be worried about it becoming much uglier

than that.

Blame it on Smokey the Bear

A good way to understand both

the degree and the nature of the current crisis is to look at

the state of the nation's western

forests. Before the 1940s, forest fires were allowed to run their

course, just as they had over the millennia. But then the government

adopted a policy to fight every fire, a battle epitomized by

the introduction of the iconic Smokey the Bear. What has happened

since is a massive build-up in the fire risk in federally managed

forests.

The following is from a CATO

Institute document on the topic...

Since the advent of the Smokey

Bear era in the 1940s, tree density in federal forests has increased

from 50 per acre to as much as 300 to 500 per acre. Federal forests

are filled with dense stands of small, stressed trees and plants

that combine with dry deadwood to provide virtual kindling wood

for forest fires.

According to Forest Service

statistics, some two-thirds of federally held forested lands

are in deteriorating health.

The consequence of governmental

meddling in the forest is that when a fire now breaks out, it

is exponentially larger, more dangerous and more expensive to

fight. Nationwide, the forested area now at extreme risk is equal

to an area about the size of the state of California.

One of these days, and probably

sooner rather than later, there will be a forest fire of biblical

proportions... and Smokey's

real-life brethren, along with houses and all that moves or doesn't, will go up in smoke.

Similarly, by continuously

tampering with the business cycle, the government has led us

to the point where the dried underbrush is piled high and just

waiting for a match. The Fed was able to throw a quick tanker

load of water onto the Bear Stearns fire...

but that doesn't mean we are anywhere near out of

the woods. (Don't you just love it when your metaphors

snap so nicely in line? I sure do!)

Which Brings Up an Interesting Question

Given virtually unlimited power,

including the ability to create money out of nothing, or to change

any rule or law or convention, bend any arm, or ban or hinder

trading in any commodity... just

how much power can the U.S. government apply to the problems

now besetting our economy and, by extension, the world?

Or, looked at from the reverse

angle, given its unlimited power, is there any way Paulson, Bernanke,

et al can fail to stabilize things?

It is an interesting discussion,

and one that requires more analysis and data than I'm in a position to provide sitting here on my

couch on a Friday morning. (We will go into it in more detail

in a special report on the crisis that is being worked up for

paid subscribers, and which should be issued following our Scottsdale

Crisis & Opportunity Summit next week.)

I will, however, comment just

a bit further.

Let's

start with the proposition that the government has absolute power,

which is largely the case these days, especially because the

populace is so numb to large numbers that outrage at the beggaring

of future generations no longer seems to be of any concern to

anyone.

So, the Fed can effectively

pump out all the money it needs to "get

her done" and if that doesn't

do it, then the Treasury can step back in. This approach, from

a policy maker's perspective, is quite attractive

because it essentially papers over the problem. Look at it this

way. If housing prices fall, on average, 20% nationwide, but

the currency depreciates at the same level, then housing weakness

would be masked... ditto 20% of stock market losses.

In case that point is not clear, look at it like this. If your

house is worth $100,000 and it loses 20%, its value would fall

to $80,000. But if the dollar was to simultaneously lose 20%,

then the price of the house would remain $100,000. The average

person would be clueless they have just taken a 20% haircut.

Pretty cool, eh?

Unfortunately for the government,

there are natural limits to everything. In this case, the most

immediate threat to this plan resides in the trillions of dollars

held by foreigners.

In recent decades these foreigners,

trading partners mostly, have been willing to swap our inflation

in exchange for market share within the U.S., the greatest consumption

engine on the planet (as an FYI, the eurozone just surpassed

us).

But that inflation is beginning

to be felt back home: in China, in the Middle East, Russia and

everywhere between. At some point, the pain, and the realization

that inflation in the U.S. is only going to get worse, is very

likely to make these dollar holders get serious about breaking

their links with the dollar, and dumping the trillions they now

hold.

And while U.S. consumers are

well aware that everything costs more these days, no matter what

the jury-rigged CPI tells them, it is when the foreigners start

repatriating our dollars that the real pain of inflation will

begin. At that point, the fire starts in earnest.

I call this the Point of

Mugabe, named in honor, of course, of Robert Mugabe, the

supreme overlord of Zimbabwe. A dictator with absolute power

in all matters, Mugabe's maladministration

of his country's economy has finally reached the point

where today, as much as he dictates against it, inflation runs

in excess of 100,000% annually. While the sheeple of that country

seem either particularly stupid, beaten down or tolerant, sooner

rather than later Mr. Mugabe's ridiculous

regime will come to an end, and probably not in a manner that

he will find personally pleasant.

In the final analysis, I remain

convinced that the praise of Bernanke et al based on their extreme

actions this past week will find its way into the history books

along with quotes such as these...

"The end of the decline

of the Stock Market will probably not be long, only a few more

days at most." -Irving Fisher, November 1929

"I see nothing in the

present situation that is either menacing or warrants pessimism...

I have every confidence that there will be a revival of activity

in the spring, and that during this coming year the country will

make steady progress." -Andrew W. Mellon, U.S. Secretary

of the Treasury, December 1929

And, of course, my favorite

recent example... Jim Cramer's

rant that people should not take their money out of Bear Stearns,

just a day before that firm collapsed. You can watch history

in the making by

clicking here.

We'll

have a lot more on this topic in our upcoming special update

report on the crisis, which will be sent to all paid subscribers

the week after next.

What's Coming

In my reading for the above,

I came across the September 2007 edition of the International

Speculator and its lead article, Preparing for Crisis.

I thought the following excerpt was worth sharing, not just because

it shows how spot-on Bud Conrad, the chief economist of this

operation, has been in forecasting the specifics of the unfolding

crisis, but because it is still as useful today as then in understanding

how things are likely to keep rolling out (the full article has

much more detail, well worth reviewing). Here's

the excerpt.

The credit crisis will not

end soon. Here's what we think is coming.

More Defaults. The bulk of the subprime loans are

adjustable rate mortgages. The continuing reset of up to $50

billion per month of subprime ARMs will keep mortgage defaults

growing, which will keep home prices falling, which means that

more of the defaults will turn into unrecoverable losses for

the investors holding the paper. The hedge funds that haven't thrown in the towel on subprime mortgages will

collapse one by one.

The economy will slow down. Lending to risky customers has dried

up. Earnings of most corporations will slide because consumers,

who can no longer turn to home equity loans and whose credit

cards are already maxed out, will cut spending. The mounting

losses in CDOs and the continuing defaults in the housing industry

will precipitate a severe credit crunch. The capital of many

banks is about to shrink, which will hamper their ability to

lend.

Stocks will fall. The next phase down in the stock market

will come from reduced earnings estimates for 2008. We could

see an auto company or a big bank announce insolvency. Fear,

and then the fear of fear itself, and the fear of being the last

one out the door will take over. Big, 300 or 400 point moves

- mostly down -

will become regular events. People have forgotten, but they are

going to be reminded, that stocks have, until fairly recently

in history, normally yielded about twice as much as bonds, simply

because they're riskier.

Dollar down. While U.S. citizens are looking to

build cash - another source of pressure on spending

and investment - few foreigners now want U.S. dollars

or dollar-denominated debt. After the failure of large U.S. institutions

begins and the Fed turns the printing presses on full blast in

an attempt to keep liquidity in the system, flight to safety

will mean a flight from the dollar. How fast they will print

is hard to guess. They've already

started, but will probably panic as the economy slows, and then

turn the presses to high. The dollar will fall in purchasing

power. Interest rates will rise across the board, with low-quality

paper hurt the worst.

If you are not yet receiving

the International

Speculator, now is a great time to sign up. With the 3-month

risk-free guarantee, you can take a leisurely look at the publication

to see if it's right for you. Check

it out.

Show Me the Money!

This week we have, as you'd expect given gold's

steep plunge, received some email wondering when the junior gold

stocks we tend to favor in the International Speculator (among

other investments that we feel are appropriate to the current

environment) will pick themselves off the mat and get on with

the business of making serious money.

This is, of course, a topic

I have discussed at some length recently, so I won't go into the topic much again here (look back

over the past couple of issues, using the archive link below).

But I will say, again, that

I remain convinced that the next big move in the junior explorers

is still ahead, and will come as the big gold stocks once again

confirm the new reality that they are becoming cash machines.

And they begin using their newly beefed-up balance sheets to

acquire the deposits needed to replenish their depleting reserves.

If you keep selling ounces without replacing them, in time, you

are nothing but a shell... and

so replacing reserves is a business dictate.

On that front, Barrick just

announced that it will spend $10 billion to acquire new mines

and resources over the next little while. You can read the story

here:

And there's

this. This week, PricewaterhouseCoopers released its Mining

Deals 2007 Annual Review... which,

among other prognostications reported on in an article on same

by the folks at MineWeb, included these...

"2008 looks set to see mining deals

reach very high record levels as super-consolidation takes place

in the market."

Despite the credit crunch,

the report finds "little evidence of a slowdown in [mining]

deal activity."

"Underpinning these trends

is the quest for world scale, resource acquisition and resource

diversification," the analysts asserted.

The study noted that exploration

costs are at all-time highs, permitting takes longer, and mining

companies are facing skills' shortages.

"These are significant barriers to meeting what is a major

upturn in world demand."

(read the full MineWeb article

on the topic by clicking here.)

This is all just the tip of

the iceberg if you ask me, and it bodes very, very well for the

juniors that are already sitting on a discovery. Yes, it is frustrating

that some of our favorites have fallen with the broader markets

lately... but this is a sector you need to be

patient with.

On that topic, yesterday someone

asked me if our subscribers were early adopters. And, after a

moment's thought, I answered, "Yes. They are looking to get in early

on a trend, and in investments that will provide far bigger returns

than average."

Early adopters, however, have

to possess both patience and a tolerance for risk. If not, then

you may be invested in the right sector, but with the wrong temperament... a recipe for disaster. To wit, you won't have the emotional staying power to get you

through the inevitable down swings and so you will invariably

sell at exactly the wrong time, on a big setback. By contrast,

an individual with the right temperament will continually look

to buy under the market and, when that corner of their portfolio

dedicated to the quality gold juniors is topped off, will look

to continually upgrade at lower prices. Because they won't be chased out by the volatility, they'll still be there to collect the big profits

as the endgame unfolds.

This is also why investing

only with money you can afford to lose and still sleep well is

so important. It assures you don't

get over-emotional and greatly improves your odds of staying

the course. And in the worst case that we are wrong and these

stocks only head down to more or less a total wipeout, you might

be discomforted, but you won't be put

out of the house.

I guess what I am saying is

that we have never made any bones about the volatile nature of

these stocks. Please be clear on why you are buying them, and

don't kid yourself into thinking they couldn't go down 50% even from here. They can. But we

wouldn't be recommending them, or investing

in them ourselves, if we didn't think

this was a play that will blow the doors off almost any other

investment you could be making just now.

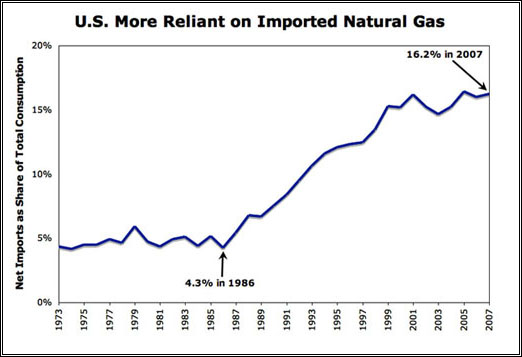

Energy Chart of the Week

Public displays of hand wringing

over America's dependence on foreign oil have become

very popular, but little attention has been paid to how natural

gas imports fit into the U.S. energy equation.

Twenty years ago, the United

States' natural gas production met nearly

all domestic demand, but that is changing -

and quickly.

The current situation is nowhere

near as dire as America's predicament

with oil supplies, of which 60% come from net imports. But the

trend of imports making up a greater share of consumption is

accelerating at a more rapid pace for "natty" than it is with crude oil. From 1985

to 2007, America's reliance on crude oil imports doubled,

but its reliance on natural gas imports has nearly quadrupled.

Because the vast majority of

natural gas imports come from Canada -

normally considered a safe source of supply -

little fuss has been made. If America has to buy more natural

gas from its neighbor to the north, what's

the big deal? They've been a steady supplier in the past,

and it's not the sort of place where rebels

run amuck blowing up pipelines, disrupting the supply chain (as

has been the case in Mexico).

Under NAFTA's

proportionality clause, Canada is bound to send 60% of its natural

gas to the United States. The problem is that Canada's natural gas production is declining. Making

a bad situation worse, the tar sands require huge amounts of

natural gas to ramp up their heavy oil operations. Canadian winters

aren't getting any warmer either, which

- coupled with a growing population

- has meant steady growth in Canada's natural gas consumption.

At recent debates, Hillary

Clinton and Barack Obama have been arguing over who would be

most qualified to tear up the NAFTA agreement. Lost in this storm

of campaign rhetoric was Canada's response.

"You might not want to renegotiate NAFTA

if you knew how badly you need that oil and gas"

was the message from Jim Flaherty, Canada's

finance minister. The Canadian government would jump at any chance

to wiggle out of NAFTA's proportionality

clause, and a Democratic president might give them the opportunity.

The good news is that natural

gas imports no longer arrive solely via the pipeline; they also

arrive by ship through the emerging global market in liquefied

natural gas (LNG). So the United States is not restricted to

Canada when looking for natural gas supply, as it was even just

twenty years ago. The bad news is that many of the biggest suppliers

of LNG are located in the Middle East and Russia - precisely the regions that America wants to

become less reliant on for its future energy needs.

[Author's Note: Over

coffee early this morning, I re-read the latest edition of the

Casey

Energy Speculator. In addition to a number of other excellent

articles, it included a fascinating article on "run

of river" energy projects, a "green" energy technology that has tremendous

upside. It produces power from rivers, without damming them,

and with relatively minor disturbance to the environment. The

article includes two recommendations, one low risk, one high

risk. If you are not yet a subscriber, learn

more about giving it a trial run.]

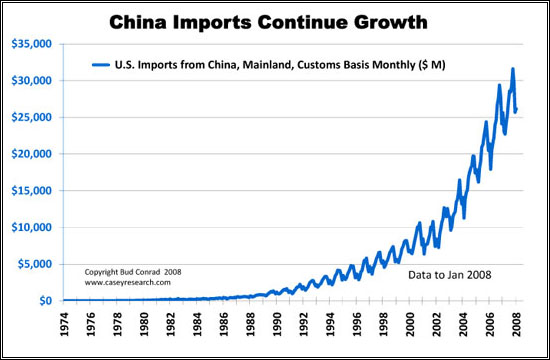

China Still Is Selling Us More and

More

Bud Conrad took a break from

his preparations for our sold-out Scottsdale Summit to send over

the following chart he thought you would find of interest.

There are a couple of take-aways

from that chart, but the one that pops out at me is that it is

a picture of American manufacturing being shipped overseas. As

a result, while there is no question that a weakening dollar

will help American manufacturers, the fact that their ranks have

been reduced to such a degree, will likely mute the benefits.

Real Estate, Real Trouble

I ran into the mother of a

close friend and a former partner at the store the other day.

I don't think I would be exaggerating if

I said she was the powerhouse real estate broker here in the

resort town that is the headquarters of Casey Research. She is

the quintessential über-agent, "can

do," "get

it done" and "never

say die" kind of individual. Always an upbeat

word about the local market and tough as nails, when needs to

be, to get the sale. Yet, in our check-out conversation she made

no bones about the fact that her views on the local real estate

market are far less positive these days. In fact, her words were

along the lines of, "I don't think

that house prices are going to come back for another decade."

In a discussion on the topic

of real estate with my mother, who holds down the family fort

on the Big Island of Hawaii, she related a tale that I had heard

before, but thought relevant to the current market, and so asked

her to write down the facts of the case. Here they are:

"Grandpa bought a large house in August

of 1929. The address was 10 Sutherland Road, Montclair, N.J.

The price was about $45,000. He finally sold it for slightly

less in 1945 after trying for years. I have an excellent photo

of the house but can't send it until later today when (and

if) I manage to reinstall another all-in-one with scanner. Love,

Mom"

Could real estate really go

down and stay down for 20 years? As hard as it seems to imagine,

the answer is yes. This is a topic I'll

have more on next week, when I share an interview with one of

your fellow subscribers who is a professional real estate appraiser

of many years and great experience from Northern California.

And That, Dear Readers,

Is It for this Week...

I'm

off tomorrow to our Scottsdale Summit. Next week's edition, written on the fly (literally) will

likely be a bit reduced. The U.S. stock market is closed for

Easter, but I can't even begin to imagine what thrills

and chills it has for us next week.

We live in interesting times,

indeed.

As always, thank you for taking

time to read these hastily-assembled thoughts.

Warm regards,

David Galland

Managing Director

Casey Research, LLC.

###

Casey Archives

321gold Ltd

|