Benson's Economic

& Market Trends

Americans are Getting a

lot Less but it's Costing Them More

Richard Benson

Posted Jul 27, 2010

Inflation is defined as the rate at which

the general level of prices for goods and services is rising,

and, subsequently, the purchasing power is falling. I’ve

always thought of inflation in terms of what we get and what

we pay, but quality and service are as important as quantity,

for the price.

I felt inspired to write this article

when I went shopping for razor blades recently and had a painfully

difficult time finding the razor blades I needed. Much to my

dismay, I discovered that most of the stores want to sell five-blade

razors at a much higher price than the Trac II razor blades I’ve

grown accustomed to. So I rebelled by buying and hording away

every last Trac II blade I could find and now have enough blades

to last for years. But it’s not only razor blades that

are disappearing or increasing in price. It’s noticeable

every time I make a purchase at the supermarket, restaurant or

department store. Following are some examples of what I am talking

about:

Cereal boxes are only half full; yogurt

has shrunk to six ounces from eight; tuna cans are now five ounces

from six; candy bars are half their size, and newspapers are

shrinking and may totally disappear. (Reporters are expensive,

so picking up and printing government and corporate news releases

is now considered serious reporting.) A meal at a local restaurant

tasted like yesterday’s leftovers and the portion size

dwindled, but the price was higher.

Also, if you can afford to go on vacation,

you’ll become an unpaid travel agent working for the airlines,

car-rental companies, and hotel. That’s right. I recently

had to spend my valuable time on the internet doing the research

then booking and paying for a trip. Then, to top it off, I had

to use my computer, printer, and paper at my own expense.

When I got to the airport, I was strip-searched and forced to

pay extra for an exit row, to check a bag, get a pillow, blanket,

and a meal. Then, I had to waste an hour of my life in a long

line while being forced to take off my shoes in honor of the

shoe bomber and pay my respects to the TSA, who added a fee to

my airline ticket. When I picked up the rental car, airport fees

and taxes pushed the cost up by a third for an older car that

wasn’t well-maintained. (The major rental companies

are hanging on to their cars until they are close to breaking

down.) When I finally arrived at the hotel, I was hit with

a resort fee, internet fee, and daily telephone charge each time

I looked at the receiver. I was careful, too, when approaching

the mini-bar in the room because the motion detectors inside

would bill me for food and beverage items that were examined

and put back but not consumed (a bottle of coke was $5). The

taxes were horrendous and I wonder if the maid service and extra

towels or pillows were bundled in the final bill.

Every time I turn around, it seems like

we’re getting less but paying more. Believe me, none of

this “less for more” is appearing in the Consumer

Price Index. I even heard the other day that postage was going

up another two cents for a First Class letter, and Saturday delivery

may be eliminated altogether. If you’re dealing with

the government, there is no such thing as First Class. State

and local governments have closed parks, cut back on trash collection,

road repairs, library hours, and laid off teachers. Meanwhile,

taxes are going up and property values are going down. In New

York City, they announced a major cut in bus and subway service

along with a fair increase. When it comes to public services,

the collapse in services – especially in cities - will

be monumental and nowhere is it reflected as a major price increase

for services actually rendered.

When examining my recent cable bill,

I thought back to the old days when TV was free before you had

to pump your own gas and wash your own windshield. The electric

bill was up again, too. (In Florida, we get a special assessment

to help pay for new solar plants and the summer has had record

heat.) Lastly, my health insurance will go up the usual 20%

next year yet I’m told by our elected officials to have

a nice summer on our beautiful beaches that are threatened by

the oil spill.

On sober reflection, there is no question

that the government’s price statistics are not for honest

measurement but for propaganda purposes. The government actually

believes that if they tell us the cost of living is not going

up, we’ll believe them and won’t notice we are actually

paying a lot more for a lot less these days.

The commonly reported inflation numbers

in America make great use of hedonic adjustments which adjust

price for quality. The best example of this is in computers.

The speed of the computer chip gets faster and the hard drive

holds more data, so the price must have gone down according to

hedonic adjustments. Unfortunately, for me, since I use the computer

to write and to access the internet, the speed and value was

limited years ago by my typing speed, so a bigger, faster computer

has little benefit.

Worse yet, most of the hedonic adjustments

are for gadgets that are designed to break or are very expensive

to fix, and must be thrown away. Cars used to have engines a

guy could tear apart and tune. Now, they have computer chips

that cost over $1,000. Most electrical high-tech gadgets are

throwaway items: Drop them, spill some coffee on them, suffer

a power surge, and they’re toast. You will then have to

buy them all over again to survive in this world of gadgets,

but you won’t see that in the price index!

For the things you buy every day –

where hedonic adjustments can’t be used to defraud you

– take a look at what has happened to prices when stamps

were $.03 cents, a gallon of gas $0.18 cents, and a loaf of bread

$0.14 cents. See below:

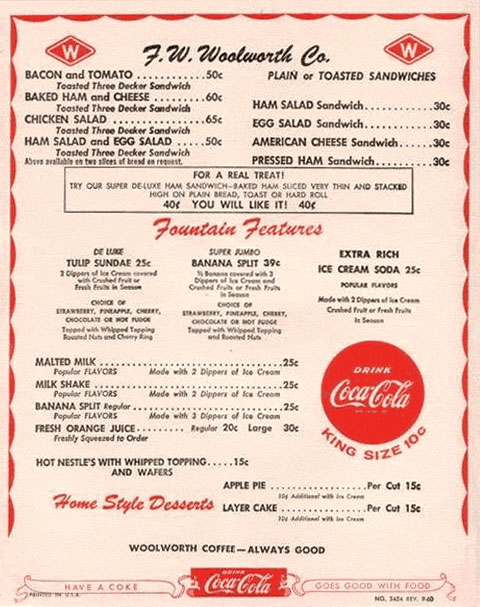

1950 Prices

This 1950 menu from F.W. Woolworth is

an excellent example of how much cheaper it was to eat out in

the 1950s. Just wait and see what it will cost to live when you

finally get around to retiring!

###

Jul 26, 2010

Richard Benson

Archives

President

Specialty

Finance Group, LLC

Member FINRA/SIPC

2505 S. Ocean Boulevard

- Suite 212

Palm Beach, Florida 33480

1 800-860-2907

email: rbenson@sfgroup.org

Richard Benson, SFGroup, is a widely-published

author on securitization and specialty finance, and a sought after

speaker at financing conferences on raising equity for mid-market

companies.

Prior to founding

the Specialty Finance Group in 1989, Mr. Benson acted as a trading

desk economist for Chase Manhattan Bank in the early 1980's and

started in the securitization business in 1983 at Bear Stearns,

and helped build the early securitization businesses at Citibank

and E.F. Hutton.

Mr. Benson graduated

from the University of Wisconsin in 1970 in the Honors Program

in Math, and did his doctoral work in Economics at Harvard University.

Mr. Benson is a member of the Harvard Club of New York and Palm

Beach.

The Specialty

Finance Group, LLC is a Florida Limited Liability Company and

is registered with FINRA/SIPC as a Broker/Dealer.

321gold Ltd

|