Casey Files: Casey Files:

This week in 'The Room'

Doug Casey

International Speculator

written Feb 15, 2008

posted Feb 19, 2008

"Unless you are new

to our services, you should, by now, be getting pretty chummy

with the right side of this trend through investments in precious

metals, energy commodities and other "stuff." Played

right, these investments will assure you won't be one of those

who, like our barely breathing canary, are caught by surprise

by the unfolding monetary crisis. And you might even get rich...

or richer than you already are."

Welcome to "The Room"

The subscribers-only home page of Casey Research.

February 15, 2008

Dear Reader...

Foolishly, I now realize, I

closed last week's column by announcing that I would endeavor

to write today's entire missive without a single mention of...

okay, well, just this once... government.

Some readers have suggested

that I could meet the test simply by replacing that specific

word with another, for instance, "Turnip." While the

idea has merit, as does even that word (looks a lot tastier than

it is), I believe that self-created rules are rules nonetheless

and no cheating allowed.

But, given the deep influence

of that particular form of human activity, the task of producing

this edition of The Room is made all the more daunting by my

admittedly childish challenge.

I suppose we could talk about

the weather.

(Actually, we can! My wife,

the chief science officer of our household, gives a dismissive

sniff any time I mention the latest forecast from local news

sources, then logs on to consult with http://www.ssec.wisc.edu/data/geo/,

a geostationary satellite with a number of filters that, once

you master it, provides all the intel you'll ever need about

what's really coming next.)

Okay, well, that about covers

the small talk.

But before we move on, I must

make one small edit to the rules surrounding today's challenge...

namely that, should I decide to quote someone else, that person

will not be subject to the same constraint, because, well, they

weren't aware of the rules in the first place.

Okay, now that we have the

rules straight, I'm going to wander into the kitchen for a further

consultation with my dear friend, Ms. Rancilio Espresso-Maker,

and let our own Bud Conrad take over the reins for a few moments.

As you may recall, last week

Bud commented on the obvious play to be had in lumber. In a similar

vein, this week he looks at commodities as a sector play...

Commodities: Looking Beyond the News

By Bud Conrad

We have read Jim Rogers' comment

on commodities in his new book and seen the price of gasoline

when we fill up, but most of us get too distracted by some enticing

traditional investment, like a stock in some extractive resource,

to think beyond the obvious.

For a year and a half, I have

been watching grains scream higher. With oil, gold and odd items

like milk and butter rising, I start to ask what might be beyond

the horizon.

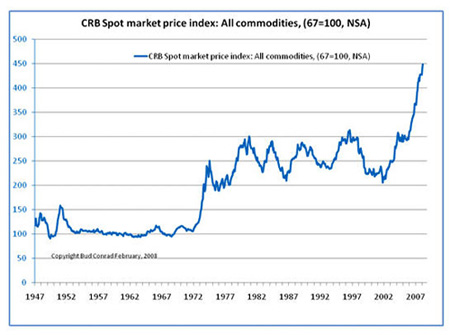

First, to report the bedrock

under the commodities, see how commodities have jumped. There's

no deflation there.

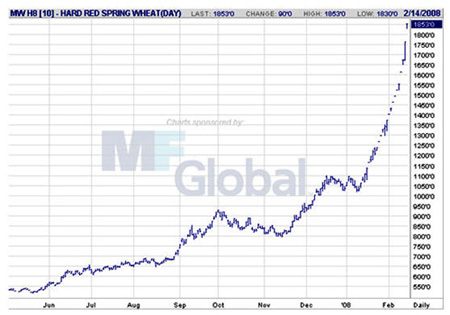

Here is a chart on Minneapolis

wheat, from $5 to $18 since last summer:

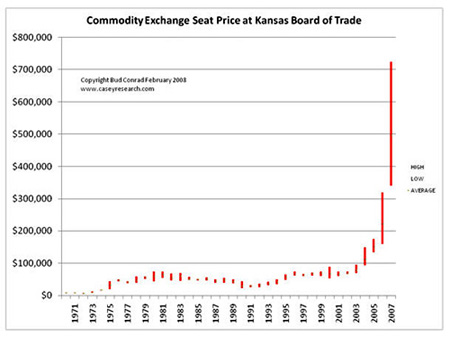

It has been said that the guys

that made the most money in the gold rush were the suppliers

that provided the tools to the miners. So, who are the guys that

are making money providing tools to the commodity traders? Here

is one measure of the jump in this vein: the price of a seat

on the commodity exchange. It jumped from under $10,000 in 1971

to $725,000 at the end of 2007 in Kansas City. These seats are

traded on the exchange, and can earn profits along the way by

being leased out to institutions or rich individuals who want

to place trades directly.

And a seat on the Minneapolis

Grain Exchange tells the same explosive commodity story, jumping

from $16,000 as recently as 2004 to $280,000 now:

All this is obvious once someone

points it out. What else should we be looking at?

(A possibly profitable trend

pops into my own mind... I'll share it a bit later on. But first,

this... )

The First Annual Casey Research Inflation

Google

One of our core theses is that

global price inflation is on an unstoppable upswing at this point.

Supporting that contention are nearly daily reports from around

the globe of rapidly escalating inflation emerging everywhere

from Russia to Saudi Arabia... from Australia to China... and

almost literally everywhere in between.

In fact, I have a rather eye-opening

way to prove the point.

Simply enter the following

search query into your favorite search engine, formatted as follows...

except replace the "name of country" with the

name of any country that pops to mind. Be sure to include

the parentheses.(name of country inflation 2008)What you'll

find, without exception, is a recent news story about local price

inflation ratcheting up far more than previous expectations.

For example, I randomly googled

Egypt... and here's what I found.

On February 8, the bank initiated

a hike of 25 basis points, bringing its deposit rate to 9% and

its lending rate to 11%. The decision came in the wake of news

that inflation hit 11.5% in the year to January, reversing Egypt's

disinflationary trend from the last quarter of 2007...

Okay, let's try another one.

Throwing a mental dart at an invisible board, it lands on...

Mauritania? Here's that story...

NOUAKCHOTT, Nov 15, 2007 (AFP)

Mauritanian President Sidi Ould Cheikh Abdallahi ordered villages

to stockpile food to help cushion the effect of rising inflation,

his economic adviser said Thursday. The announcement came just

days after the latest unrest over the crisis. Some six thousand

tonnes of wheat had already been put aside for the stocks as

part of a bid to stabilise prices, said Sidi Mohamed Ould Biye.

The announcement [came] after a series of violent protests since

last week over spiralling prices have left one person dead and

17 injured."

There are a number of reasons

for this powerful upswing, but none more important than the fiat

monetary regime that allows for a steady, unfettered flow of

freshly minted paper and its electronic doppelgangers to enter

the market. The most widely used and traded commodities, energy

and food, are, like canaries in an old-fashioned coal mine, early

warnings of what's coming.

This week, for instance, we

have the news out of England that families there are now spending

an extra £1,300 pounds a year (US$ 2,550) on household

items, most notably food and fuel, which, according to an article

in the Daily Telegraph, are rising at the briskest pace in 17

years.

As you can see by letting your

eyes float back up the page to Bud's first chart, which shows

the commodities index curve moving up more or less steadily since

the U.S. dollar's link to gold was broken, the canary is now

lying on its back, its cute little feet stretched upwards, a

convulsive twitch the only indication of a weak spark of life.

Is there any force on earth

that can stand in the way of commodities continuing to rise over

the next thirty years and beyond? (With the inevitable short-term

corrections along the way, of course.)

Absent a wholesale abandonment

of the fiat monetary system, the answer is no. That many of these

same commodities are concurrently getting harder and more expensive

to find in any useful quantities only exacerbates the problem.

And, of course, as the cost

of living goes up, so must wages and benefits, some of which

are already pegged to automatic adjustments.

By now almost everyone is familiar

with the concept of "tipping" points -- that point

beyond which the inevitable also becomes the imminent. My favorite

partner of all times, Doug Casey, is of the opinion that we are

at that point. By now almost everyone is familiar

with the concept of "tipping" points -- that point

beyond which the inevitable also becomes the imminent. My favorite

partner of all times, Doug Casey, is of the opinion that we are

at that point.

I am finding it harder and

harder to disagree.

Unless you are new to our services,

you should, by now, be getting pretty chummy with the right side

of this trend through investments in precious metals, energy

commodities and other "stuff." Played right, these

investments will assure you won't be one of those who, like our

barely breathing canary, are caught by surprise by the unfolding

monetary crisis. And you might even get rich... or richer than

you already are.

These are topics we will, of

course, continue to cover at greater length, and with far more

specificity, in our various subscription services.

[NOTE: If you're new

to Casey Research and are looking for a good place to get started,

take an inexpensive subscription to our BIG GOLD as that monthly

newsletter offers simple and lower-risk ways to play the inflation

trend. For more on BIG GOLD and its 3-month, 100% money-back

satisfaction guarantee, click

here.]

Dispatches from the Front Lines of

the Credit Crisis

Remember back when... when

certain individuals associated with certain unnamed institutions

were pontificating that the subprime losses would amount to no

more than $100 billion to $150 billion? It turns out that said

individuals were somewhat ill informed, a point made clear by

the steady stream of blood-soaked dispatches coming back from

the front of the credit crisis. Just this week...

✓ Mortgage

insurer MGIC announced yesterday it had a net loss of $1.47 billion,

or $18 per share, mainly attributable to a $1.2 billion loss

reserve. The company is now said be to urgently seeking new capital

in order to avoid further rating downgrades.

✓ It

was announced Wednesday that between April and December 2007

alone, Japanese financial institutions have incurred losses of

600 billion yen (US$5.5 billion) from investments related to

U.S. subprime mortgages. I have recently come across credible

analysis that says the Japanese banks are scrambling behind the

scenes to avoid fully disclosing the size of their subprime losses,

but that it could run into many multiples of the number reported

this week.

✓ Bond

insurer MBIA this week begged for relief from short-sellers and

further, asked that the rules be changed about how bond insurers

are assessed. Otherwise, they were at risk of going out of business

by virtue of having done a spectacularly poor job and being punished

for it with a ratings downgrade. Predictably, their argument

revolves around the time-honored contention that they are too

large to fail. Which is another way of saying that the burden

of their losses should ultimately be shifted to taxpayers.

✓ Warren

Buffett seems to disagree, in effect, encouraging their collapse

by offering to off-load the company's municipal bond liabilities

(as well as those of the other bond insurers) at fire sale prices.

Grasping at straws, the equity markets did a dead-cat bounce

on the news based on the observation that, "Ah, Buffett

is doing what JPMorgan did in 1907 to bail out the stock markets!"

Not so fast, say us...

Bud Conrad's take...

"Buffett is no dummy. He isn't in this for the good of the

U.S. economy: he's in it to make money. So I doubt he is paying

more than the Muni insurance is worth. The sellers are up against

the wall, having fire sales to stay afloat.

"They would be selling off their only assets that are worth

anything, leaving behind the toxic waste. This is not the bailout

that will fix the overleveraged guarantees on $2.4T of bonds

by these insurers; rather, it confirms that they are desperate,

and even closer to worthless, in my opinion. If such a deal goes

through, it shortens the life of the insurers unless a big government

bailout emerges."

✓ UBS,

Europe's largest bank, announced this week a fourth-quarter subprime-related

loss of almost $12 billion. And it's not over yet. According

to Bloomberg, the bank's CEO said that 2008 would be another

"difficult year."

✓ Perhaps,

like a child caught with its hand in the cookie jar and then

tries to deflect attention by pointing to the chocolate-smeared

face of a nearby sibling, UBS analyst Philip Finch issued a report

today stating that, in his view, the world's banking sector as

a whole could suffer another $203 billion in losses due to the

credit meltdown.

A billion here, $200 billion

there, this is beginning to add up to real money. Or is it? It's

hard to say any more, thanks to the steady drumbeat of these

large numbers. It is positively numbing.

Which begs the question...

What, Really, Is a Billion?

Some time ago, I did an article

in which I tried to remind people just how much a billion dollars

is.

As I can't find that article

to republish here, I trolled into the internet, that source of

all knowledge, to find a reference I recalled from speeches Ronald

Reagan used to make on the topic.

Here it is, from a 1977 speech.

Does anyone realize how much

a single billion is? A billion minutes ago Christ was walking

on this earth. A billion hours ago our ancestors lived in caves,

and it's questionable as to whether they'd discovered the use

of fire.

A billion dollars ago was 19 hours in Washington, D.C. And it'll

be another billion in the next 19 hours, and every 19 hours until

they adopt a new budget at which time it'll be almost a billion

and a half.

But let me really paint the picture for you. If you gentlemen

sent your wives out on a shopping spree, and gave them each a

billion dollars, and told them not to spend more than a thousand

dollars a day, they won't be home for 3,000 years.

Of course, that was then, and

this is now. Based on the 2008 budget, it no longer takes 19

hours for $1 billion of your tax dollars to go out the door,

but just three.

Or, viewed another way, your

tax dollars are being spent at a rate of $331 million each and

every hour of each and every day... 365 days of the year.

And even at that frenetic pace,

it still takes 125 days to spend a trillion. Using $100 bills

as our unit of measure, we find that it would require a stack

670 miles high to add up to $1 trillion.

Gee, I'm not sure that helped.

The Solution to All That Ails the

World

(But Don't Tell Anyone!)

By Doug Hornig

Last weekend's meeting of the

G-7 finance ministers in Tokyo came and went without much publicity.

Concern about the state of the world economy was expressed, but

no momentous actions were taken. Yawn. Yet for those who were

paying attention, some very revealing dialogue slipped out.

Now let it be said that honesty

and transparency are uncharacteristic of government in general.

If they were more common, the people might actually know what

was going on behind the curtain. And that's the last thing governments

want because, were the public not so dumbed down, it might respond

appropriately, with torches and pitchforks.

Thus our surprise at the following:

One of the things G-7 officials

discussed was the need for collective action to calm markets

if price moves become irrational,

Jean-Claude Juncker, who chairs

the Eurogroup -- the monthly meetings of Eurozone finance ministers

and the European Central Bank -- said in an interview he's concerned

about ongoing turbulence in the financial markets.

"We are not yet at the

end of the crisis," Juncker said. "The corrections

will drag on for a few weeks, months. We have agreed in Tokyo

that if there are irrational price movements in the markets,

we will collectively take suitable measures to calm the financial

markets."

No big news there. Although

we devoutly believe in free markets, we're not so naïve

as to believe that's their actual state. Governments intervene,

all the time. Always, of course, "for our own good."

But here's the kicker. When

asked what form such collective calming action might take, Juncker

said: "Whoever has a strategy, should not set it out. Otherwise

it will lose its effect if it is explained."

Well, that exposes the man

behind the curtain, doesn't it? What Juncker is admitting is

that not only should governments intervene, but it's important

that they do so in secret. A strategy explained might become

ineffective. Or, in other words, if people knew what these guys

were up to, they might not want to go along!

A remarkably candid moment

that Juncker probably wishes he could take back.

[NOTE: Doug Hornig is

the editor of the Daily Resource Plus, our free daily

e-letter on all the latest news related to resource markets.

If you are not yet receiving this valuable, yet complimentary

service, you can sign up by

clicking here now. ]

An Unfolding Trend

Earlier in this edition, Bud

challenged readers to come up with other trends and ways to play

them profitably.

I have an early entrant. It

is that over the next ten years, we are going to see a growing

number of nations to ban the export of critical resources.

As I have commented on in the

past, given that it has now been established that Mexico's massive

Cantarell oil field is past its peak and at risk of becoming

uneconomic within the next 10 years, how long do you think it

will be before that country starts restricting oil exports to

its northern neighbor?

In fact, oil imports from Mexico

are already off by 21% just since December 2006. And they are

expected, based on current trends, to drop by as much as another

1 million barrels a day over the next decade (from about 1.3

million bbl per day currently).

For the record, in addition

to Mexico, the other largest oil exporters to the U.S. include

Canada at the #1 spot, followed by Saudi Arabia and then Venezuela,

at #3. Thus, when Hugo Chavez threatens to cut oil shipments,

as he has done again recently, it is a threat actually worth

paying attention to.

So, one entrant on a trend

to profit from would be to buy the oil sands companies that have

gotten beaten up. It is just a matter of time before Canadians

see the wisdom of dropping a nuclear power plant over the oil

sands, providing the energy required to extract the oil economically.

This play could take awhile to unfold, but given how beat up

many of the oil sands companies were, it's a play to keep an

eye on.

But my big idea here is that,

as the world's resources come under increasing pressure, you

can expect to hear more and more calls for countries to limit

exports -- the equivalent of hoarding on a national scale --

leading to massive economic dislocations and, one would assume,

opportunities for the fleet of foot.

Lending support to this idea,

Vietnam announced this week that it would immediately begin cutting

back the amount of coal it will allow exported, and is thinking

of stopping all exports by 2015. According to Bloomberg, Nguyen

Khac Tho, vice director of the Ministry of Industry and Trade's

energy and petroleum department, made the following comments

in a phone interview:

Coal is a resource that

can't be renewed. Our most important task is to meet domestic

demand to ensure national energy security.

(NOTE: I would be remiss

on many levels if I didn't mention that we have been following

the coal story closely in the Casey Energy Speculator... to learn

more and take a trial subscription is as easy

as clicking here.)

The Letter Bag

I received the following note

from a subscriber, Daniel T. I thought you'd find the following

excerpt of interest.

Dear David,

I want to convey something that may be of interest to you, with

regard to what's happening in the ongoing saga of the big banks.

About six weeks ago, a close friend told me that she had just

gotten a letter from her mortgage lender informing her that her

HELOC (Home Equity Line of Credit) is now frozen due to the "current

financial climate" or some vague reason like that.

I immediately thought about my own HELOC and said to myself "They

won't ever do that to me - I'm an accredited investor, never

ever a late payment on anything, no credit card debt, no car

loans, lots of equity in a higher-end home in a neighborhood

that actually appreciated in the last year, great FICO score,

etc."

My HELOC was for about $250,000, which I never touched and only

thought of it as perhaps useful one day for some quick cash to

bridge some investment opportunity, or whatever.

But because I believe Bud Conrad and all his brilliant analyses

(not to mention you and the rest of the Casey crew), I decided

to take all of my equity money out of the HELOC except for a

few thousand, and put it into something that will return, at

the very least, the cost of the interest payment and exceed even

that for some profit. (That's not hard to do being a Casey Research

subscriber).

Guess what? In less than a week, I got the same letter as my

friend. It was from IndyMac Bank, one of the bigger banks, telling

me that my HELOC was now frozen. From the contents of the letter,

I could tell that it came from another department of IndyMac

which had no idea I had just cleaned them out.

You better believe that I was very happy I got those $$$ out

and put them to good use.

I tell you this so as to possibly warn others, especially those

that are absolutely depending on their HELOC to carry them through

rough times. We are going to see a lot more of this. If they

would do this to someone with my financial profile, then, well...

look out.

Just Google "banks freeze helocs" and have a look.

One can only imagine what will happen when this becomes widespread

and what will happen to people who utterly depend on their HELOC

for survival. Scary. This could be the last straw for many.

I'm very much looking forward to seeing you again at the Crisis

and Opportunity Summit in Scottsdale. The last one was great.

Best,

Daniel T

Make no mistake, the credit

crisis is far from over. In fact, it is spreading.

Miscellany

Foreigners Go Home... Many in the U.S. wish the illegal immigrants

would get the hell out. Well, if you fall into that camp, you

will be cheered to hear that you may be getting your wish. An

unintended consequence, however, is that they may be taking some

segments of the economy with them. Follow the link below for

the story from the New York Times. [here]

Except Sovereign Wealth Funds... Here's a cool tool to

look at the size and distribution of sovereign funds. Note that

there are two tabs in the upper right-hand corner of the page

the link leads to...

http://tinyurl.com/yokar9

The Nature of Complexity... I have often commented on the fact

that we live in a complex world. Which is why, no doubt, so many

people are willing to let the mass media do their thinking for

them. It is far easier to accept as truth the latest news burbling

out of CNN, rather than puzzle things out for yourself. On that

topic, earlier this week, Doug Casey forwarded me a link to an

exceptional speech on that topic by author Michael Crichton.

If you are comfortably seated and have a bit of time, do yourself

a big favor and give this a read. You might even want to pass

it along to your family, friends and associates. Given the general

dearth of critical thinking these days, the world can use all

the help it can get.

Here's the link...

http://www.michaelcrichton.com/speech-complexity.html

And that, dear readers, is it for this week's edition.

In review, I found that I sort of, but not quite, avoided references

to the "Turnip" today. It is, I can assure you, no

simple task given the deep roots that the Turnip has in all things,

financial and otherwise.

A quick glance at the numbers shows that gold is holding, yet

again, over $900 on the week, and the U.S. stock market is, once

again, losing ground.

As always, I greatly appreciate you taking time out of your day

to read.

Sincerely,

David Galland

Managing Director

Casey Research, LLC.

###

Doug Casey

Casey Archives

321gold Ltd

|