|

|||

Gold May Be Near a TurnRick Ackerman

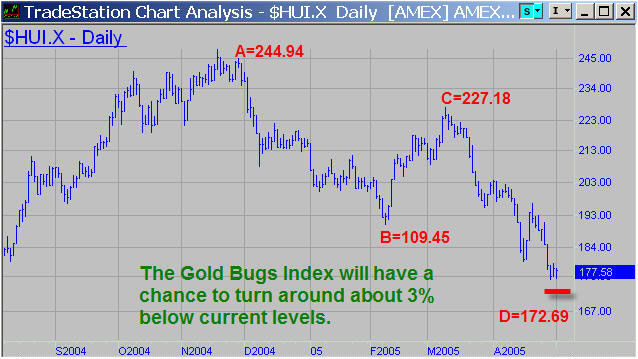

I've been doing my best to avoid raising your expectations for gold, since technical signs have not looked too promising for the last couple of months. Most recently, we focused on some Comex charts to tell us whether the intermediate-term trend might be changing from bearish to bullish. The drum-roll number was 441.20, basis the July contract, and although the futures came within $2 of that price last week, they have since receded by nearly $10, dashing our hopes for the umpteenth time. But this latest bout of weakness may be just what bullion needed to recharge for a sustained move above the $451 peak recorded on March 11. The bullish scenario looks more compelling in the chart of the HUI, and that is why I have reproduced it below instead of a Comex chart. I've labeled an AB impulse leg and a CD follow-through leg that has a 'D' target just a couple of points beneath last Thursday's 175.32 bottom. To be precise, the hidden-pivot target lies at 172.69, slightly less than 3 percent away. My hunch is that the current correction in gold will not end before that number is reached. However, that could be within a matter of days, so we should be prepared to attempt some bottom-fishing in some of the mining stocks tracked in Rick's Picks. As has been our practice in recent months, any bids will be tied to very tight stop-losses. This is because, if the 172.69 pivot works at all, it is likely to work very exactly. If so, there is no reason to risk more than small change as we speculate against the trend. Detailed strategies for doing so will be provided this week in the Current Touts section of the newsletter. click on chart to enlarge *** Penny Pinching Grappling with the trend? Check out Rick's Picks' archives to see how well Rick Ackerman has done with his forecasts and trading strategies. Rick Ackerman Information and commentary contained herein comes from sources believed to be reliable, but this cannot be guaranteed. Past performance should not be construed as an indicator of future results, so let the buyer beware. Rick's Picks does not provide investment advice to individuals, nor act as an investment advisor, nor individually advocate the purchase or sale of any security or investment. From time to time, its editor may hold positions in issues referred to in this service, and he may alter or augment them at any time. Investments recommended herein should be made only after consulting with your investment advisor, and only after reviewing the prospectus or financial statements of the company. Rick's Picks reserves the right to use e-mail endorsements and/or profit claims from its subscribers for marketing purposes. All names will be kept anonymous and only subscribers' initials will be used unless express written permission has been granted to the contrary. All Contents ©2005, Rick Ackerman. All Rights Reserved. You can subscribe here. |