Job Numbers Tell The Story

& What's Happening With Gold?

Emanuel Balarie

Mar 13,

2007

This past week we saw an expected

bounce in the stock market. But per my last

commentary, we are not out of the woods when it comes to

this sell-off. I typically have CNBC on in my office, and it

never ceases to amaze me the continual assertion by pundits that

we are in the midst of a goldilocks economy and that the stock

market is undoubtedly going to head higher over the next several

months. Whether or not you subscribe with my 20%+ decline in

the market, you have to at least understand that we do not have

a goldilocks economy.

Friday's job numbers are yet another example of Wall Street simply

focusing on the positives and failing to acknowledge the problems

that will face us in the future. While the unemployment rate

declined from 4.6% to 4.5%, jobs created in February (97,000

jobs) was the lowest increase in 2 years. And even the jobs that

were created occurred in primarily the health care and service

sector. The service sector jobs, however, often lags behind the

economy. For instance, the consumer will continue spending and

buying until they no longer can afford to do so (because of job

loss, rising interest rates, higher mortgage payments, etc.).

When the consumer curbs back on their spending, you will then

see job loss in the service sector. If Mr. Jones decides to put

off buying a new car because he recently lost 10 % of his stock

portfolio, the car salesman will likely not make the additional

car sale. In turn, he might not go out to dinner as often or

spend money in the local economy. As you can imagine, this will

result in a trickle down effect and service sector jobs will

likely get slashed.

On the other hand, the jobs that are already getting slashed

are those in the housing and manufacturing sector. The recent

report showed that construction employment fell by 67,000 jobs

and the manufacturing sector (think automobile industry) lost

an additional 14,000 jobs. This not only foreshadows a declining

real estate market but also an economic contraction in the United

States (recession).

Since 2001, more than 40% of the private sector jobs were directly

or indirectly a result of this housing bubble (real estate agents,

mortgage brokers, construction workers, appraisers, home improvement

stores, and many more). This is why the housing market is such

a big factor in the future direction of our economy. As I have

stated previously, I believe that a housing led recession is

more than likely (View My Real Estate/Recession Article

From January 2006). Naturally, as the housing market continues

its decline, the jobs that were gained will be lost.

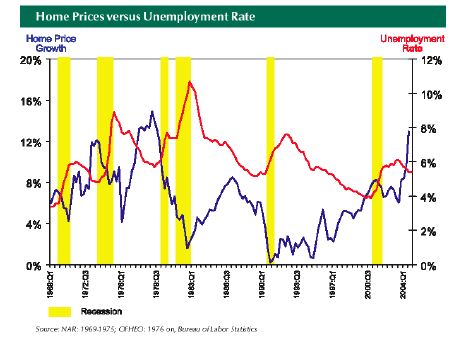

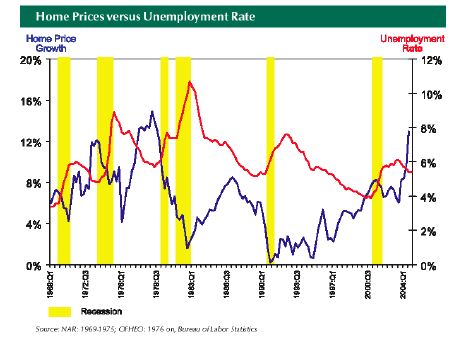

Not that this projection is anything new. Take a look at the

following chart that shows the correlation of housing prices

to employment.

Source: itulip.com

Source: itulip.com

What you will notice about

the above chart is that in the past, declining home prices have

signaled an increase in the unemployment rate. And of course,

this makes perfect and logical sense. Not only will the investor's

psyche (once they see falling home prices) translate into less

spending, but job loss will weigh heavily on the US economy.

Thus, if you want to keep an eye on which direction the economy

is heading, focus on the job numbers in the housing and manufacturing

industries.

What's Going On With Gold?

What exactly is going on with

gold? Several weeks ago I mentioned that gold's decline was fundamentally

unwarranted. I continue to believe this is the case. I sent this

comment to several reporters earlier this week:

"It seems to me that gold is looking to form a base around

the 640 level. The recent decline from the highs has put gold

in an oversold position and I would expect any type of stability

in the global marketplace to spur an onslaught of fresh buying,

especially out of Asia. Investors that blink might be surprised

to see the price of gold back at last month's highs within a

relatively short period of time. In light of continued inflationary

pressures, a weak US dollar, and geopolitical tensions the decline

of gold was fundamentally unwarranted.

Additionally, there has also been a lot of talk regarding gold

not acting as a safe haven. And while the decline in gold prices

alongside a declining stock market might initially trigger this

thought, investors should not forget the longer-term historical

significance. Throughout history, gold has acted as a safe haven

in times of political and economic stability. It has served as

a hedge against rising inflation, and it has preserved wealth

for thousands of years. These ideas are not easily erased in

one week. Gold as a safe haven is branded on the minds of investors

across the globe. Investors should see the recent sell-off in

gold as a buying opportunity. The longer-term bullish fundamentals

are still in tact and prudent allocation to this market is justified."

In a couple short weeks, the

price of gold went from an overbought situation to an oversold

situation. One of the indicators that I use to determine whether

a market is overbought or oversold is the relative strength index

or RSI. Take a look on the daily chart on April Gold futures

contract.

As you can see from the above

chart, whenever the RSI has moved towards an extreme oversold

position, gold has responded with a rally. However, it is important

to note that this is just one indicator. Also, there can be situations

where a market which is oversold can continue to be oversold.

My outlook, however, is that gold's oversold position coupled

with the above mentioned fundamental bullish factors, will likely

result in a sharp move up within the next week or so.

There are a number of different

ways that you can participate in the gold market. If you are

interested in learning more about gold futures and options on

gold futures, I am offering a free educational brochure to anyone

who asks. You can request one HERE.

Additionally, you can also

subscribe to Wisdom Commodity Weekly, a free weekly newsletter

that provides commentary, outlook, and market analysis on a wide

variety of markets. You can do so here:

Futures and options trading

involves substantial risk and is not suitable for everyone.

Emanuel Balarie

Update Sep 2007 Emanuel Balarie has started a new investment

company:-

email: ebalarie@commoditynewscenter.com

website: www.commoditynewscenter.com

Balarie Archives

Emanuel

Balarie

is President and CEO of Jabez Capital Management. In addition,

he is also editor of www.commoditynewscenter.com and the author of Commodities

For Every Portfolio: How To Profit From The Long-Term Commodity

Boom.

Mr. Balarie's industry experience ranges from commodity stocks

to futures to alternative investments. He is a highly regarded

advisor to clients and institutions on the commodity markets,

and has had his research published all over the world. In addition

to being a regular guest on CNBC, Balarie is frequently quoted

in financial publications such as, The Wall Street Journal,

Reuters, Marketwatch from Dow Jones, and Barrons. Mr. Balarie

is a graduate of UC Berkeley. Emanuel

Balarie

is President and CEO of Jabez Capital Management. In addition,

he is also editor of www.commoditynewscenter.com and the author of Commodities

For Every Portfolio: How To Profit From The Long-Term Commodity

Boom.

Mr. Balarie's industry experience ranges from commodity stocks

to futures to alternative investments. He is a highly regarded

advisor to clients and institutions on the commodity markets,

and has had his research published all over the world. In addition

to being a regular guest on CNBC, Balarie is frequently quoted

in financial publications such as, The Wall Street Journal,

Reuters, Marketwatch from Dow Jones, and Barrons. Mr. Balarie

is a graduate of UC Berkeley.

For more information

on Emanuel Balarie you can visit www.commoditynewscenter.com or email him at ebalarie@commoditynewscenter.com

321gold Ltd

|

Emanuel

Balarie

is President and CEO of Jabez Capital Management. In addition,

he is also editor of

Emanuel

Balarie

is President and CEO of Jabez Capital Management. In addition,

he is also editor of